CPA Webinar: Protecting Real Estate Clients from Hidden Financial Risks

What Accountants Will Get Out of It

By attending, accountants will:

- Identify red flags that signal growing risk in real estate portfolios

- Understand what to look for in clients who have outgrown their current tracking system

- See how better visibility improves reporting, compliance, and advisory conversations

- Understand when it’s time to introduce a purpose-built solution

Set the Stakes (5 minutes)

Real estate clients are getting more complex—and accountants are the first to feel it.

Cover:

- Increasing entity counts

- Investor reporting pressure

- Debt and compliance complexity

- Why “we’ll fix it later” doesn’t work

The Red Flags Accountants Should Never Ignore (15–20 minutes)

A. Structural & Entity Chaos

- No single view of properties, entities, owners

- Partners don’t understand what they own

- Constant cleanup requests during tax season

Demo bridge:

“This is usually where spreadsheets multiply—and visibility disappears.”

B. Debt & Capital Stack Blind Spots

- Loans tracked outside accounting systems

- Refinances missing or unclear

- Difficulty answering lender or investor questions

Demo bridge:

“If it takes hours to answer simple financing questions, there’s a system problem.”

C. Reporting Breakdowns

- Inconsistent property-level reporting

- Custom reports recreated repeatedly

- Clients asking for insights accountants can’t easily deliver

Demo bridge:

“At this point, accounting data exists—but it’s not usable.”

Why Traditional Accounting Tools Stop Working (Key Transition)

This is where demos naturally belong.

Explain:

- Accounting systems are not designed for portfolio-level real estate management

- They don’t handle:

- Entity relationships

- Ownership structures

- Debt-to-asset mapping

- Long-term historical visibility

Reframe the problem:

“It’s not bad accounting—it’s the wrong tool for the job.”

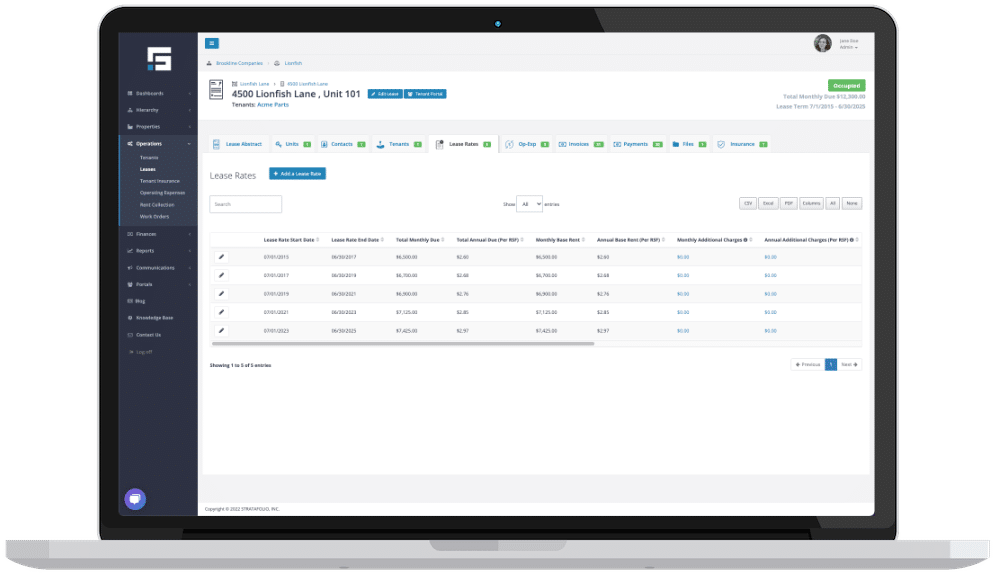

What “Good” Looks Like (Live STRATAFOLIO Demo – 5 minutes)

Show how firms:

- See all entities, properties, and ownership in one place

- Track debt and capital cleanly

- Support advisory conversations with confidence

- Reduce cleanup work and client confusion

Narrative:

“Here’s how accounting firms regain control and clarity.”

How Firms Use This to Win More Advisory Work (5 minutes)

Highlight:

- Stronger client conversations

- Proactive guidance instead of reactive cleanup

- Differentiation from other accounting firms

- Better client retention

If you’re seeing these issues in your clients, we’ll walk through your real-world scenarios in a personalized demo.

The Top 10 Tax-Time Red Flags in Real Estate Clients

“We’ll Get You That Later” Financials

What you hear:

“We’re still waiting on a few numbers.”

Why it matters:

Late, incomplete, or constantly revised data usually means:

- Poor internal controls

- No real-time visibility

- Heavy spreadsheet dependency

Future issue:

Audit risk, lender issues, missed opportunities—and massive cleanup work.

Too Many Entities With No Clear Purpose

What you see:

- Dozens of LLCs

- Inconsistent ownership percentages

- Entities formed “just in case”

Why it matters:

Entity sprawl without structure increases:

- Reporting errors

- Compliance risk

- Partner disputes

Future issue:

Clients won’t understand their own portfolios—and neither will new advisors.

Depreciation Schedules That Don’t Match Reality

What you see:

- Assets still depreciating after sale

- Inconsistent methods across properties

- Missing component detail

Why it matters:

Depreciation errors compound over time.

Future issue:

IRS exposure, missed cost segregation, and inaccurate tax planning.

Debt That Lives Outside the Accounting System

What you hear:

“The loan details are in a spreadsheet.”

Why it matters:

If debt isn’t tied to:

- Properties

- Entities

- Guarantees

…it’s not being managed—only recorded.

Future issue:

Refinance confusion, lender reporting failures, and bad capital decisions.

Capital Contributions & Distributions That Are Hard to Explain

What you see:

- Partner loans that “sort of” exist

- Capital accounts that don’t tell a story

- Manual equity tracking

Why it matters:

Capital confusion is the #1 trigger for partner disputes.

Future issue:

Legal exposure, investor dissatisfaction, and expensive reconciliations.

“Can You Break This Out by Property?”

What you hear at tax time:

“We need property-level numbers… by next week.”

Why it matters:

If property-level reporting isn’t readily available:

- The client lacks operational insight

- Accounting is reactive

Future issue:

Inability to scale, poor decision-making, and advisor fatigue.

Ownership Changes That Weren’t Properly Tracked

What you discover:

- Buy-ins, buyouts, or partner exits mid-year

- Ownership changes not reflected everywhere

Why it matters:

Ownership errors affect:

- Allocations

- Basis

- Compliance

Future issue:

Disputes, amended returns, and audit risk.

Heavy Reliance on One Person’s Knowledge

What you notice:

“Only Jim knows how this works.”

Why it matters:

If portfolio knowledge lives in one person’s head:

- There’s no continuity

- No documentation

- No scalability

Future issue:

Key-person risk, operational collapse, and advisor liability.

No Clear History of Properties Over Time

What’s missing:

- When assets were acquired

- When refinances happened

- How entities evolved

Why it matters:

Real estate decisions are cumulative.

Future issue:

Poor long-term planning and inability to support audits, sales, or estate planning.

Clients Asking Questions Accounting Systems Can’t Answer

What you hear:

- “How leveraged are we really?”

- “Which properties are underperforming?”

- “What do we actually own today?”

Why it matters:

When systems can’t answer basic questions, confidence erodes.

Future issue:

Clients seek answers elsewhere—and advisors lose strategic relevance.

ABOUT THE SPEAKER

Jeri Frank, Co-Founder and CEO of STRATAFOLIO

Jeri Frank, along with co-founder Uriel Barillas, founded STRATAFOLIO when, as a real estate investor herself, dealt with the frustrations of having to manage her portfolio on spreadsheets and QuickBooks alone. What began as an aha moment has turned into a successful commercial property management software company with more than 2Billion in assets managed today.

Jeri is a long-time Forbes contributor, a 4+ year Forbes Business Council member, National Association of Realtors REACH member and more.

Want to talk to an expert?

Learn how you can keep using QuickBooks and save over 80% of manual effort when using STRATAFOLIO to manage your operations, global finances, assets, and investors. Utilize our two-way connection with QuickBooks to gain one fully integrated system.