It’s time to get another commercial real estate loan…or refinance an existing commercial real estate property. You know the process.

To begin, you pull out the spreadsheet previously started for your last commercial real estate loan. Like many before you, you had great intentions of keeping your data up to date so the next loan would be much easier.

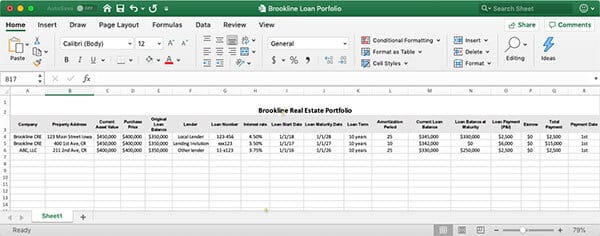

However, somewhere along the way, you had fires to put out. So, you quit updating your spreadsheet or it was only partially updated and you forgot where you stopped. Your spreadsheet probably looked something like this:

Problems with Spreadsheets

Beginning in Excel is where most real estate owners begin. And it makes sense when you are getting started and when your commercial real estate portfolio is small. But, as you grow and expand, the inefficiencies increase.

Every single purchase adds additional burdens in record-keeping and complexity of your operation. The complexity builds slowly over time. Then, new staff enters the picture or existing staff leave. With those departures goes part of the company’s knowledge (and likely access to records which resided in email).

Anyone who has ever worked in spreadsheets knows its issues:

- Easy to create a data error, and replicate that error across the spreadsheet

- Difficult for anyone but the original creator to understand what they have created

- Multiple users mean multiple ways of doing things which leads to inconsistencies

- Extremely manual

- No access to real-time data

- Limited access for other users

- Versioning control issues

And really, the list goes on.

Unfortunately, everyone has a horror story associated with spreadsheets – some less public than others. More than one customer has shared mortifying experiences of sitting in front of a lender and finding a spreadsheet error.

Why You Need to Track your Debt Service

Every company needs to track their debt service. Everyone knows this. Most companies try.

At any time you should have a clear picture of how much debt you owe, to who, key debt metrics, and when those loans are due. Having this information readily available allows you to act quickly if there is an interest rate change. Or in the event, you are purchasing a new property, or there is a request for information from one of your existing lenders.

But most importantly, the organization of your debt puts you in the driver’s seat. Knowing exactly what your debt profile looks like allows you to react confidently with lenders, potential partners, or when an opportunity presents itself.

What Should You Track

Keeping in mind the intended use of this data. The data could be for your accountant, lender, or planning internally, you should track the following:

- Lender

- Loan number

- Original loan amount

- Purchase price

- Interest rate

- Loan start date

- Loan end date

- Term

- Amortization period

- Pay off amount

- Early pay-off penalties

- Principal & Interest (P&I) payments

- Escrow (and for what – Insurance, Taxes, Reserve)

- Current loan balance

- Current Asset value

- Key Metrics (Loan-to-Value, Loan-to-Cost, Debt Coverage Ratio/Debt Coverage Service Ratio).

Download your free PDF cheatsheet containing essential metrics for managing your loans.

We agree that is a lot of data! It is not uncommon for there to be more than 20 columns of data with each loan! But it is important to understand what your current Loan-to-Value or Debt Coverage ratio is. Or, when your next loan is coming due so you have time to shop for the best rate.

Applying For a New Loan

When it is time to apply for your next loan, one of the first things you will need to do is fill out a personal financial statement and/or provide a global view of the business. The lender needs a clear picture of all your current assets and your liabilities, in addition to information about the asset that is being purchased or refinanced.

For many companies, this means pulling together information for the lender from paper files, emails, asking questions of your teammates, and checking multiple bank accounts to pull this information together. Unfortunately, it is often a time-consuming activity that is repeated with every loan.

Lenders require information to ensure you are a good financial risk. There are several metrics they look at when evaluating both the individual loan and your global profile. Consequently, a few key things they look at from an asset perspective are:

- Total asset value

- How much equity you have available across your portfolio

- Total debt

- Overall Loan-to-value (LTV)

- Overall Debt Service Coverage Ratio (DSCR) sometimes referred to as Debt Coverage Ratio (DCR)

- Rent rolls

- Cashflow

They look at all of these pieces of data to evaluate the risk. Any number of things could negatively impact the performance of your portfolio:

- Interest rates could increase

- Vacancies could increase

- A downturn in the economy and delays in rent payments

Having all of your information easily available without delay, and knowing where you sit in respect to all of these data points, will instill confidence with your lender. Overall, lender confidence means lower interest rates.

Let me say it again:

Lender Confidence = Lower Interest Rates

Benefits of a Loan Inventory and Dashboard

Peace of mind tops the list for why our customers like having all of their commercial real estate loans tracked in a single organized location like STRATAFOLIO.

STRATAFOLIO provides the following benefits:

- Visualization of your entire loan portfolio

- Automated recording of principal paydown (for QuickBooks customers)

- Alerts and reminders for loans coming up for renewal

- Exportable spreadsheet of all your loans that can be shared with lenders, accountants or partners

- Consistency in process

- Real-time metrics for Loan-to-Value and Debt Service Coverage Ratio (DSCR) sometimes referred to as Debt Coverage Ratio (DCR)

- Consistent calculations

- Time saved by staff so they can spend their time doing real value-add activities

- Quick access to information to share with your lenders, means lender confidence

- And, as we mentioned earlier….Peace of Mind

Until recently, there was a gap in the market when it came to real estate analytics – and particularly around tracking commercial real estate loans. But now, there’s an innovative solution!

STRATAFOLIO is a data management software that was developed just for commercial real estate owners and landlords. It helps automate complex processes, visualize data, manage investors, achieve better interest rates, manage commercial leases and more. It integrates right into your existing accounting software and provides a variety of tools that you can’t find anywhere else.

Schedule your demo today and learn how we can help you.

Jeri Frank