For many real estate owners and landlords across the country, the first real impact of the COVID-19 is becoming a reality with rent collection. Clearly, rent payments have been profoundly impacted by COVID-19.

If you are like many landlords, you’ve already been fielding lots of calls from tenants. Their tenants are expressing concerns about their inability to make their upcoming rent payments.

In this article, we address:

- The importance of tracking

- The most common scenarios for rent impact

- Tracking in QuickBooks

- Stay in front of this

We advise you to consult with your CPA or tax advisor before implementing any strategy. Some of these strategies could have a tax consequence.

The Importance of Tracking

If you participate in any government-related relief program or are working with your lender, you need accurate, up-to-date records. Some programs have loan forgiveness components, and you don’t want to miss out because of sloppy record-keeping.

Likewise, your lender’s time is also at a premium. Having organized clean records when working with them to change loan terms will promote confidence in you and your operation. Lenders often struggle with disorganized landlords, set yourself apart.

The Most Common Scenarios for Rent Impact

The news is full of stories of distressed retailers, restaurant owners, and other small businesses. They have significant concerns about their ability to pay both rent or their employees. Some retailers came out early (Subway, The Cheesecake Factory, and Mattress Firm) and declared publicly they intended to withhold rent payments due to government-enforced store closings. However, for most landlords, the conversation with tenants around the impact to rent is not nearly as public.

The last thing a landlord or owner wants to do right now is to find a new tenant. But the reality is, Covid-19 is impacting tenants across the spectrum. The National Multifamily Housing Council is reporting that nearly one-third of renters did not pay their April rent. For many landlords, the conversation around rent really comes down to a few different scenarios. They can offer rent reduction, rent deferral, or rent abatement, which we describe below.

Rent Reduction

In a rent reduction scenario, the tenant and the landlord agree to reduce a tenant’s rent for a specified period of time.

Rent Deferral

In the case of a rent deferral, the landlord and tenant agree to defer some or all of a tenant’s rent payment until a later time or to over a period of time. However, at some point, the tenant will repay the full deferred sum.

Rent Abatement

In the situation of rent abatement, the landlord agrees to forgive the past due rent essentially. However, the landlord will want assurances that the tenant intends to stay in the space and stay current on future rent payments.

Tracking Impacted Rent Payments in QuickBooks

Next, we cover how to track these different tenant agreements in QuickBooks and how these transactions will appear on the sales receipt, journal entries, Profit and Loss Statements, and the Balance Sheet.

Rent Reduction

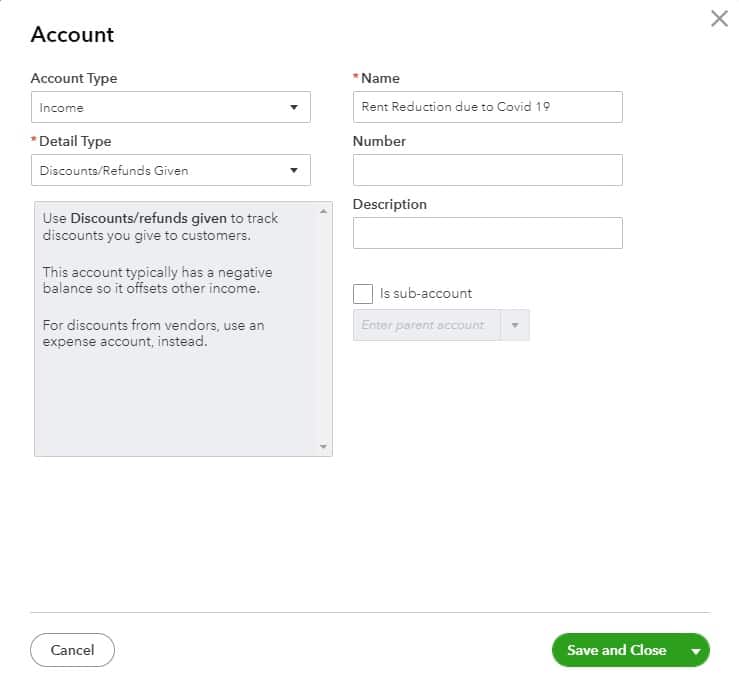

To record a rent reduction, you would first need to set up a “discount” type of account in your QuickBooks that will be a contra-income account. A contra-income account is created to allow you to see the full amount of rent and discounts. Consider calling it “Rent Reduction Covid 19.”

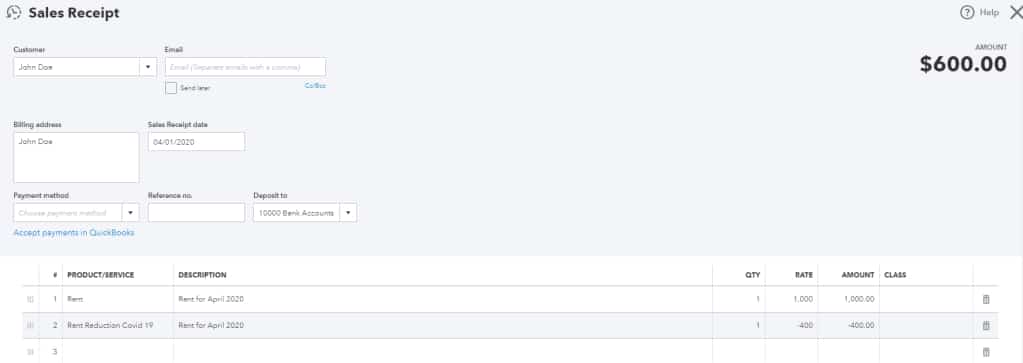

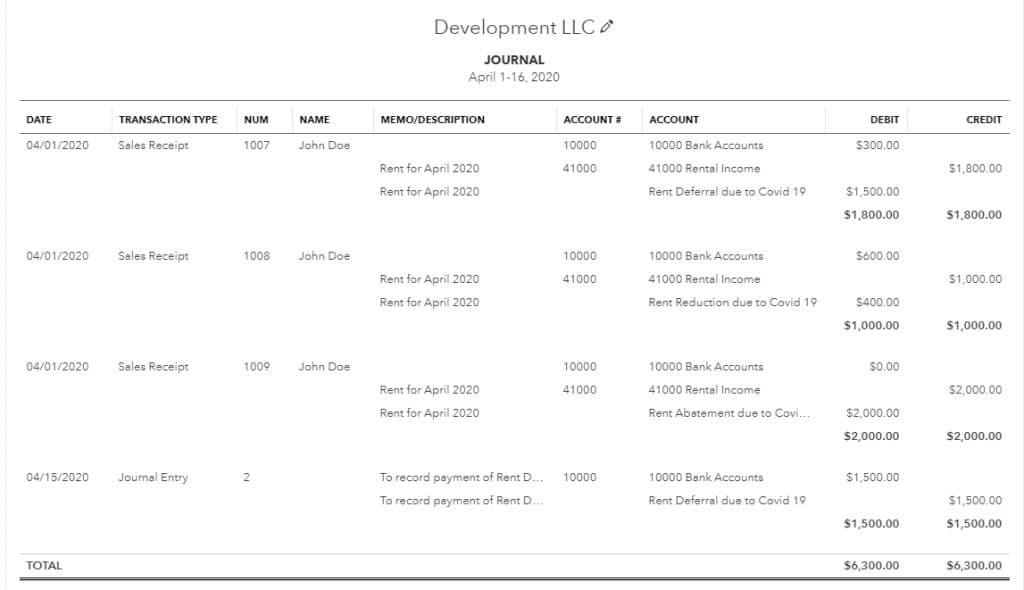

In this example, rent for that unit was $1,000/month, and the discount that you agreed upon was $400. This is how you will record the sales receipt once you receive the rent payment.

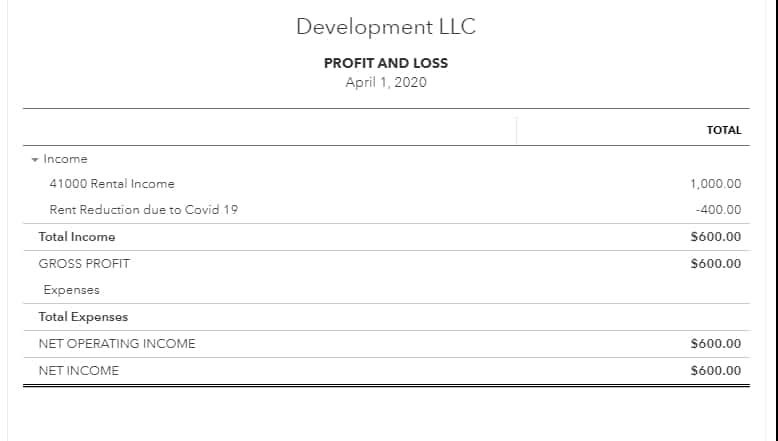

As you can see on the Profit and Loss below, the rent reduction due to Covid 19, is clearly outlined. If you do this for each tenant, you have will have an accurate and full record of your agreed-upon rent reductions across your business.

Rent Deferral

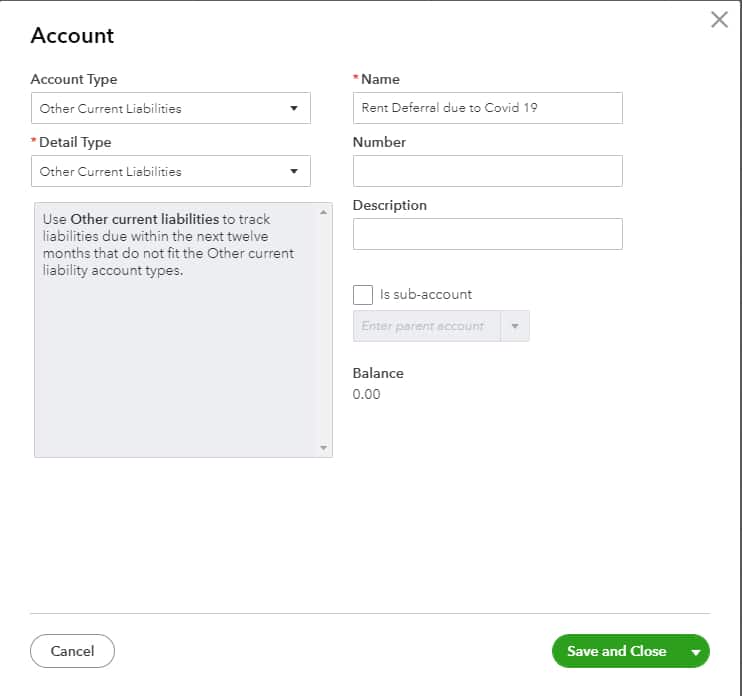

To record a rent deferral, first create a QuickBooks account labeled “Rent Deferral Covid 19” as an “other current liability” account.

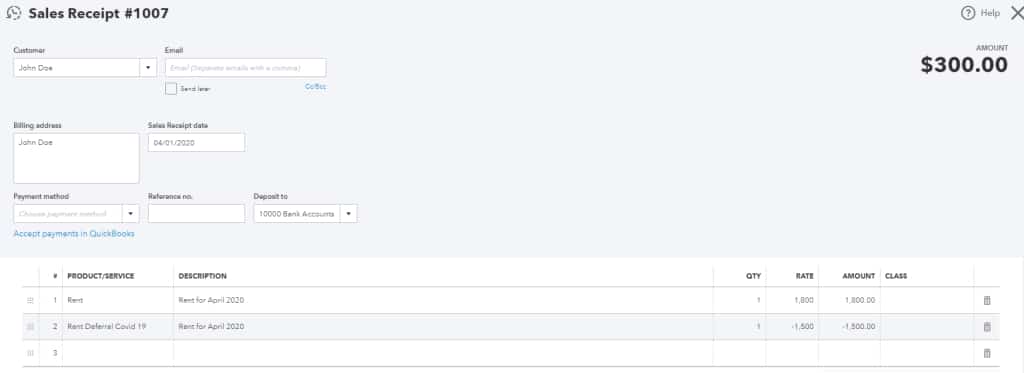

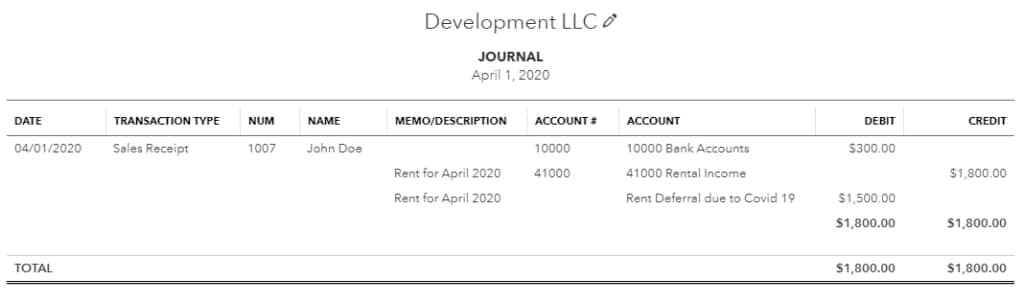

To record this, you will need to make a journal entry that debits the Rent Deferral account and credits the Rental Income account for the amount that is being deferred. This is a non-posting journal entry and will not show up on your Income Statement until the payments have been collected.

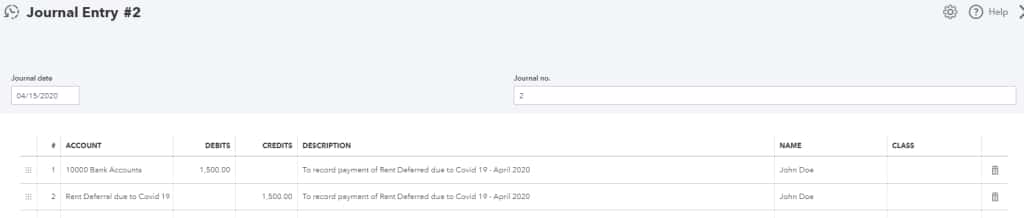

When the tenant eventually makes a payment, the journal entry will be to debit the bank account that the money is being taken into and credit the Rent Deferral account to clear it out.

When the tenant makes the remainder of their deferral payment, you will record a journal entry and date the transaction with the date when the money was received.

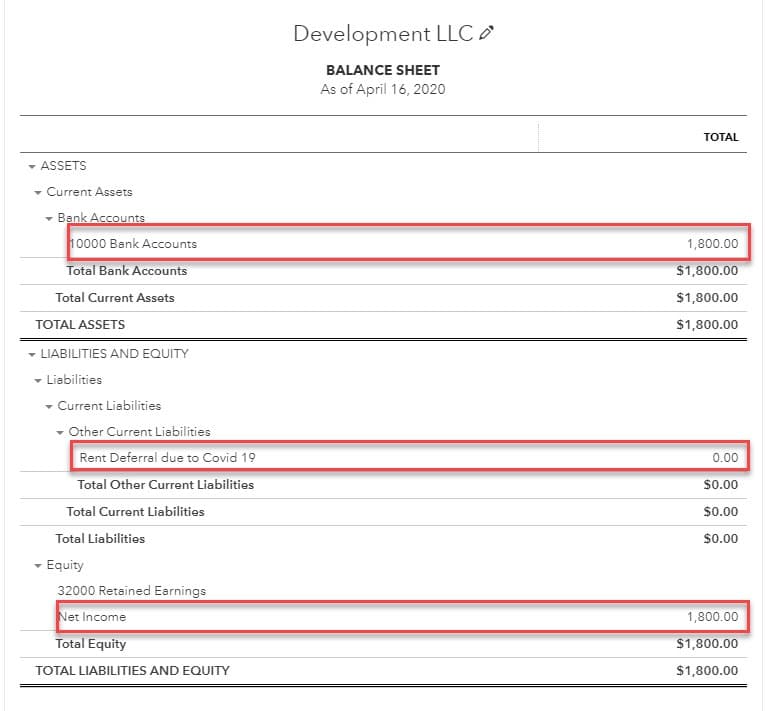

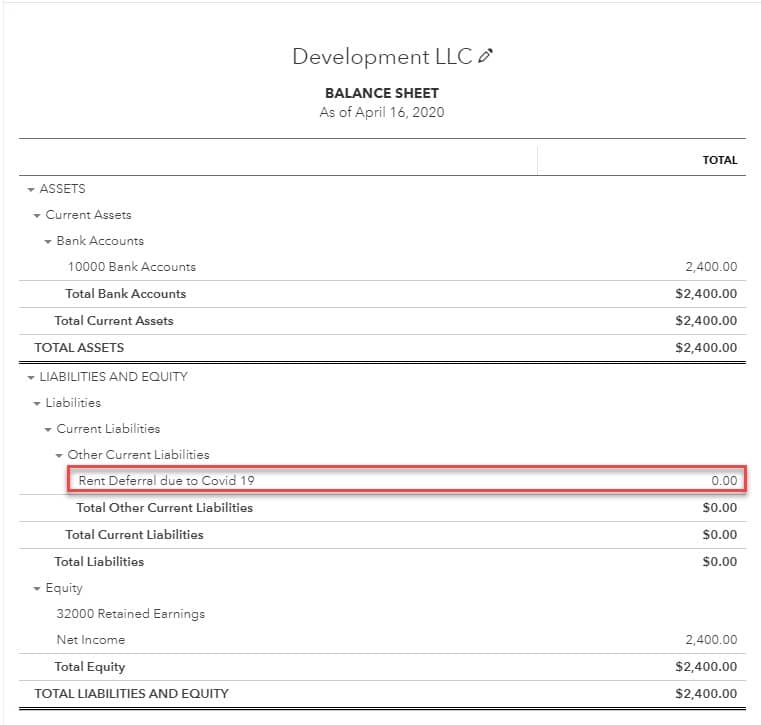

As you see below, the $300 collected for rent on April 1st was deposited into the bank account. The total amount of rent of $1,800 is reported in your rental income. However, the remaining $1,500 is sitting in the liability account you created called Rent Deferral due to Covid 19.

Once the deferred amount is recorded, the Balance Sheet liability account for Rent Deferral due to Covid 19 will go to $0, and your bank account will reflect the collection of the entire rent. As you will see, your net income now also reflects the receipt of full payment of rent.

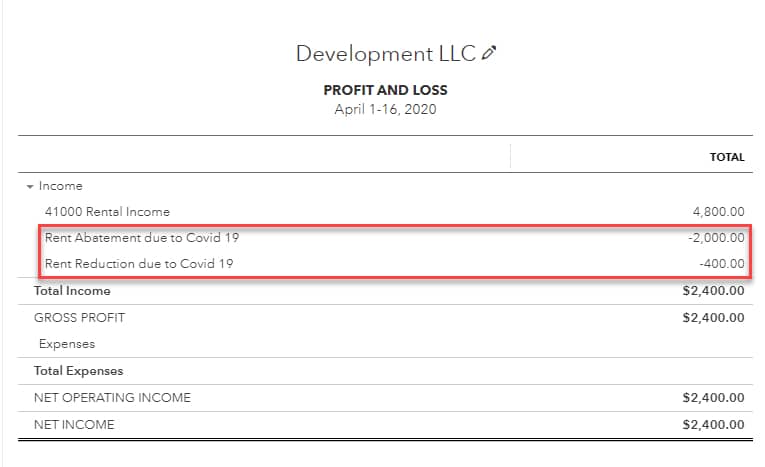

This is the Profit and Loss Statement reflecting the full receipt of the deferred rent payment.

Rent Abatement

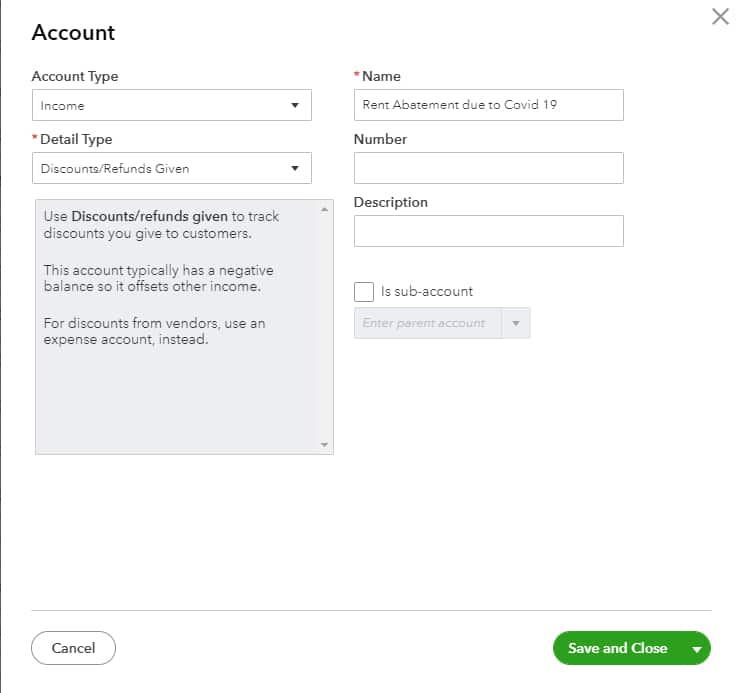

If you agree with your tenant to completely forgive their rent, you will want to create an additional “discount” account. We will label it “Rent Abatement Covid 19.” It is another contra-income account.

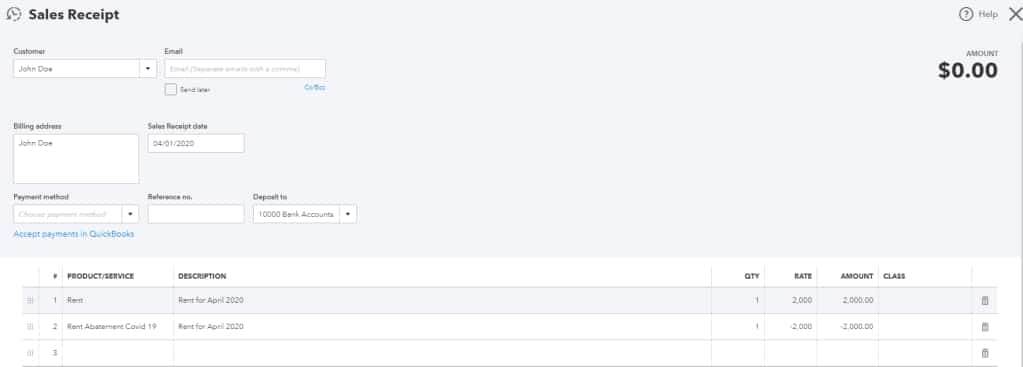

This sales receipt, including the amount of rent collected in the first line and the following line, enters the entire amount as a negative number for the Rent Abatement account. This will create a $0 entry in cash but will show up as income and contra-income on the income statement. In the end, they will balance each other out. The transaction will not show up on the Balance Sheet.

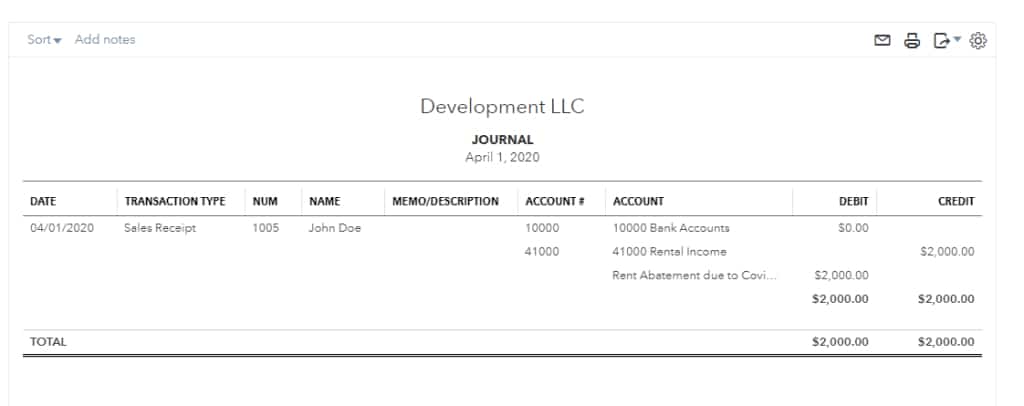

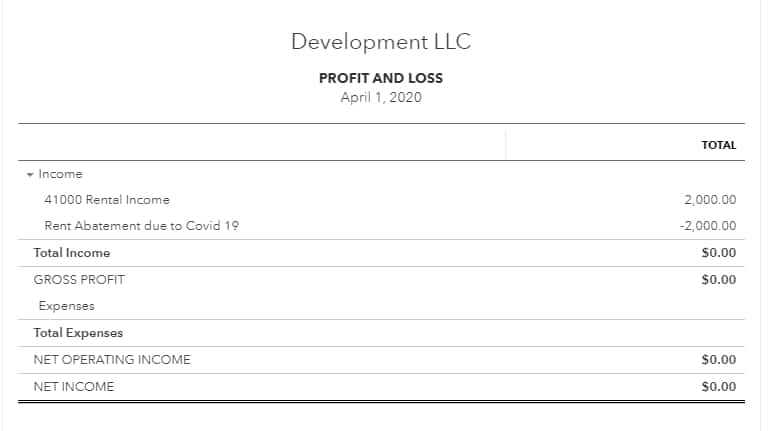

As you see below in this journal transaction, no money was collected for rent on April 1st. As a result, there was no deposit into the bank account. The total amount of rent of $2,000 is reported in your rental income. And, it is also recorded in the contra-income account, Rent Abatement due to Covid 19.

This Profit and Loss Statement reflects that all of April rent that would have been collected is captured in the contra-income account of Rent Abatement due to Covid 19. The net income is $0.

Rent Impacted by COVID-19 – The Full View

In the event you have all three scenarios at the same time, your Profit and Loss will show both of the contra income accounts – Rent Abatement due to Covid 19, Rent Reduction due to Covid 19. The Balance Sheet will reflect the Rent Deferral due to Covid 19.

If you want to see the transaction report journal, this is how the entries would appear.

These entries are made to serve as a tracking mechanism only. At the time of publication, there is no tax write off or advantage for reduction or abatement of rent. We advise you to consult with your CPA or tax advisor before implementing any strategy. Some of these strategies could have a tax consequence.

Stay in Front of This

As you have probably already noticed, this is messy. We encourage you to get ahead of this. Documentation is your friend. It will help with talking to your lenders and investors. This means documenting:

- Your conversations

- Any agreements

- Tracking the impact correctly in your financial records

- Requesting and tracking proof of impact (Note from your employer, unemployment application,

STRATAFOLIO can help. Now more than ever, it is critical that your real estate portfolio is organized well. Our team is standing by to help. Contact us today for assistance.