Investing in real estate can be a success, but going it alone can be challenging and highly risky. It also takes a little savvy to become successful in the real estate market since it’s a highly competitive sector. Strategy matters with all investment opportunities, including with your real estate portfolio. Even if you choose a more hands-off approach to property management or real estate investing, there is no such thing as passive real estate.

A successful commercial real estate portfolio consistently generates positive returns, resulting from an actively managed strategy. Investors cannot apply the “set-and-forget” method and expect substantial returns. The keys to a successful real estate portfolio lie in the following tactics.

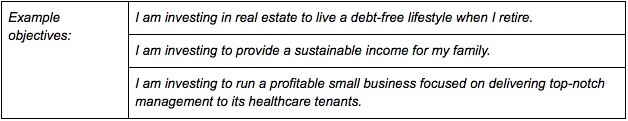

Investment objectives

Define the reasons why you are investing. Do you seek financial independence? Will the investment fund travel opportunities or finance a college education? Will the investments become retirement income? If real estate investing forms the basis of your income, then the objectives should cover the minimum revenue required to maintain your quality of life. Large portfolio owners may have the staff to fund in addition to personal income requirements. Objectives form the basis of a real estate portfolio because they create an end goal.

If you choose to work with an investment property or portfolio advisor, setting investment objectives is the start of the process. “We use your investment objective (income, growth and income, growth, or trading/speculation) to help you clarify your investment ideas and identify your risk tolerance, which is the level of risk of loss you’re willing and able to tolerate in order to achieve your investment goals,” says Wells Fargo Advisors.

Take action by documenting your investment objectives. Then, keep these objectives up front in your real estate investment plan.

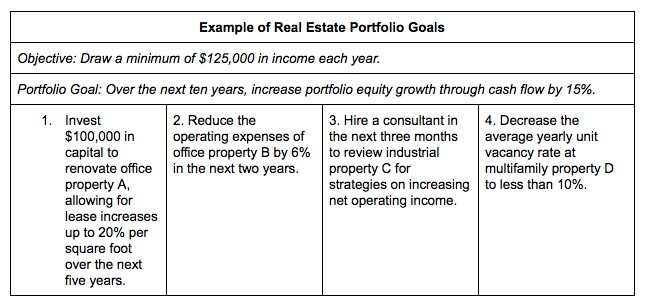

Set goals

Clear objectives inform the portfolio’s goals. A goal is not the same as an objective. Goals should be SMART: specific, measurable, actionable, realistic, and time-bound. Depending on the scope of your real estate portfolio, you can have several goals. One goal can measure the portfolio’s overarching performance. Next, individual holdings can have smaller goals along the path to reaching your overall objective.

During your goal setting session, make sure to define how long you plan to invest in real estate and clarify the level of risks you are willing to take in your asset acquisitions.quisitions.

Add your clarified goals to your real estate objectives in a written real estate investment plan.

Diversify Your Real Estate Portfolio

Ever heard the cliché, “never put all your eggs in one basket?” Diversity is wise in real estate investing. The market can fluctuate. While a downturn is not immediately predicted and markets are looking up, it’s challenging to predict with absolute certainty conditions 5 or 10 years down the road.

How you choose to diversify your real estate portfolio is up to you. Decisions will depend on your risk tolerance, overall objectives, and timeline.

“For me, if I have the right parts in place, I want to own in multiple cities. But there are positives and negatives to that plan for investing, and I had to weigh those out carefully. I do see owning long-term buy and hold real estate in multiple markets as a hedge against being caught and tripped up in the next bubble,” said Chris Clothier of REI Nation.

Besides diversifying by location like Clothier, a portfolio could vary holdings. Some investors choose to combine REITs with property holdings like single-family rentals. Other build portfolios around a specific submarket, like mixed-used, office, medical, warehousing, etc. For example, a real estate portfolio can contain only health care but perhaps vary the assets by location, size, or the specific type (medical office, labs, urgent care, et al). And, the same application could apply to multifamily housing for millennial or post-retirement populations.

Select the assets to meet portfolio goals at the right level of risk for you. To make the right diversification decisions, in your real estate investment plan decide:

- What is your level of risk tolerance?

- Should you invest in REITs? If so, what kind of REIT is right for you?

- Will the portfolio only acquire properties in a specific niche?

- What market(s) will you acquire properties?

- What are the ideal characteristics of a potential portfolio asset?

Use Data to Inform Decision-Making

Numbers are the foundation to sound investing decisions. Your portfolio performance should be transparent. Real estate investment assets can be broken down into various metrics to suit your goals: monthly operating costs, net operating income, repairs, and more. Every strategic decision you make, whether it’s to acquire or dispose of assets, to invest in capital repairs, or to diversify, should be based on real-time accurate data. This treasure trove of information, or “big data,” is what helps real estate investors make better decisions.

In practice, the metrics you choose to use should be a direct reflection of the portfolio’s stated objectives and goals. For instance, take one of the previous goals in the above example: “Reduce the operating expenses of office property B by 6% in the next two years.” To track the progress on this goal, investors would want to see the asset’s operating expenses over time.

To succeed at real estate investment, a regular review of the portfolio’s performance is a must. STRATAFOLIO can help. Our visual dashboards make it easy to read real-time data on your real estate Investments. Never before has it been so easy to understand as a real estate investor how your real estate portfolio is performing by monitoring it through effective data dashboards.