Income Items in QuickBooks allow you to separate the type of income you receive without creating multiple income accounts. When creating an Item, you also specify the Income Account it is connected to. Essentially, you are creating sub-items under an Income Account. The Income Items are needed for invoicing and will be easily tracked in QuickBooks reporting.

At STRATAFOLIO, we highly recommend invoicing to track your tenants and their rental income. Using Income Items for each of your revenue types is a best practice for invoicing with QuickBooks Online. Also, Income Items are needed to utilize the invoicing functions in STRATAFOLIO best.

To better understand Income Items, it is helpful to see how they are set up and used for invoicing. In this article, we will show you step-by-step how to add Income Items to QuickBooks Online and how they are used in invoicing.

Typical Income Items

For Commercial Real Estate, the names can be whatever you feel best describes it. These are the typical Income Items that we recommend are:

- Base Rent

- CAM (Common Area Maintenance) Income/Expense Recovery

- Insurance Income/Expense Recovery

- Real Estate Taxes Income/Recovery

Adding Income Items in QuickBooks Online

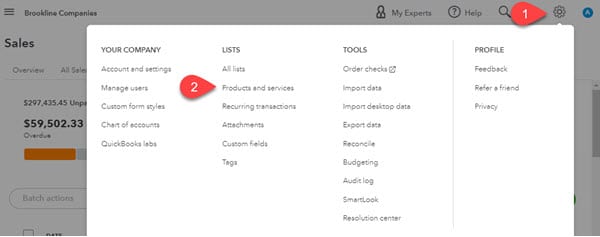

- To add an income item, select the gear icon in the top right corner, then select Products & Services under Lists.

- Next, click the green New button

- Select Service from the list.

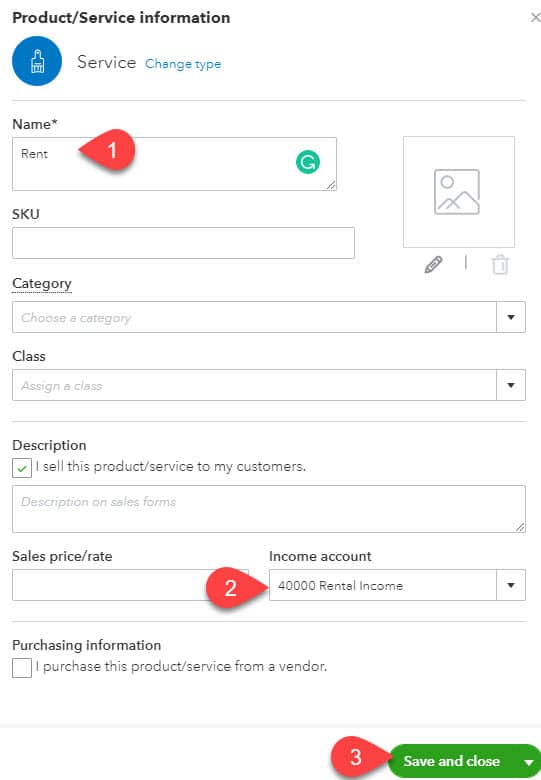

Most of the income items you use will be under service for commercial real estate since renting a building and common area maintenance are services you provide to your tenants. - Enter a Name for the Income Item, select the Income Account it will post to, then Save & Close.

Do NOT add a Class for your Income Item. You will add the Class when you create an invoice. This allows you to have fewer items created and causes less confusion.

- Repeat this process for each Income item that needs to be added.

NOTE: As you see in the image above, you can add additional information when you create the Income Item such as an SKU & Sales price/rate. Leaving those fields blank is preferred due to Rent & CAM rates varying from tenant to tenant and over time.

Using Income Items for Invoicing

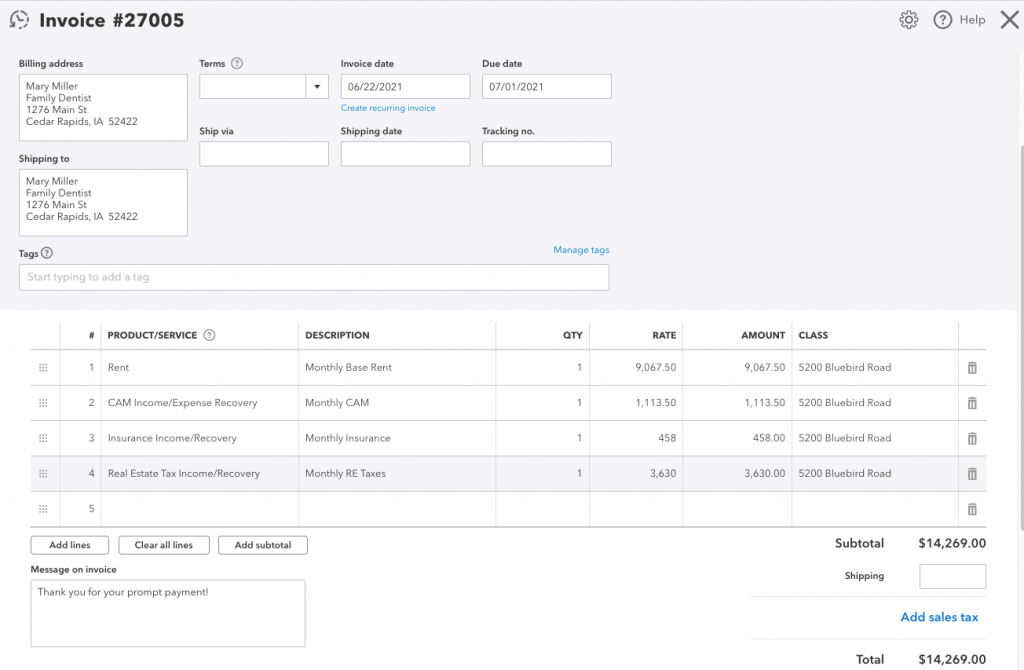

Once Income Items are set up, they can be used to create the invoice for your tenants.

Notice that the Class is specified in the invoice. Selecting Class in the invoice rather than setting it as part of the Income Item allows a single Income Item to be used for multiple Classes.

Also, in the example above, four different Income Items are used. The last three, CAM, Insurance, and Property Taxes are all posting to the same Income Account even though they are three separate items on the invoice. Having items separated but still linked to the same Income Account is especially helpful when running reports on these operating expenses in QuickBooks.

| Income Item | Income Account |

|---|---|

| Rent | 40000 Rental Income |

| CAM Income/Expense Recovery | 41000 CAM & Recovery Income |

| Insurance Income/Recovery | 41000 CAM & Recovery Income |

| Real Estate Taxes Income/Recovery | 41000 CAM & Recovery Income |