This article contains a consolidation of all the Knowledge Base links for Common Area Maintenance (CAM). CAM and Operating Expense setup can sometimes be complicated and unique per portfolio. Please review how your Onboarding team set up your leases and accounts and contact the Onboarding Team if these links do not cover your needs.

CAM Reconciliations

STRATAFOLIO’s Common Area Maintenance (CAM) Reconciliations Reports are a powerful tool for Commercial Real Estate (CRE) Investors and Managers when dealing with NNN leases. Quick and easy CAM reconciliations mean better tracking of expenses and budget performance. Accurate CAM reconciliations are an essential part of ensuring that money is not being left on the table and getting reimbursed for things that should be according to the leases that have been signed.

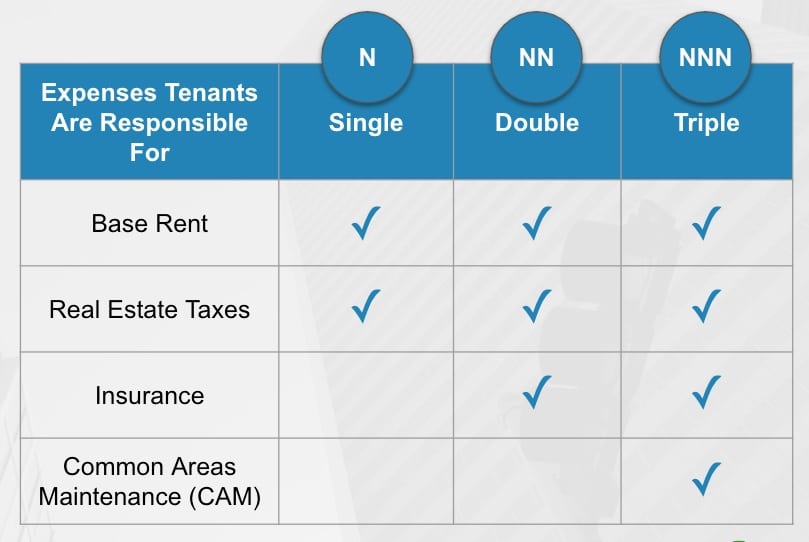

NNN Leases

The big difference with Commercial Real Estate is that the leases are typically Triple Net/NNN leases. Each of the Ns in a triple net lease stands for a specific expense that the tenant will pay their portion of.

All of the tenants will pay their Base Rent. Then, depending on the lease, they may only pay for one expense, two expenses, or all three of them.

The first N is for Real Estate Taxes, which a tenant is very often required to pay, even on a ground lease.

The next N is for Insurance, such as the General Liability Insurance that the landlord pays for the building. Therefore, the lease will state that this is a cost that they share and is a typical expense that the tenant will pay.

The last N is for Common Area Maintenance, CAM, or Operating Expenses. Here, it is important to know what the tenant will and will not pay for as part of their lease. This is a negotiating factor for many tenants and landlords. Most large corporations have specific items that they will and will not pay for, therefore the leases should clearly states this.

Best Practices

We have found that a best practice for Common Area Maintenance and CAM Reconciliations is to calculate the budgeted amount from the past year’s actual expenses, if available. You can use that amount to calculate the tenant’s monthly amount you will invoice.

This allows several things:

- The tenant pays a set amount monthly, so no large bills at the end or beginning of the year

- Saves time doing pass-thrus for expenses monthly (especially for the bookkeepers who are basically doing monthly reconciliations of these expenses)

- The owner doesn’t have to pay the whole expenses upfront

STRATAFOLIO highly recommends utilizing Reimbursable and Non-Reimbursable GL accounts. This delineates between expenses that you should include in CAM reconciliations or not in the QuickBooks accounts. This leads to more clarity and accuracy in reporting.

OpExp Tab in STRATAFOLIO

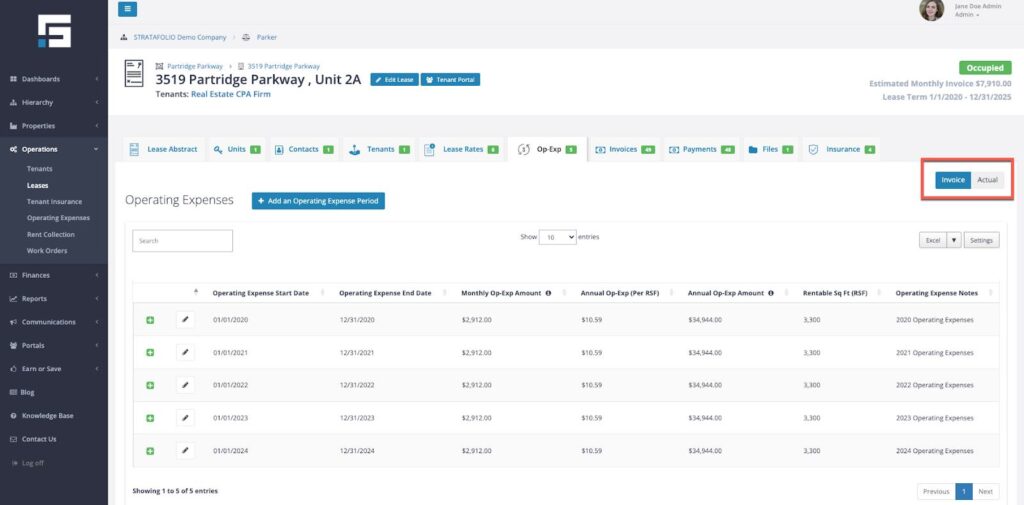

Invoicing vs. Actuals

The Op-Exp tab has two parts: Invoicing and Actuals. The slider is located on the right-hand upper corner of the OpExp tab in the lease. These two parts of OpExp work together to invoice the correct amount of CAM to collect monthly on the invoices and to complete the reconciliations at the end of the period.