A good chart of accounts is the foundation for good record-keeping. This is true for all industries, including commercial real estate.

Let’s Talk Chart of Accounts

What would you do if one of your tenants requested additional information about a specific type of expense from the previous year? For many organizations, this request creates hours of work. And it also highlights the need for a financial, organizational overhaul. The start of a financial overhaul, or getting started on the right foot, is a solid chart of accounts.

We recently created a second sample chart of accounts (COA) focused on companies that own and manage commercial real estate. Every industry sector has specific needs, and real estate is no different. In the newly created COA (which you can find at the bottom of this article), we outline the most common accounts used in the industry.

Our previous chart of accounts, which you can find in the article, How to Set Up a Chart of Accounts for a Real Estate Company, focused more heavily on the accounts needed to manage residential real estate. Our new chart of accounts addresses the need for tracking expense types commonly associated with triple-net leases, including Common Area Maintenance (CAM)/Reimbursable Expenses.

This is the tip of the iceberg on what we are going to cover in this article.

Before diving into the COA, we need to highlight a few things that drive how you want to set up your new accounting structure.

Also – if you are new to QuickBooks and are looking for other information on how to set up your QuickBooks correctly from the beginning, check out our article on Commercial Real Estate and QuickBooks: The Best Ways to Get Started.

Preparing for CAM Reconciliation

One of the big differences between residential and commercial real estate is the use of triple net leases (NNN). With the use of NNN leases comes a different kind of expense grouping. One of these expense types that need to be tracked and managed are operating expenses, commonly referred to as Common Area Maintenance (CAM).

Tenants pay these operating expenses to help cover the costs associated with operating and overhead expenses for the common area. NNN leases typically consist of three main components, property taxes, insurance, and CAM. It is important to track and manage these expenses carefully.

CAM reconciliation generally happens at the end of the year or the beginning of the following year. At that time, the landlord provides a reporting of all the expenses incurred during the year. The tenant has a responsibility to cover their portion of the building expenses for the year. The tenant portion is frequently referred to as the pro-rata share. The specific tenant’s financial responsibilities are generally outlined in the lease.

For more information on CAM Reconciliation, check out our free guide on the foundations of common area maintenance (CAM). This contains a comprehensive and complete breakdown of what cam is how to calculate pro-rata, and best practices.

Terms in the Lease

As outlined in the lease, the tenant agrees to pay a certain amount (usually monthly) to cover these operating expenses. When the reconciliation report is generated, if the owner’s expenses were greater than the amount collected from the tenant during the year, the tenant may owe for the remaining difference. On the other hand, if the expenses were less than what the tenant paid, the landlord may refund or reduce the following year’s monthly CAM charges accordingly.

Either way, the landlord/owner must have a clean record of all the expenses incurred throughout the year to ensure full repayment of the CAM expenses. Plus, it is necessary for future budgeting.

Remember that you need to track expenses in various areas, and CAM expenses are just one of them. We will address the other areas as well below. A good way to track expenses is to use the class function in QuickBooks. If you want to learn more about CAM reconciliation, check out this article. But first, let’s address classes.

To Class or Not to Class

Classes are a great tool in QuickBooks to keep track of income, expense, and net profit of different segments (or buildings) within your business. Think of it as having a separate set of books, segmented by class, within one QuickBooks account. For commercial real estate, classes make it simple to see how each asset, building, or unit is doing compared to the others. The use of classes allows you to see your entire organization within that QuickBooks account easily within the Profit & Loss Report (P&L).

Some people prefer to use sub-accounts rather than classes. And while there are some benefits to using sub-accounts, there are some notable drawbacks. These concerns are particularly true if you have a lot of sub-accounts. First, when using sub-accounts, your P&L can get very long and unwieldy. Then, when collapsing to see the parent account, you lose the details you were trying to see in the first place. Additionally, the use of sub-accounts makes it far easier to make mistakes when posting entries.

On the other hand, when using classes, you post a transaction to the main expense or income account. The class does the rest. As a bonus, you can enable a setting to alert you if no class is selected. This safety mechanism prevents you from posting without a class by accident.

One thing to keep in mind with the use of classes is that the Balance Sheet represents the company as a whole. The individual classes are not broken down on the Balance Sheet. Depending on your organization’s needs, this may not work for you, and you will still want to use the sub-accounts as well. If you need to see each building separately on the Balance Sheet and the P&L, you may want to consider separate QuickBooks accounts.

The Actual Commercial Chart of Accounts

Every set of books will be slightly different based on your needs. For instance, in our sample COA, we include Elevators as a Reimbursable Expense. However, if you do not have an elevator, then this does not apply to your COA. This is the same thing as with Overhead and Business/Operating Expenses. Automobile Expenses for one company may be a Business Expense and Overhead Expense for another company. Based on our commercial real estate customers and advice from tax accountants, we have compiled a list that will get you pointed in the right direction. If you have questions about a specific account and where it should go on your P&L, it is best to ask your accountant or tax accountant for their advice.

Problems with Numbering

Why should you use a numbering system on your COA? Each account created in the chart of accounts is typically assigned a unique name and a unique number to identify the account. These accounts are typically five or more digits and each. The first digit will signify what type of account it is, whether it be an asset, liability, etc. This numbering schema is widely accepted as well, so when you are working with other accountants or bookkeepers, you are speaking the same language on what the account signifies.

| Number | Description | Purpose |

|---|---|---|

| 10000 - 19999 | Assets | Bank accounts and any real estate owned |

| 20000 - 29999 | Liabilities | Anything owed including mortgages and credit cards |

| 30000 - 39999 | Equity | Equity represents the shareholder's stake in the company |

| 40000 - 49999 | Revenues | Amount earned with income-producing properties |

| 50000 - 59999 | Operating Expenses | Directly related to the sale of your service (not typically used in a service business) |

| 60000 - 69999 | Overhead Expenses | Amount spent to run your real estate business, including payroll, advertising, etc. |

| 70000 - 79999 | Non-Operating Income | Income created by non-operating activities such as investments, earned interest, etc |

| 80000 - 89999 | Debt Services | Expenses to track your capital gains/losses on the property, investments, etc. |

| 90000 - 99999 | Miscellaneous Other Expenses | Misc non-operating and non-overhead expenses incurred that are infrequent expenses |

Some accounts may be used for Building/Operating Expenses, Overhead Expenses, or both. If this is the case, create a different account in each of the expenses and clearly label them.

Correct Labeling is Key

Labeling is the key to making sure that your expenses are recorded correctly. This will save a lot of time and frustration, verifying that the transactions are correctly posted. Clear labeling will also save you money when your tax accountant is preparing your tax returns at the end of the year.

Let’s talk through an example. Utilities can show up in three separate expense accounts, depending on your needs. In our sample chart of accounts for expenses, we use the labeling of “Reimbursable,” “Business,” and “Overhead.” This separation of expenses allows for clear bookkeeping.

- Reimbursable – these are expenses that need to be separated for NNN leases. This separation helps when doing CAM Reconciliations at the end of the year or quarter to differentiate between expenses allowed to be included in the NNN charges and those that are not. Exactly what is reimbursable varies by property type and the lease.

- Business – these are expenses that are directly related to the activity of renting commercial real estate. These expenses are incurred during the day to day activities directly related to producing income from your rental income-producing real estate business.

- Overhead – these expenses are related to the running of the real estate business. Think of it this way, would you have this expense even if one of your buildings is not being rented? Your cell phone bill would need to be paid even if your buildings are not currently being rented.

Finally, when creating a chart of accounts, it is important to leave a gap between numbers if you want to add additional accounts. Your goal is to keep your COA between 50 and 100 accounts, if possible. As you will see, that can be difficult.

Importing of COA in QuickBooks

If you are using QuickBooks, when you are setting up the new company, it gives you the option to start with their sample COA for your industry.

Using the industry default from the system has its advantages and disadvantages. If you don’t already have a COA as a baseline to begin, you may need to use the industry default as your starting point. However, this often results in many more adjustments to meet your specific needs in the long run. That’s why we created a sample commercial COA for commercial real estate.

The Steps for Importing

Below we have outlined the steps for uploading a COA to a QuickBooks Online account.

The Import

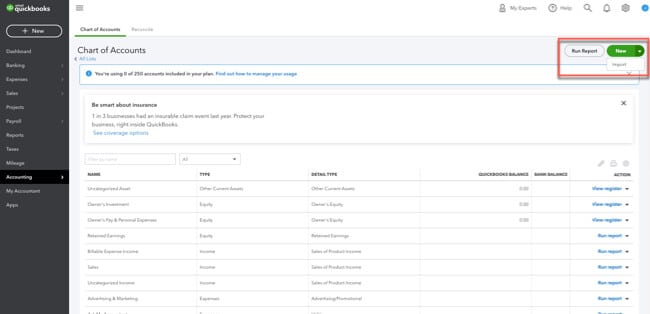

Begin by going to the left-hand side of QuickBooks Online and selecting Accounting, and then select Chart of Accounts. A picture will appear with the green button to “See your Chart of Accounts” to select.

Next, use the green drop down on the top left to select “New” and then “Import.”

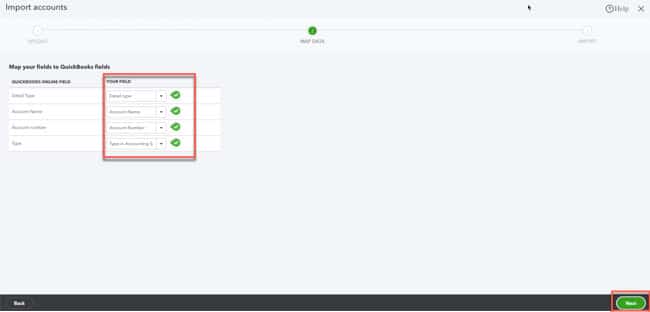

Browse for the Excel file you saved on your drive. You will want to make any modifications before uploading. Note: You can access our sample commercial COA at the bottom of this article.

The Verification

Make sure to verify that you have correctly mapped the fields from the Excel document within your QuickBooks Online account after importing it.

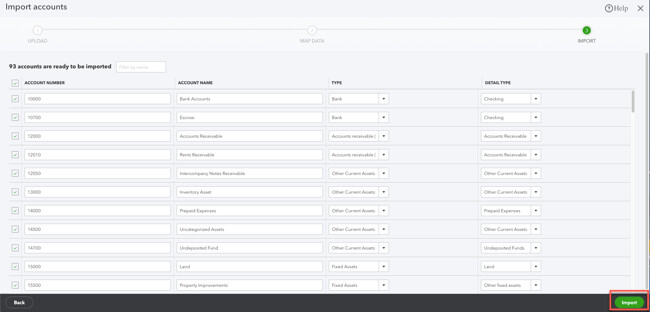

The last screen will be the imported COA for you to review and make any final changes before saving. You can always adjust and edit later as needed, but it is less work to make edits at this stage.

The Cleanup

Note: There will be a number of accounts that will show up as duplicated accounts. We have included them in our sample COA so you have account number references.

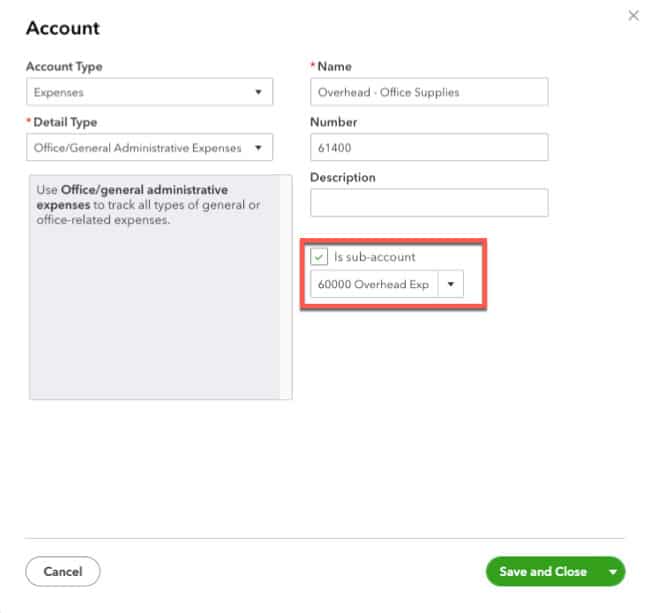

Once everything is in QuickBooks Online, you will want to create sub-accounts for any accounts that have parent accounts. Select the account that needs to be edited and make it a sub-account under the parent account, as shown in the example below.

In our downloadable sample, anything with a carrot is a sub-account. If you follow this process, it will allow you to collapse certain categories when looking at the P&L.

Our sample commercial real estate COA includes the type and the detail type needed for QuickBooks to get all of the accounts in the correct place on the first try. It also includes the numbering. Alter, add, or delete the accounts you may need on the worksheet, and it is ready for importing. This is a much easier process than changing all of the accounts in the auto setup.

Start with the Basics for your COA

Based on years of experience as an accountant servicing the real estate community, I have seen many financial statements. A well-run real estate company starts with a clean and well-developed chart of accounts that is consistent. The chart of accounts is the foundation for all good reporting and allows for faster decision-making. Invest the time upfront. It will save you time and money on the backend when you are preparing your CAM reconciliations or taxes.

Below we have provided a view and descriptions for each of the accounts in our commercial real estate COA. You can access a copy of the COA below the table.

(WARNING: This is a long table below, but it is useful content.)

| Account Number | Account Description | Type | Use |

|---|---|---|---|

| 10000 | Bank Accounts | Bank | Record all deposits or checks in this account |

| 10700 | Escrow | Bank | Some investors like to their insurance and taxes to be paid out of escrow which means the money is collected in advance and then paid out each month |

| 12000 | Accounts Receivable | Accounts Receivable (A/R) | Accounts Receivable (A/R) is money that customers owe you for |

| 12010 | Rents Receivable | Accounts Receivable (A/R) | These are unpaid or unapplied rents |

| 12050 | Intercompany Notes Receivable | Other Current Assets | Any mortgage or real estate loans your business has made or purchased in other companies owned by the same company |

| 13000 | Inventory Asset | Other Current Assets | The cost of goods your business purchases for resale. An account automatically created in QuickBooks |

| 14000 | Prepaid Expenses | Other Current Assets | To record payments for expenses that you have already expensed but have not yet paid |

| 14500 | Uncategorized Assets | Other Current Assets | For current assets not covered by the other types typically used within the year |

| 14700 | Undeposited Fund | Other Current Assets | A holding account for cash or checks that haven't been deposited yet |

| 15000 | Land | Fixed Assets | Separate out the value of the property and the land. Each land asset will have a separate account |

| 15500 | Property Improvements | Fixed Assets | Record all property improvements that are greater than $2500. Each property will have its own account to attribute any improvements to |

| 16000 | Building | Fixed Assets | To track the cost of structures you own and use for your business. Separate out the value of the dwelling and the land. Each property will have a separate account |

| 16500 | Building Improvement | Fixed Assets | Record all building improvements that are greater than $2500. Each property will have its own account to attribute any improvements to |

| 17000 | Closing Costs | Fixed Assets | Closing costs related to an asset that will increase the asset's value. |

| 18000 | Furniture & Equipment | Fixed Assets | Any furniture, fixtures, and equipment your business owns and uses |

| 19000 | Accumulated Depreciation | Fixed Assets | Each property (not land) will have depreciation each year that needs to be recorded |

| 19900 | Security Deposits Held | Other Assets | Asset account for security deposits held for tenants. |

| 20000 | Accounts Payable | Accounts Payable (A/P) | Accounts Payable (A/P) is the amount you owe to your vendors |

| 21000 | Credit Cards | Credit Card | The credit card accounts |

| 22000 | Payroll Liabilities | Other Current Liability | The amount of taxes that you owe to Federal, State, and Local government agencies for payroll taxes you have withheld from employee paychecks but not yet paid |

| 23000 | Tenant Security Deposits Held | Other Current Liability | Security Deposits held on behalf of your tenants. They do not belong to your business unless used when the tenant vacates |

| 25000 | Intercompany Notes Payable | Long Term Liabilities | Loans or notes that are payable within the organization in the long-term |

| 26000 | Notes Payable/Loan | Long Term Liabilities | Long-term notes, mortgages, lines of credit, or loans. Each property will have its own account to record the mortgage |

| 30000 | Equity Accounts | Equity | Any equity put into the business should be accounted for here |

| 38000 | Retained Earnings | Equity | Retained Earnings is the net income from previous fiscal years |

| 39000 | Opening Balance Equity | Equity | Account used to start an account and should be a zero balance |

| 40000 | Rental Income | Income | Any Rental Income produced by rent producing income property. If you are using Classes, there's no need to have individual accounts per property |

| 41000 | CAM & Recovery Income | Income | Any Reimbursable Income received. Typically used for NNN Leases |

| 42000 | Commission Income | Income | To record income collected for Commissions |

| 43000 | Tenant Late Charge Income | Income | Late payments fees and interest received from tenant |

| 44000 | Other Income | Income | This might include pet rent, appliance rents, garage rent, storage, etc. Can split out to the degree you want to be able to analyze your income from these different income streams |

| 48000 | Services Income | Income | Account created by QuickBooks for income from a product or service |

| 49000 | Uncategorized Income | Income | Account created by QuickBooks for income as part of the Online Banking feature |

| 49000 | Unapplied Cash Payment Income | Income | A holding account for income that has been received but not yet posted to an invoice for a tenant |

| 50000 | Reimbursable Expenses | Expenses | Parent account for Reimbursable Expenses, those that are incurred and expected to be paid for by tenants with NNN leases |

| 50100 | Reimbursable > Cleaning | Expenses | CAM/Reimbursable expense from tenant for cleaning of common area |

| 50200 | Reimbursable > Elevators | Expenses | CAM/Reimbursable expense from tenant for elevators |

| 50300 | Reimbursable > HVAC | Expenses | CAM/Reimbursable expense from tenant for HVAC |

| 50400 | Reimbursable > Landscaping | Expenses | CAM/Reimbursable expense from tenant for landscaping |

| 50500 | Reimbursable > Plumbing and Electrical Repairs | Expenses | CAM/Reimbursable expense from tenant for plumbing and electrical repairs. Can split into two if needed |

| 50600 | Reimbursable > Repairs and Maintenance | Expenses | CAM/Reimbursable expense from tenant for general repairs & maintenance. Can add additional accounts if needed to be more specific |

| 50700 | Reimbursable > Safety/Security Contracts | Expenses | CAM/Reimbursable expense from tenant for security or safety contracts |

| 50800 | Reimbursable > Snow Removal | Expenses | CAM/Reimbursable expense from tenant for snow removal |

| 50900 | Reimbursable Utilities > Electric | Expenses | CAM/Reimbursable expense from tenant for electricity. Can be combined into one Utility account if desired |

| 51000 | Reimbursable Utilities > Gas | Expenses | CAM/Reimbursable expense from tenant for gas. Can be combined into one Utility account if desired |

| 51100 | Reimbursable Utilities > Trash/Water/Sewer | Expenses | CAM/Reimbursable expense from tenant for trash, water and sewer. Can be combined into one Utility account if desired |

| 52000 | Insurance Expense | Expenses | Insurance expense paid for your real estate business properties |

| 53000 | Notes Payable Interest Expense | Expenses | Interest paid on notes payable, mortgage, LOC, construction loan, etc |

| 54000 | Property Taxes | Expenses | Property taxes paid on your real estate business properties |

| 55000 | Business Expenses | Expenses | Parent account for Business/Operating Expenses that are not reimbursable |

| 55100 | Business > Cleaning/Janitorial | Expenses | Cleaning or janitorial expenses for your business not directly associated with one building or tenant and not reimbursable by tenant |

| 55200 | Business > Commission Expense | Expenses | Commission expenses for your business not directly associated with one building or tenant and not reimbursable by tenant |

| 55300 | Business > Equipment Rental | Expenses | Equipment Rental expenses for your business not directly associated with one building or tenant and not reimbursable by tenant |

| 55400 | Business > Inspections | Expenses | Inspections for your business not directly associated with one building or tenant and not reimbursable by tenant |

| 55500 | Business > Property License and Permits | Expenses | Property Licenses and Permits for your business not directly associated with one building or tenant and not reimbursable by tenant |

| 55600 | Business > Materials | Expenses | Materials for your business not directly associated with one building or tenant and not reimbursable by tenant |

| 55700 | Business > Property Management Fees | Expenses | Property Management Fees not directly associated with one building or tenant and not reimbursable by tenant |

| 55800 | Business > Repair & Maintenance | Expenses | Repairs and Maintenance for your business not reimbursable by tenant |

| 55900 | Business > Small Tools | Expenses | Small Tools purchased not directly associated with one building or tenant and not reimbursable by tenant |

| 59000 | Business > Uncategorized Expenses | Expenses | Uncategorized Expenses not directly associated with one building or tenant and not reimbursable by tenant |

| 60000 | Overhead Expenses | Expenses | Parent account for all overhead expenses for the real estate business |

| 60100 | Overhead > Advertising & Promotion | Expenses | Any money spent promoting your company in advertising |

| 60200 | Overhead > Automobile Expense | Expenses | Any costs associated with vehicles that are overhead expenses |

| 60300 | Overhead > Bank Service Fees | Expenses | Payments made to financial institutions that could include overdraft fees, fees for checks, etc. |

| 60400 | Overhead > Computer Software | Expenses | Computer Software purchased for your real estate business |

| 60500 | Overhead > Consulting Fees | Expenses | Consulting Fees paid as overhead for your real estate business |

| 60600 | Overhead > Continuing Education | Expenses | Continuing Education for employees or owner for your real estate business |

| 60700 | Overhead > Dues and Subscriptions | Expenses | Any dues & subscriptions related to running your real estate business |

| 60800 | Overhead > Entertainment | Expenses | Expenses to entertain employees |

| 60900 | Overhead > Insurance General Liability | Expenses | General Liability Insurance paid for employees |

| 61000 | Overhead > Insurance Workers Comp | Expenses | Workers Compensation paid for employees |

| 61100 | Overhead > Internet | Expenses | Internet for your real estate business |

| 61200 | Overhead > Legal Fees | Expenses | Legal Fees for your real estate business not specific to a certain asset |

| 61300 | Overhead > Meals | Expenses | Meals for your real estate business |

| 61400 | Overhead > Office Supplies | Expenses | Office Supplies for your real estate business |

| 61500 | Overhead > Payroll | Expenses | Payroll for your real estate business |

| 61600 | Overhead > Payroll Taxes | Expenses | Payroll Taxes for your real estate business. Will need to add specific taxes or let the software add them for you when the payroll function is used |

| 61700 | Overhead > Postage and Delivery | Expenses | Postage and Delivery charges for your real estate business |

| 61800 | Overhead > Professional Fees | Expenses | Can include separate accounts for Legal, accounting, consulting, or memberships |

| 61900 | Overhead > Office Rent Expense | Expenses | Office rent expense if paying rent for your business' office |

| 62000 | Overhead > Telephone/Cell Phone | Expenses | Telephone or Cell Phone expenses for your real estate business |

| 62100 | Overhead > Trash | Expenses | Trash service or pick up for your real estate business |

| 62200 | Overhead > Travel & Parking | Expenses | Travel and parking for your real estate business in general |

| 62300 | Overhead > Utilities | Expenses | Utilities paid for your real estate business office |

| 69000 | Overhead > Uncategorized Expenses | Expenses | Any other overhead expenses that do not fit into a category. This should be used rarely |

| 70000 | Interest Income | Other Income | Interest that is earned from investments, assets, etc. |

| 71000 | Insurance Proceeds Received | Other Income | Monies received from insurance proceeds |

| 72000 | Uncategorized Income | Other Income | Any other income that do not fit into a category and is to go below the line on the P&L. This should be used rarely |

| 80000 | Capital Gains/Losses | Other Expense | The gains or losses from the sale of real estate in the organization |

| 90000 | Ask My Accountant | Other Expense | A temporary hold or suspense account until you can ask your accountant where an expense should be posted to |

| 91000 | Depreciation Expense | Other Expense | The expense related to the depreciation of an asset |

| 93000 | Other Expenses | Other Expense | Any unusual or infrequent expenses that don't belong to any another other expense type. |

| 94000 | Charitable Contributions/Gifts | Other Expense | Gifts to charity and contributions |

| 99000 | Reconciliation Discrepancies | Other Expense | Used to account for small discrepancies that can not be reconciled |

Download your free sample commercial real estate-focused Chart of Accounts.

Learn how we are working with commercial real estate companies to automate their processes resulting in faster CAM reconciliations, lender and investor reporting, and invoicing.