What is the difference between the direct cash flow method and the indirect cash flow method in commercial real estate? How do you calculate these methods? And, finally, what is the impact on your cash flow statements? As a commercial property investor, owner, or even manager, these are key processes to understand when seeking to grow your business.

In this article, we will address the following:

- What a cash flow statement is and why it matters in commercial real estate

- How the direct and indirect methods calculate cash flow

- Which method accounting standards (GAAP and IFRS) allow or prefer

- When each method is typically used in CRE reporting

- Common mistakes to avoid when preparing cash flow statements

Because most commercial real estate (CRE) firms use accrual accounting, cash flow techniques help translate those reports into instantaneous information about how money truly flows into and out of your company.

Read on to learn more about this crucial aspect of commercial real estate accounting and how you can use it to make smarter investments.

Difference Between Direct and Indirect Cash Flow

Most commercial real estate firms use accrual accounting, so transactions aren’t entered when cash changes hands, but rather when they occur. Because of this reality, the income statement fails to accurately reflect cash flow; that’s what the cash flow statement is designed to do.

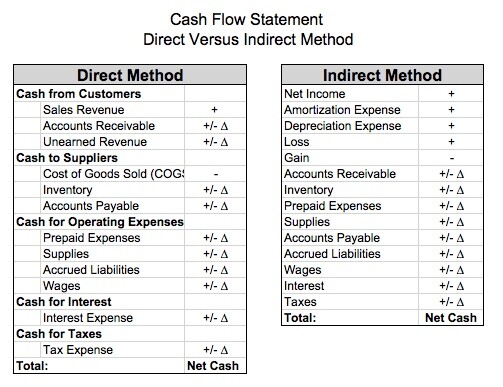

The direct method reflects actual operating cash receipts and payments, such as rent received or paid to suppliers. The indirect method begins with net income and accounts for non-cash items and changes in net working capital.

They balance the same amount of cash flows, but the direct method is more explicit, while the indirect method is easier to compute from accrual records.

Which Cash Flow Method Do Accounting Standards Require?

A common question in commercial real estate accounting is whether GAAP or IFRS requires one method over the other. The answer is no, both standards allow either the direct or indirect method for reporting operating cash flow. IFRS encourages the use of the direct method for greater transparency, but both IFRS and GAAP ultimately permit either approach.

In practice, most U.S. companies will tend to use the indirect method since it is easier to prepare from accrual-based accounting system data. The direct and indirect methods both translate accrual results to cash flow — they just differ in how they present the operating cash flow section. Many investors and analysts prefer the direct method because it shows exactly where cash is coming from and where it’s going.

Cash Flow Statement

Among the many financial statements CRE business leaders rely on is the cash flow statement. At its most elemental level, the cash flow statement, or the statement of cash flows, is a report that illustrates how cash flows into and out of a business. This financial statement helps a company understand the change in cash and how different activities impact it. There are three separate areas of a cash flow statement:

- Operating activities: Any revenue-generating business activities are recorded in the operating activities. These generate revenue, expenses, gains, and losses. Essentially, operating activities do not include costs associated with investing or financing.

- Investing activities: They encompass fixed assets or long-term asset transactions, often referred to as property, plant & equipment (PP&E), and other investments.

- Financing activities: Finally, the financing activities on a cash flow statement document third-party backers of your company through investors or loans. This is also where your long-term liabilities and stockholder equity are recorded.

Cash Flow Statement Categories

Cash Flow Statement Categories

| Operating Activities | Investing Activities | Financing Activities |

|---|---|---|

| Associated with revenue collection, expenses, gains and/or losses | Related to long-term assests | Related to long-term liabilities and owners' equity |

In reality, the only difference between direct and indirect cash flow resides in how the operating activities are calculated, as illustrated in this graphic.

To show the difference in practice, below are examples of how direct vs. indirect cash flow methods handle typical commercial real estate transactions.

How Direct and Indirect Cash Flow Methods Work in Commercial Real Estate

Imagine a tenant pays $50,000 in rent:

- Direct method: that $50,000 posts immediately as cash inflow under operating activities — you see the cash where it came from.

- Indirect method: you start with net income and then adjust for the change in accounts receivable to reflect that the payment was collected; the cash impact is shown through the reconciliation, not as a line-item inflow.

A $100,000 roof replacement is another typical transaction. The impact on operating cash varies based on timing and whether any associated operating reimbursements or reserves are impacted, but both approaches record the outflow in investing activities.

These transaction-level views are easier to reconcile when your rent roll, expenses, and accounting are connected, which is why many teams rely on the best property management software to reduce errors and speed reporting.

Direct Cash Flow Method for CRE Expense Tracking

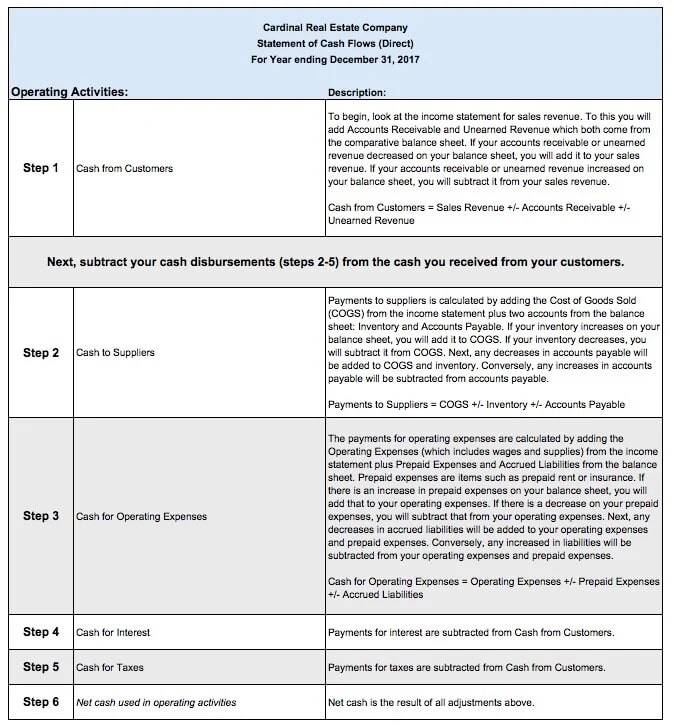

With the direct method, also referred to as the income statement method, you identify all sources of cash receipts plus all cash payments. The Financial Accounting Standards (FAS) Board recommends the direct cash flow method because it is a more transparent cash flow view. However, most companies’ charts of accounts are not structured in a way to accommodate this easily. Two categories exist for direct cash flow: cash coming from customers and cash disbursements.

Attached is a description of those activities that go into the direct cash flow method.

Indirect Cash Flow Method: Reconciling Net Income

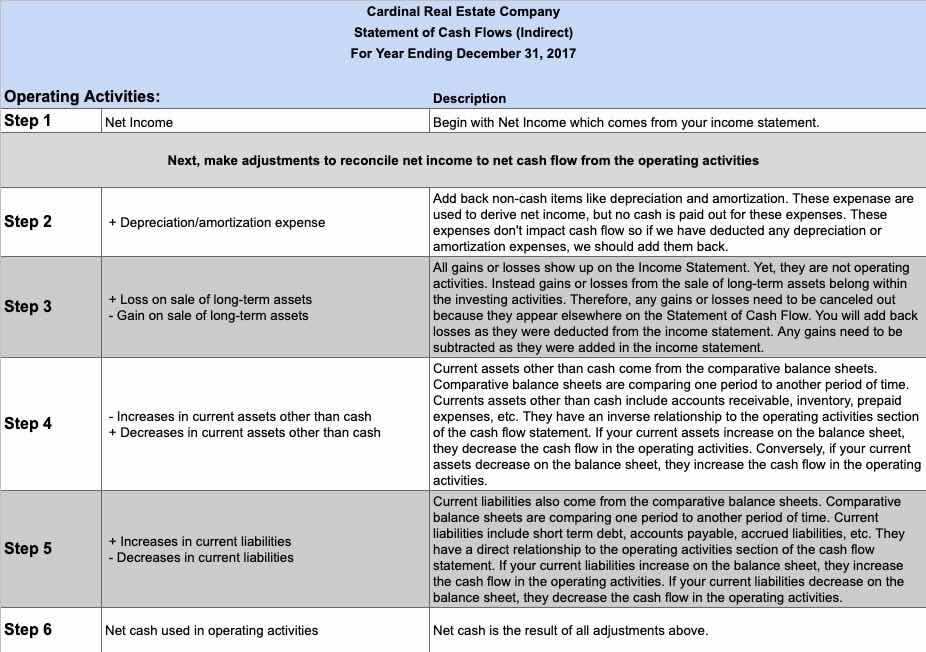

Notably, the most commonly used cash flow method is the cash flow statement indirect method. You may also see the indirect cash flow method referred to as the reconciliation method. With the indirect cash flow, you are reconciling accrual-based net income back to actual cash flow. If you are a QuickBooks user, QuickBooks generates their cash flow reports using the indirect method.

Information for indirect cash flow is simple to compile, as it comes directly from the income statement and balance sheet. Ordinarily, this information is readily available through your accounting system. With the indirect cash flow method, you begin with your net income and then add back or deduct those items that do not impact cash.

Attached is a description of those activities that go into the indirect cash flow method:

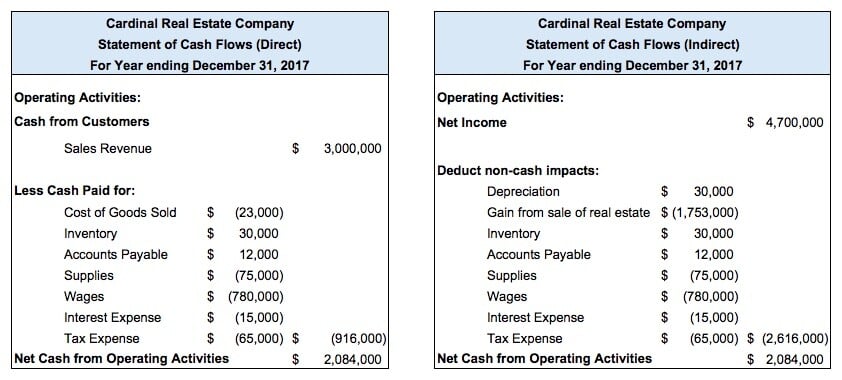

Results of Direct vs. Indirect Cash Flow

Regardless of what approach you take, the net cash flow should be the same amount. The true variations are in how you get there and how at ease you are with the specifics.

The important thing is to select a method and stick with it. Cash flow is necessary to manage a business successfully, so owners have sufficient cash on hand to fund operations. In short, without a regularly prepared cash flow statement, it will be difficult to see the big picture of your company’s performance.

Common Cash Flow Reporting Mistakes in Commercial Real Estate

Accurate cash flow reporting is essential in commercial real estate; however, certain errors persist. Below are key pitfalls to avoid;

- Mixing up CapEx and OpEx – For example, treating a new HVAC system as an expense instead of a capital investment.

- Forgetting tenant improvement allowances – These impact cash outflows and reimbursements and must be tracked carefully.

- Double-counting reimbursements – Sometimes recorded as both income and a reduction in expenses, which inflates cash flow.

Using cloud-based property management software helps minimize these risks by keeping expenses, improvements, and reimbursements clearly categorized in one system.

FAQs

Why is direct cash flow especially helpful for tracking CRE expenses?

Direct cash flow provides a clear, line-item view of cash receipts and payments, with commercial real estate firms having sharp visibility into the flow of cash, even in an accrual accounting system. It is easier to detect trends in expenditure and adjust budgets on an ad-hoc basis.

Can I use the indirect method for commercial property net income reconciliation?

The indirect method cash flow is especially useful for commercial property net income reconciliation. This approach converts all transactions from your income and balance sheet back to cash.

Which method is preferred for forecasting CRE property cash flow in 2025?

Both cash flow methods can be useful for forecasting in commercial real estate. Direct cash flow is excellent for accurate, specific insights, especially short-term, while indirect cash flow provides a simpler but broader view that can be helpful in long-term planning.

Master Cash Flow with STRATAFOLIO

STRATAFOLIO’s cash flow dashboard is the simple solution to financial reporting. Access broad and specific views for a full understanding of your portfolio, isolate specific time periods, and even project cash flow for the future. Designed for commercial real estate investors, owners, and property managers, STRATAFOLIO gives you all the accounting tools you need for growth. To learn more about how STRATAFOLIO helps you track cash flow, schedule a free demo now.