Managing finances for a commercial real estate business is no small feat, especially when juggling multiple properties, tenants, and stakeholders. However, mastering commercial property management accounting is essential for business growth. This ultimate guide breaks down the key principles, tools, and best practices you need to streamline operations, stay compliant, and maximize returns, helping you turn complex property data into clear, actionable insights.

What is Property Management Accounting?

Commercial property management accounting is a specialized branch of accounting focused on tracking, analyzing, and reporting the financial performance of properties such as offices, retail centers, and healthcare buildings.

Unlike general accounting, it involves property-specific processes like rent roll management, common area maintenance (CAM) reconciliations, net operating income (NOI), lease accounting, tenant billing, and compliance with lease terms. It requires detailed organization by property and tenant, along with an understanding of real estate cycles, financing structures, and investor reporting. This discipline ensures accurate financial oversight while supporting strong operational decisions and long-term growth.

What are the Benefits of Good Commercial Property Management Accounting?

- Higher revenue, lower costs: careful tracking of revenue and expense patterns allows owners to see issues, refine prices, and find opportunities for new savings and earnings.

- Easy regulation compliance: clear and accurate records make it simple to follow tax laws and financial regulations. Compliance avoids regulations and fines while building trust with tenants and business partners.

- Clear reporting: Clean, comprehensive reports provide owners and investors with the information they need to understand business performance and make informed decisions for future growth.

Property Management Accounting Basics

Generally Accepted Accounting Practices (GAAP)

GAAP is a set of standardized rules for accounting and financial reporting. These rules help accountants follow best practices for reliability, consistency, and transparency in their businesses. GAAP rules also make it easier to compare metrics between businesses. Some of the most important principles in property accounting include:

- Consistency: ensuring that regulations, methods, and standards remain the same over time.

- Matching: revenue is recorded in the same period in which it is earned.

- Materiality: reports clearly and fully disclose business assets, liabilities, and financial details.

- Conservatism: calculations and reports are carefully verified to maintain accuracy.

Cash vs. Accrual Basis Accounting

It is crucial to know the difference between cash basis and accrual basis accounting and which one your business uses.

Cash basis accounting records income and expenses on the date they are actually received or paid, rather than on the transaction date (when they are due or agreed upon). This method is simpler and may be easier to keep track of for smaller businesses. Property management software, such as STRATAFOLIO, display the account data in cash basis accounting, but can be switched to accrual depending on your needs.

Accrual basis accounting, on the other hand, records income and expenses on the transaction date, regardless of when money actually changes hands. Accrual basis accounting gives a broader view of a business’s financial situation and is required by GAAP standards, but may be more complex to maintain.

Double-Entry Bookkeeping

GAAP standards also require double-entry bookkeeping. This means that each business transaction is recorded in at least two accounts. For property management, transactions are entered separately as debit and credit. The double-entry method makes it easier to catch errors and offers a clear, organized financial record.

Common Area Maintenance (CAM) Charges/Reconciliation

Tracking and reconciling common area maintenance (CAM) charges are one of the most important parts of accounting for commercial property management. CAM requires owners to estimate the cost of upkeep and operation of all shared spaces on each property and divide out how much each tenant is likely to owe, based on square footage. Then, at the end of the year, CAM charges must be reconciled to show each tenant how much extra they owe or what they will receive back based on the budget.

In addition to maintaining trust between owners and tenants, careful calculation and analysis of CAM charges and reconciliation are essential to business growth. By reviewing each year’s reconciliation, owners and accountants can make adjustments to future charges for more accurate and profitable outcomes.

Keeping Multiple Business Accounts

The separation of businesses is important in commercial real estate. Most owners will open up a separate legal entity for each acquisition. With that acquisition, there are separate bank accounts and a separation of tracking in an accounting platform. A single account makes sorting out different transactions and funding sources extremely difficult, and may even cause legal or procedural difficulties.

For example, you might want to separate your business-facing side, which handles things like payroll, utilities, and your own office space, from your property-facing side, which handles rent and property maintenance, and other property-related finances. However, account structures can vary widely depending on specific business needs.

Creating a Chart of Accounts

A chart of accounts (COA) is an organized list of a business’s complete financial information. When well-managed, a chart of accounts depicts trends and financial health. Its organization can also help you make budget adjustments and keep track of necessary details for taxes. Additionally, it is an important resource to share with banks and investors so they can best understand your business’s performance.

While you can build and maintain your own chart of accounts, this will become more complicated as your business grows and you need to add more and more assets. An overly bloated chart of accounts creates confusion for everyone using and reviewing the output in financial reports. Establish a standard and adjust as necessary as you grow.

For QuickBooks users, one way to avoid this confusion as your business grows is to use classes in your chart. Classes allow you to add multiple assets to a single account, keeping QuickBooks functional and organized even for larger portfolios.

How to Set Up Your Property Management Accounting System

Follow these tips to establish a strong property management accounting system that suits your needs.

Choose a Strong Accounting Software

Using software designed for accounting vastly improves organization, accuracy, and efficiency for your business. While a variety of products target different sizes and types of businesses, most small to medium businesses use QuickBooks. QuickBooks offers automations, tracking services, and reporting to help you understand the details of your business.

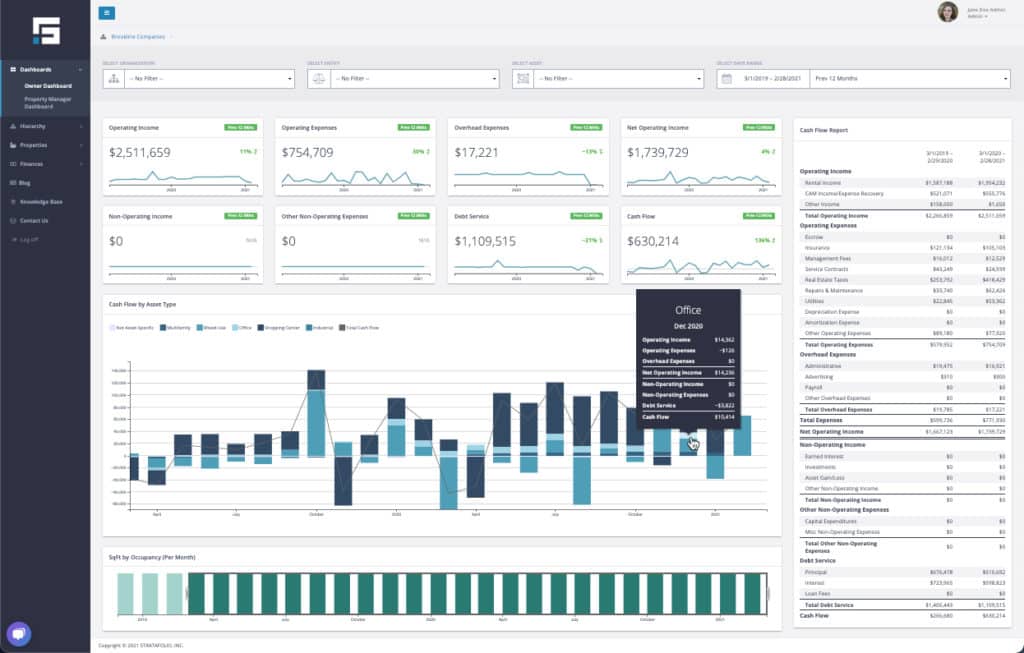

Programs like QuickBooks can also integrate with additional software specifically designed for property management. Solutions like STRATAFOLIO tailor the information in QuickBooks to your unique business needs, such as automated CAM reconciliation and net operating income (NOI) calculation.

Hire a Professional

Even if you believe your financial needs are simple, it is always a good idea to work with a professional accountant. Professionals ensure you comply with regulations, are familiar with important calculations and processes, and help identify issues you may overlook. Plus, they are likely to work through your accounting needs more quickly and help you achieve a better financial situation overall. Most accounting professionals are familiar with QuickBooks, which makes day-to-day and tax time work more cost-efficient.

Pay Attention to GAAP

It may seem obvious, but understanding and adhering to GAAP standards will help you apply best practices to your commercial property accounting. Since these are widely used standards, they can also help you compare with other businesses in your industry.

Report and Analyze Regularly

The most important aspect of good reporting is to run reports regularly. Though it depends on the report and your specific needs, this often means reporting monthly. Regular reports allow you to quickly spot and solve issues, while also generating important information about performance trends.

Information from reports helps accountants, owners, and investors make informed choices about pricing, processes, purchases, NOI, important debt metrics, and other key aspects of growing a commercial real estate business. Important reports for commercial property accounting include a rent roll, schedule of real estate owned, balance sheets, and profit and loss statements.

To ensure that your reports are regular, accurate, and easy to understand, it’s a good idea to use a property management software like STRATAFOLIO to create them for you.

Learn How STRATAFOLIO Contributes to a Robust Property Accounting System

Whether you’re an experienced accountant or just starting to learn property accounting ideas, get the support you need with STRATAFOLIO’s comprehensive commercial property management software. STRATAFOLIO makes it easy to organize your data, run reports and CAM reconciliations, and share important financial details. Automated processes help you save time and avoid costly human errors during important calculations.

For more information on how STRATAFOLIO can serve your property accounting needs, schedule a free demo today.