In the Setting up a Chart of Accounts for your Real Estate Management Company blog, we talked high level about setting up a Chart of Accounts for a real estate company. This time we are taking it one step further and we are walking you through the process, step by step for QuickBooks desktop. You can download the free sample IIF file at the bottom of the blog, or an Excel Sample company.

A critical task for commercial owners

If you are a QuickBooks Online user and want to know how to set up a chart of accounts in that version, check out the blog and video: How to Set Up a Chart of Accounts for a Real Estate Company in QuickBooks Online.

This chart of accounts is more focused on a portfolio comprised of residential real estate. If your portfolio has mostly commercial real estate assets, check out our new blog: Setting up a Chart of Accounts for a Commercial Real Estate Company

We had the opportunity to sit down with Amy Heinen from Quick Action Accounting to do a deeper dive into the process of setting up a Chart of Accounts. As an experienced accountant, Amy has seen her share of poorly organized Charts of Accounts. In our conversation, she talked about the process she recommends and provides tips along the way to make the process go a little smoother. Amy is a QuickBooks expert and a local favorite accountant.

Topics Covered:

- Importance of a good Chart of Accounts

- The function of a Chart of Accounts

- Elements of a Chart of Accounts

- Process for importing an IIF file

- Results of a good Chart of Accounts in your financial reports

Importance of a Good Chart of Accounts

If the Chart of Accounts is not set up correctly from the beginning it can lead to a lot of time and money to clean up down the road. Many businesses have struggled simply because they were unable to clearly see how their business was operating. Don’t let that be you. And, if your current Chart of Accounts is not meeting your needs, invest the time and make it a tool you can rely on.

Main Function of a Chart of Accounts

The Chart of Accounts is the foundation of your business. It provides a way for you to share data with others including bankers and accountants. The Chart of Accounts gives you a mechanism for you to tell the story of your business. If appropriately organized, you will be able to see how your business is performing in key financial reports.

What is the Chart of Accounts Composed of?

- Assets – These are your stuff and things: Cash, Accounts Receivable, Properties

- Liabilities – Things you owe: Accounts payable, Taxes payable, Notes payable (mortgages)

- Equity – What you actually own

- Revenue – Sales and rental income

- Expenses – Costs you incur to generate sales

Starting from Scratch to Import

Amy shared you can use the templates that are provided within QuickBooks. However, she finds she ends up making so many alterations that it would have been easier to start from scratch. So, that is what we are going to illustrate – importing a template Chart of Accounts for a real estate business from scratch. The procedures we have provided apply to QuickBooks. But, the concept for a good Chart of Accounts apply to any accounting system.

To begin the process, go to Lists and Select Chart of Accounts.

Before importing the IIF file (Scroll to the bottom of the blog to download a free copy of the IIF File), clean out all the accounts you do not need. This will prevent duplicates when the template IIF file is imported. As a note, there are a few accounts you will be unable to delete as QuickBooks will require them and they will be dealt with later in the process.

Here is what you should be left with after cleaning out the Account before importing the IIF file.

Next, turn on the numbering for your Chart of Accounts. Go to Edit and select Preferences. Under Accounting, select Company Preferences. Then check the Use account numbers box and select OK. You can turn this on before or after you import your file.

If you are using the template IIF file we provided, download that now to your desktop. To import, go to File, select Utilities, then Import, and then IIF Files. (Scroll to the bottom of the blog to download a free copy of the IIF File.)

A successfully imported file will look like this when the import is complete.

Numbering in your Chart of Accounts

How you set up your numbering is up to you, but giving yourself room to grow is good. Here is an example of how you could use a 5 digit numbering schema.

Deleting an Account

To Delete an account, select the account you want to delete, right click and select Delete Account, or control + D on the keyboard. QuickBooks will ask you if you are sure you want to delete this account. Click OK.

Setting up Subaccounts for your Real Estate – Fixed Assets

Once the IIF file has been imported, you can add subaccounts for each of your unique assets. You will create a subaccount for all the fixed assets for each property you own. Most people use the address of their property when they create the subaccounts for each Fixed Asset account.

To add an account, go to the bottom of the Chart of Accounts screen and select Account and then New.

This screen will come up and you will want to select Fixed Asset and then Continue on the bottom right.

On the next screen, you will enter the account name (100 15th Ave in this case) and then select the Subaccount, Dwelling/Building, assign the number in the right-hand corner, then hit Save & Close.

Continue this very same process for Land, Property Improvements, and Accum Deprec (accumulated depreciation). The unique number you assign to each property will be used for all the subaccounts. By breaking your fixed assets out in this way, it will help your accountant when they record your taxes. Those are the same categories on your tax returns. Your Chart of Accounts should have subaccounts for each property under Dwelling/Building, Land, Property Improvements, and Accumulated Depreciation.

Setting up Subaccounts for your Real Estate – Notes Payable

Your Notes Payable section should have subaccounts for each mortgage you have. Go to the bottom of the Add New Account and select Long Term Liability and select continue.

Once again add in the Account Name for your property, select the Subaccount of Notes Payable, and continue with your unique numbering sequence in the right-hand corner. In the Description, you can reference your lender and account number as reference.

Setting up Subaccounts for your Real Estate – Escrow

Next set up the subaccounts for the Escrow Account. Create a new account and select Bank and hit Continue.

Like the other subaccounts you have already set up, you will enter the property address, the unique number of the property and that it is a subaccount of Escrow Accounts. Select Save & Close.

Setting Up Your Profit and Loss Accounts

The way you set up your income and expense accounts will help you understand your business and tell the story of your performance. Many people have only a single account for rental income. But including separate incomes for base rent, garage, pet income, common area maintenance charges, etc. will provide you greater clarity. The separation of revenues will show you what drives your revenue.

Like you previously did, to add additional subaccounts for rental income, click Account at the bottom left hand of the Chart of Accounts screen, select New and begin. When you are on the Add New Account screen, select Income and click Continue.

As before, follow the same unique numbering schema for each property. And create a subaccount for each type of rent or rental type income you plan to track.

Setting up Properties in the Customer Center

The Customer Center is where each tenant or customer is set up. Each individual tenant will be a customer. This set up will allow you to see the income separated out by customer (or property) in your financial reports.

Financial Reports – The Final Step

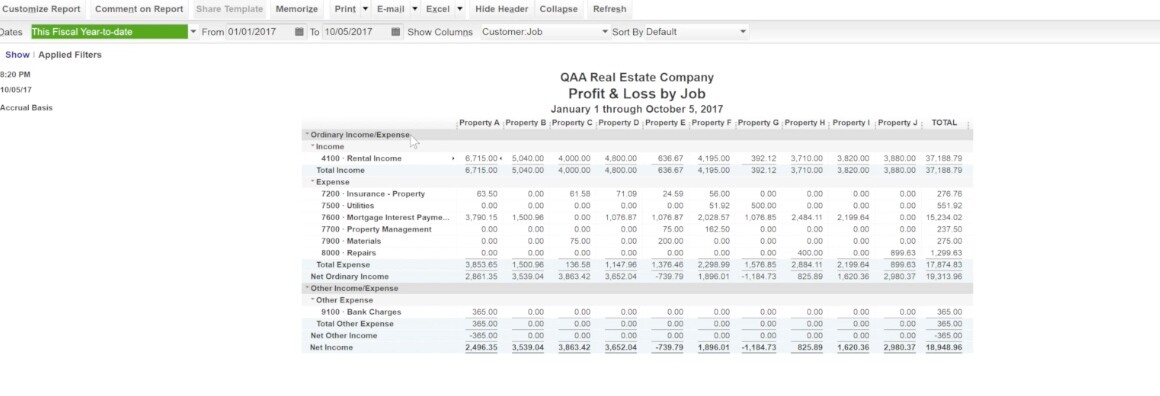

Finally, it is time to run reports. To run Reports, go the top menu bar and find Reports, then Company & Financial. Select the report type you are interested in running. In this instance, we are running Profit & Loss by Job.

Here is what your Profit & Loss by Job will look like. Any income or expense will align with each customer now.

The Balance Sheet is another important report to look at when evaluating the performance of your company.

There are a number of other reports you can run as well, but these will get you started on the right foot. As we have stated before, organizing your chart of accounts correctly from the very beginning will pay off. You will be able to understand your business more clearly and allow you to track that metrics that matter. As an added bonus, your accountant will appreciate your clean records and your lender will commend your organization.

Or, if the IIF version does not work for you, try our Excel Sample Real Estate Company file below: