Common area maintenance charges (usually abbreviated as CAM) are often part of a NNN commercial lease. As one of the net charges billed to tenants in a NNN lease, this fee allows landlords to take proper care of their commercial properties. But what is common area maintenance reconciliation, exactly? Here’s what you need to know about shared maintenance costs, roles of landlords and tenants in the process, and CAM reconciliation.

What Do Common Area Maintenance Charges Include?

CAM charges cover the expenses of maintaining or repairing areas that commercial tenants share. It may vary depending on the lease terms, but generally, it may include any of the following costs:

- Cleaning of lobbies, bathrooms, elevators, etc.

- Landscaping

- Snow removal

- Parking lot repair and maintenance

- Security systems

- Trash pickup

- Other repair, maintenance, or janitorial needs in common areas

Costs will vary from one property to the next due to differences in shared space, but all property owners should communicate with their tenants and inform them about the exact allocation of CAM charges. This way, tenants know what to expect, leading to higher satisfaction and fewer disputes. This way, tenants know what to expect, leading to higher satisfaction and fewer disputes.

How Are CAM Costs Divided Among Tenants?

A CAM charge is generally a passthrough expense normally referred to in a lease as additional rent that is charged on top of the base rent. Passthrough expenses mean that the owner is initially responsible for the cost but passes it directly on to the tenants in turn, without marking it up or otherwise changing it from the original expense. It is usually based on a tenant’s pro-rata share or their proportionate share of the building they rent. The pro-rata share calculated by the square footage each individual tenant occupies compared to the property’s total rentable space. The lease agreements will outline CAM charges for each tenant’s share.

It’s also important to note that not all leases require that tenants pay CAM charges. In a gross lease, tenants pay for everything in one lump sum instead of paying a base rent and a CAM charge. Commercial triple net (NNN) leases are the most common type of lease that bills tenants for common area maintenance.

Understanding CAM Caps and Audit Rights in Lease Agreements

What is reconciliation in real estate, you ask? It helps to first understand how CAM terms work in a lease. CAM, or Common Area Maintenance, refers to the fees that cover shared spaces like lobbies, hallways, parking lots, and landscaping. Knowing what is common area maintenance and how it’s managed makes it easier for landlords and tenants to stay on the same page and avoid confusion.

Many lease agreements include CAM caps, which limit how much CAM rent or expenses can increase from year to year. For example, a lease might restrict annual CAM maintenance increases to 3–5%. This cap helps tenants manage predictable operating costs while still allowing landlords to recover reasonable maintenance expenses.

Another key lease provision involves tenant audit rights. These give tenants the right to review the landlord’s detailed records related to lease CAM charges and shared expenses. This transparency builds trust and ensures tenants are paying accurate CAM leasing costs rather than overcharges.

Understanding what is CAM on a lease and the rights tied to it protects both parties. Whether you’re a landlord managing multiple properties or a tenant reviewing your agreement, pay close attention to clauses about rent and CAM charges, leasing CAM, and how CAM is reconciled annually. With STRATAFOLIO, landlords can easily document all CAM charges for rent and share detailed reports with tenants — making the reconciliation process simple and dispute-free.

What is CAM Reconciliation?

CAM reconciliation is the process of summing up all the operating expenses paid by the landlord throughout a calendar year or CAM period and ensuring those expenses match the actual amounts paid by the tenants sharing the common area where the expenses took place. In other words, it compares the amount of expenses estimated to the amount of expenses collected. Reconciliation results in one of two outcomes:

- If the expenses collected are more than what the tenants paid, then the tenants are responsible for providing the difference of those expenses.

- If the expenses collected are less than what the tenants paid, the landlord is responsible for returning the difference to the tenants.

For most NNN leases, CAM expenses typically serve as a passthrough expense.

Check out the 6 Best Practices for Common Area Maintenance (CAM) Reconciliation. This article will be a good place to start in order to understand the reconciliation process better.

Common CAM Reconciliation Mistakes and How to Avoid Them

Now that you understand what is a CAM charge in commercial real estate, it’s just as important to know where things can go off track. Common Area Maintenance (CAM) reconciliation is meant to ensure the lease CAM charges billed to tenants match the actual operating costs paid by the landlord. But when the process is done manually or without proper checks, small errors can quickly turn into costly problems.

Here are a few common mistakes landlords often make during CAM reconciliation — and how to avoid them:

- Inaccurate expense categorization: This happens when costs like capital improvements are recorded as CAM maintenance. Mixing these up can cause disputes later, so always double-check which expenses qualify as CAM.

- Incorrect pro-rata share calculations: If a tenant’s share of rentable space is calculated incorrectly, both rent and CAM charges can be thrown off. Using consistent data across all leases helps prevent this.

- Poor recordkeeping: It’s difficult to define CAM charges or back them up during reconciliation without clear documentation. Organized digital records make the process smoother and more transparent.

- Delayed reconciliation: Waiting too long to complete reconciliation in real estate often leads to confusion or frustration for tenants. Regularly reviewing expenses throughout the year keeps everything on track.

To avoid these pitfalls, review your expenses regularly, maintain transparent records, and consider automation tools. With STRATAFOLIO, you can easily track CAM leasing costs, monitor your budget in real time, and export clear reconciliation reports. This makes it easier to explain CAM charges meaning to tenants, reduce misunderstandings, and build trust.

By staying proactive and organized, you’ll ensure your lease CAM charges remain fair, accurate, and easy for everyone to understand.

How Can A Landlord Make CAM Reconciliation Easier for Everyone?

No one wants to have unexpected costs at the end of the year. If the landlord overestimated the CAM costs, they would be responsible for reimbursing each tenant their respective share. But, if they underestimated the CAM costs, tenants would receive an unpleasant surprise when they receive the bill for the additional expenses they owe. If the difference is significant, it can be problematic for either party who must pay. Therefore, landlords must estimate CAM costs as accurately as possible to make CAM reconciliation less of a burden. Be sure to understand where you could make grave mistakes and how to avoid them.

For effortless CAM reconciliation, turn to STRATAFOLIO.

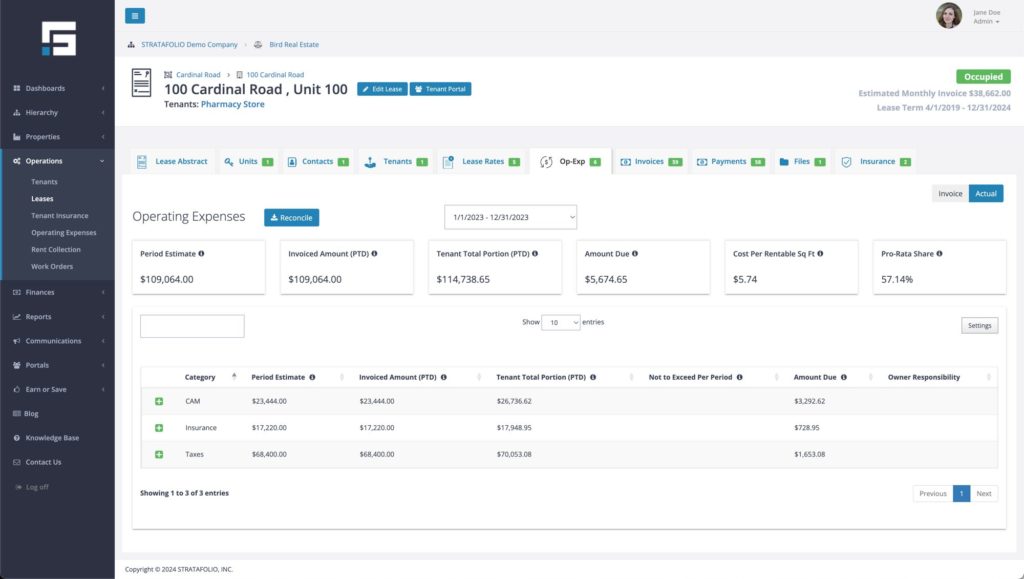

With our tool, you can manage and track all your net expenses throughout the year, so you can instantly know if you need to tighten up on an operating cost category or ramp up your spending. You have a quick visual to see how you are doing with each tenant in relation to your CAM budget. It is crucial to review your budget regularly to find areas of improvement.

Plus, when it is time to do reconciliation, we help you with an easily exportable report that you can share with your tenants. Ensuring that everyone has access to a clear explanation of all fees significantly increases tenant satisfaction. This improves your chances of building strong relationships, retaining good tenants, and improving overall profitability.

Finally, STRATAFOLIO’s automated CAM processes allow you to reconcile in a single click. This efficient process frees up your time to focus on growing your business and helps you avoid mistakes.

With all your commercial real estate data organized in one place, you can make more accurate estimates for next year. Contact us for a free demo to learn more!