STRATAFOLIO tracks loans to give you an up-to-date look at the organization’s entire portfolio. STRATAFOLIO connects the QuickBooks Liability accounts to the Loans. This shows the current analytics in the Loan Dashboard. When you enter a loan in STRATAFOLIO, you must connect it to the account in the QuickBooks Chart of Accounts (COA) where you are recording the loan. Mapping the QuickBooks loan account to the loan input in STRATAFOLIO will (upon sync and QuickBooks updates) update the current balance in STRATAFOLIO.

Mapping Chart of Accounts in STRATFOLIO

Map the Chart of Accounts for each of the integrations before starting with the loans. For more information on how to map the COA, please refer to:

How to Map a New Account in STRATAFOLIO That Was Created in QuickBooks.

Mapping Loans

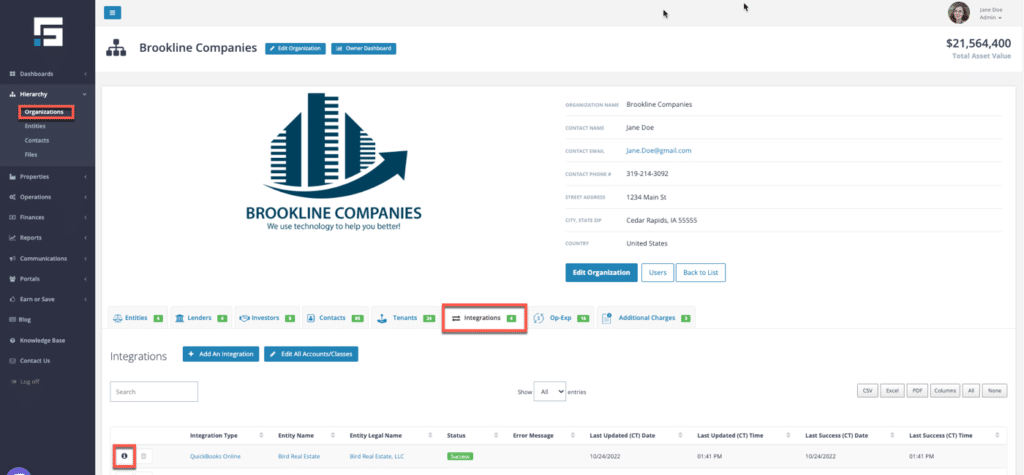

On the main Organization page, select the Integration tab. This tab contains a list of loans that are linked to QuickBooks accounts. Click the Integration “i” corresponding to the QuickBooks file that contains the loans to be updated.

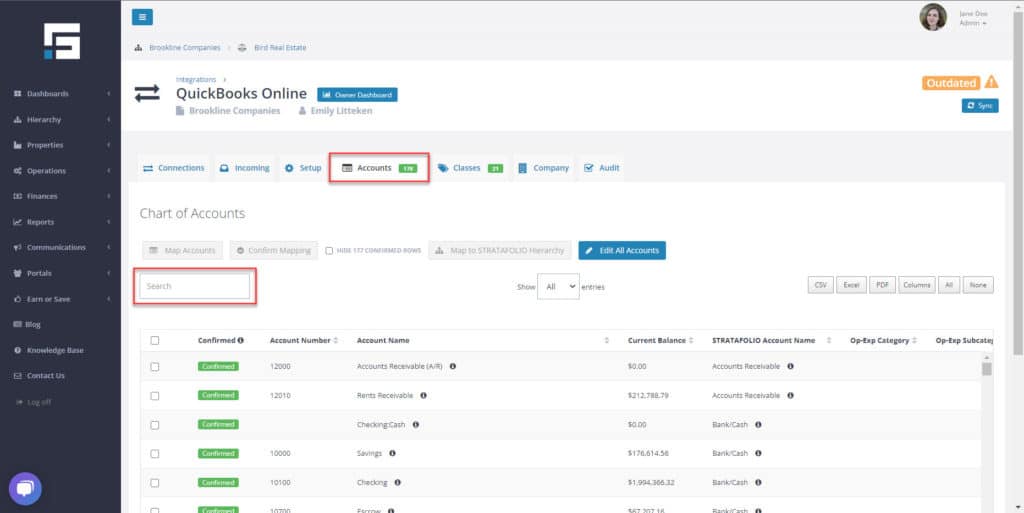

First, click on the Accounts tab. Begin typing the account name from QuickBooks into the Search field to find the proper account in the COA.

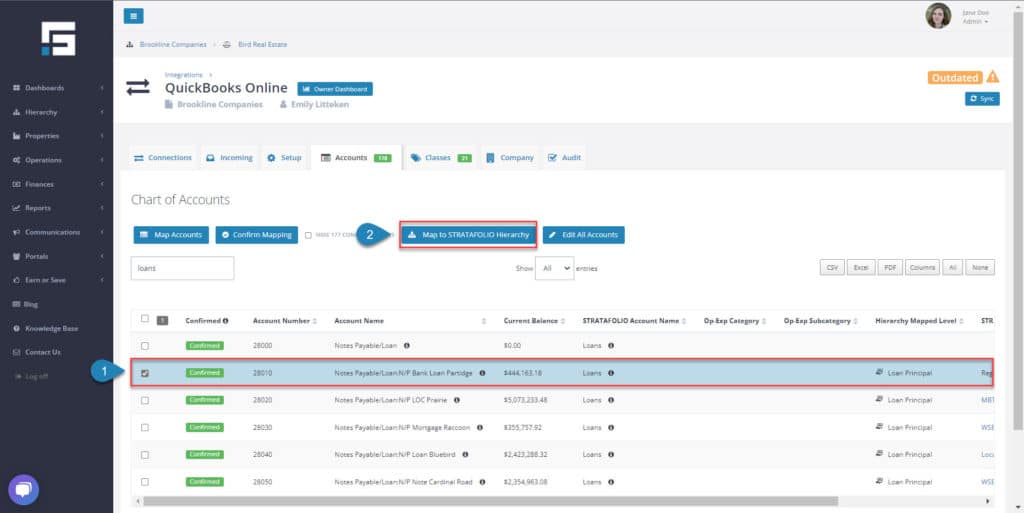

Now, click the checkbox next to the correct loan account. Next, click the Map to STRATAFOLIO Hierarchy button.

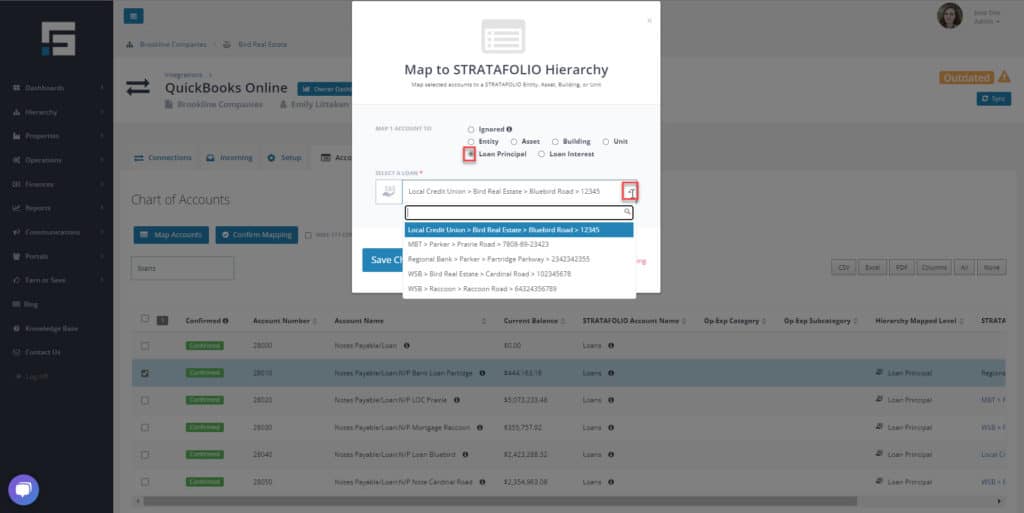

Next, select Loan Principal. The drop-down shows all the loans currently entered into STRATAFOLIO for this entity. Select the correct loan in STRATAFOLIO and click Save.

This finishes the Mapping process. Lastly, the inputted loan’s current balance will update when the QuickBooks account updates and syncs to STRATAFOLIO.

** Note: In order to maintain accurate analytics, it is important to follow best practices and update the loan balances and interest on a monthly basis. By doing so, you can ensure that your data is up-to-date and reflective of the current state of your loan portfolio. Additionally, keeping your analytics accurate can help you make informed decisions about how to manage your loans and ensure that you are on track to meet your financial goals.