Many family businesses invest in retail real estate. This article will shed light on what you should know before investing in strip malls, highlighting variables that could impact your investment success. Unfortunately, it’s easy to make a misstep, by choosing the wrong center, because it’s a “good deal”. Our goal is to help you pick the right property and avoid the wrong one for long-term investing success.

What is a strip retail shopping center?

A strip shopping center is also known as a strip mall, strip plaza, or retail center. It is usually a one-story building with room for 2 – 20 smaller 500 – 4000 sq. ft. retail tenants. It could be anchored or unanchored. An anchored (e.g., grocery or other anchor) center has one or more anchors driving customers to the center. An anchor tenant could be a grocery store, a pharmacy, a hardware store, or a few larger clothing stores (over 15,000 sq ft) that attract shoppers. A strip shopping center could have parking or, if located downtown or in a small village, could have shared parking (parking garages or parking lots). In those cases, there is not usually enough on-street parking available.

The most important Indicators of success for investing in strip malls are their location and sales per square foot.

One indicator of success is a solid central location with significant but not overwhelming traffic, surrounded by other stores that shoppers want to visit, say hardware stores, gyms, boutiques, restaurants or medical services create an active environment for businesses that want to lease there.

The average sales per square foot in retail stores with a square footage of less than 1,800 sq feet is between $115 to $140 annually. Successful grocery stores make between $350 – $500 a square foot. But they have low 1-5% Margins and need to sell a large volume of products per square foot.

Not attractive to retail businesses is a location with lots of uncontrolled crime, homeless people camping out in front of or around the strip center, graffiti, gang and or drug dealing activity, or evidence of Illegal dumping and lack of parking.

In addition, lack of enough retail traffic or having too much traffic are automatic turnoffs for a retail tenant who depends on the volume of dollars generated per foot to pay the rents and the salaries of those who work in each store. Stores with long bowling alley-like depths are unattractive to a retail tenant unless the rent is inexpensive. The shorter the bay depth, the closer it is for a retail shopper to purchase goods. In other words, the fewer the steps the more money the tenant makes per square foot.

Investing in a strip mall can be fruitful or a disaster

Things to look for

A strip center may be more successful if it is located in an area where the residents of nearby neighborhoods have higher annual incomes and is in a growth area.

Of course, there are exceptions to the higher income rules, such as retail stores that house dollar stores, liquor stores, cannabis dispensers, and laundromats that target low- and moderate-income residents and can generate sufficient income per foot for the tenant.

Typically, higher-income neighborhoods allow business income to be consistent because nearby residents have extra cash to purchase elective goods. As income per family settles below $75,000, resident income is sucked up by taxes, school fees, rent, insurance, and groceries. There is not much left over for elective retail experiences.

Things to consider

Investing in a strip mall located in a medium- or higher-income area could be more successful for an investor in the long run (depending on the competition from another strip mall). A high-quality location can attract better-quality tenants, but there are limitations.

For example, e-commerce businesses are absorbing close to 20% of the annual retail traffic, due to free shipping, 24-hour accessibility and aggressive price competition and are creating increasing competition for smaller retail stores. Investors will want to invest in properties that have tenants with solid business plans and strong capitalization and a creative longer-term retail concept.

Cash flow at a strip center is greatest for the property owner when tenants move in and sign long-term leases. Unfortunately, many smaller local retail tenants tend to execute 3—to 5-year leases because they are not sure what the future will bring.

Other challenging issues that commercial landlords experience are the costs for leasing expenses, tenant improvements, and any of the expenses (NNN cost) that are not included in bill backs to the tenants.

It is not unusual for tenants in smaller strip shopping centers to have modified gross leases where the tenant pays only for their rent, interior maintenance, and utilities. The landlord pays for exterior maintenance, including landscaping, HVAC maintenance, property taxes, insurance, and capital improvements. A triple net lease is where the landlord is able to bill back most expenses except capital expenses and leasing fees. This can affect the landlord’s profitability because triple net leases reduce the owner’s expenses and pass them to the tenant.

Evaluating retail demand

Another way to gauge the success of a building is by evaluating local retail demand. In some areas, there is an oversupply of retail buildings and retail stores. It makes sense to visit potential sites, meet with retail brokers, and become a member of the International Council of Shopping Centers (ICSC) to find the resources necessary to make informed decisions. There are companies available that complete retail reviews and search for you to make a thoughtful purchase decision.

What are some essential factors for successfully investing in a strip mall?

- Quality of construction

- Interesting architecture

- Parking that equals at least four spaces per thousand square feet of leasable space

- Location easy to walk to or drive to

- Enough curb cuts to the roads that allow people to visit the site. One curb cut is never enough.

- Signage codes that make it easy to find a tenant

- Parking in front of or on the side of a location, not in the back.

- Other retail stores in the area that might drive traffic to your location

- Traffic count – not so many that drivers pass you by.

- Understanding tenant success by including a lease clause that tenants are required to send you monthly financials. This information will give you a solid handle on the success of that location

- Evaluating and feeling comfortable with tenant mix. For example, a center could include tenants like this:

- A pet store, Self-defense Tenant, Clothing store, hairdresser, A national math Tutor

- Or, a dentist, a liquor store, two restaurants, and a workout gym could be a good mix

Other considerations

National tenants vs. regional or local tenants

- National tenants may sign longer-term (10 years +) leases and pay higher rents. However, in exchange for higher rents and longer leases, the tenant will want a significant tenant improvement allowance. That works if you have cash.

Local and regional tenants will take a space as is or just want new paint and flooring so they can get a lower rent.

Rents that are replaceable

- Key question is always can you replace a tenant that fails with a new tenant at the same rental rate. It takes some time to research to ensure that you understand the rental rates for the specific submarket that you own your property in. Costar, CREXI or a local appraiser real retail broker are good sources of information regarding lease rates.

Restaurants, medical uses, and laundromats

- These tenants use a lot of water and other utilities. These expenses should be billed to the tenant via their own meters or via sub-meters that are read and billed monthly. If you don’t bill these back, you can’t afford these tenancies. If your market does not allow the billing back of these expenses due to competition or a proclivity for gross leases, you don’t want to own the building or have these tenancies.

Exclusive use clauses and “go dark “clauses

- Regional and national tenants will ask for exclusive use clauses. A convenience store might make it almost impossible to bring in additional tenants with their extensive list of exclusions. Go dark clauses allow tenants to reduce rents or move out if an anchor moves out. You may be desperate for a tenant but go dark clauses can kill your center if they are exercised, better to get a little less rent from another tenant or get rid of the clause.

Leasing agents and Property managers

- Smaller centers may not need a property manager if you have time to track all of the leases or use a product like Stratafolio to abstract and track the lease clauses. This will save you at least 4 % of your annual income.

- On the other hand, finding and keeping a retail leasing agent active in your sub-market is the key to profitability. They know the leases in use, the lease rates, and the players (tenants and other agents) that can help speed up your way to finding a tenant and improve your tenant mix. Shop around for the best agent and plan to stay in touch with the second and third-tier agents, just in case your agent is too busy being successful and you need to make a change. This also helps with staying on top of the regional market conditions.

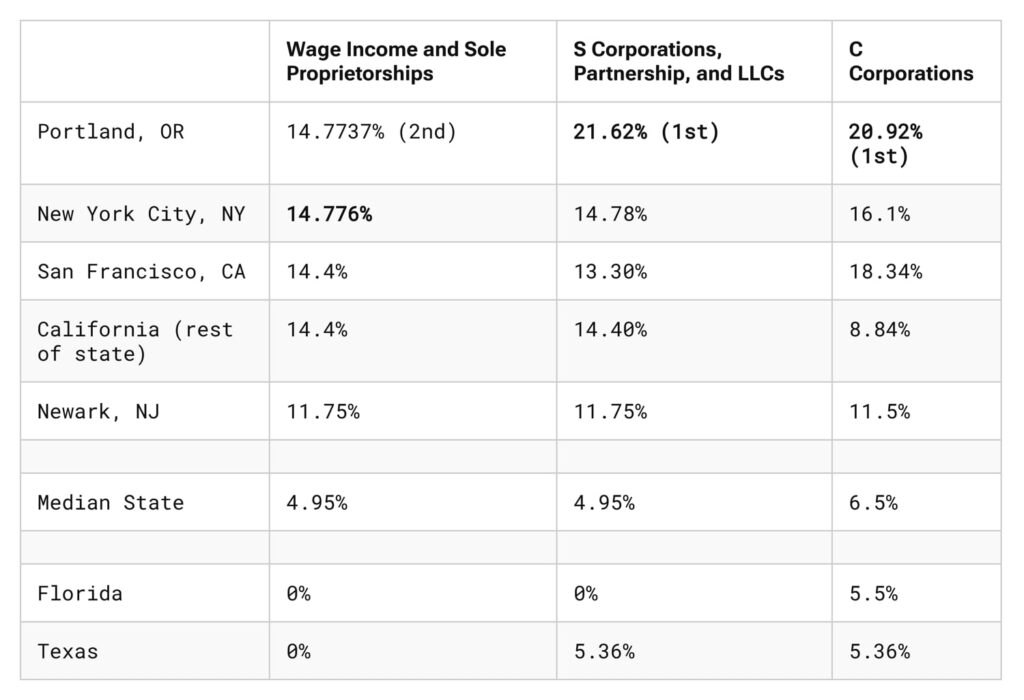

Taxation – Financial considerations

- Finally, as you decide where to invest, you need to consider the tax implications (State, County, Local) for every state. It can change your yield by 6 to 10 percent, and a greater yield means more money in the bottom line. For example, there are cities, counties, and states that tax for childcare, gross profits, homeless resettlement, and corporate activity taxes, to name a few, and there are cities and counties that don’t. Understanding the financial implications of your decision-making is just as important as deciding on a successful location. See the chart below (courtesy of the Tax Foundation, Portland’s Weirdly High Taxes, June 25, 2024):

Conclusion

As you can see, many variables affect the success of investing in strip malls. It takes time and patience to source a profitable center. It’s easy to make a misstep by choosing the wrong center because it’s a “good deal”. Our goal is to help you think through many of the decision variables and remind you to consider them as you shop for a retail strip center.