Recording your escrow and mortgage incorrectly creates a series of issues for you as the owner, all of which are significant. Today’s blog will explore how to properly set up a mortgage escrow account. Read along!

Let’s Talk About Mortgage Escrow

First and foremost, recording incorrectly means you will have an inaccurate financial picture. Second, it makes it difficult to make decisions using your financial reports. And third, it adds costs to you because your CPA will spend more time resolving your issues at tax time.

In this blog we talk about:

- What an escrow account is

- How to record your mortgage payment with escrow correctly

- The impact of incorrectly recording your escrow

We had the opportunity to sit down with Amy Heinen from Quick Action Accounting again. She took us through some of her best tips on mortgage payments and escrow accounts. Amy is a QuickBooks expert and a favorite local accountant. We worked with Amy on two other QuickBooks blogs that may be of interest for real estate companies – Setting up a Chart of Accounts for QuickBooks Desktop and Setting up a Chart of Accounts for QuickBooks Online. Finally, If your portfolio has mostly commercial real estate assets, check out our latest article: Setting up a Chart of Accounts for a Commercial Real Estate Company

What is an Escrow Account?

At the time you take out a mortgage, lenders often give borrowers the option to create an escrow account. The escrow account is like a holding account for your lender to pay your taxes and/or insurance. It is an account that you fund each month as part of your mortgage payment. When you have an escrow account your mortgage payment will include the following elements:

- Principal

- Interest

- Escrow for insurance (if selected)

- Escrow for taxes (if selected)

The accruing funds are used to cover the taxes and/or insurance for the property you purchased. Then, when the taxes or insurance are due, the lender withdraws from your escrow account and pays the taxes or insurance on your behalf. The lender monitors the cost of insurance and taxes and occasionally adjusts your escrow payments accordingly.

Special Offer from our Sponsored Link Above

Setting up Your Chart of Accounts

To begin, include the following accounts in your Chart of Accounts:

- Property as a Fixed Asset split out between the Building and Dwelling costs

- Notes Payable (your mortgage) as a Long Term Liability

- Escrow Account as a Bank Account

- Interest Expense as an Expense

As we have talked about in a previous blog article, it is critical to set the chart of accounts up correctly from the beginning so you are able to see your complete financial picture.

Making your Mortgage Payment

Once your chart of accounts is set up you can begin making payments. In this example, our mortgage payment to Loancare totals $871.37 as shown in this image from the mortgage statement.

When you record your mortgage payment transaction, split the payment between Notes Payable, Interest Expense, and Escrow Accounts according to what is on your mortgage statement. In this example, the actual principal and interest for the November scheduled payment are not yet known. We will enter the Last Regular Payment Breakdown information until we have more information.

Memorize the Transaction

Many accounting systems will allow you to memorize a transaction which will make your life easier. We recommend you do this when recording your mortgage payment. This helps save time and helps with consistency in how you record your payments.

In QuickBooks:

- Select Memorize

- Name the transaction

- Select Automate Transaction Entry

- Select Monthly for How Often

- Identify the Next Date for the transaction

Even though this transaction has been memorized, you will need to adjust the amounts slightly each month once you receive your statement. The principal and interest amounts will adjust each month as you pay down the loan. Each month a bit more of your mortgage payment will go to the principal and a bit less to interest. Additionally, your lender may increase or decrease the amount you are paying to escrow which also has the potential to impact your mortgage payment.

Updating Your Escrow Account

Your mortgage statement will reference when your lender paid taxes or insurance from your escrow account. Once your lender completes this transaction, record it in your Escrow Account in your accounting system. To do that in QuickBooks, use the Write Check from the appropriate Escrow bank account and write the check for the amount the paid by your lender. Your escrow balance will then stay in line with your lender.

Annual Escrow Account Disclosure Statements

At least annually, your lender will provide a statement about your escrow activity. It shows the current payment as well as any anticipated increases or decreases in your escrow payment before it actually happens. Generally, the escrow statement includes an analysis of previous escrow payments and projections for the coming year. Also available is information about recent payments for insurance and taxes.

Impact of Recording Your Mortgage and Escrow Incorrectly

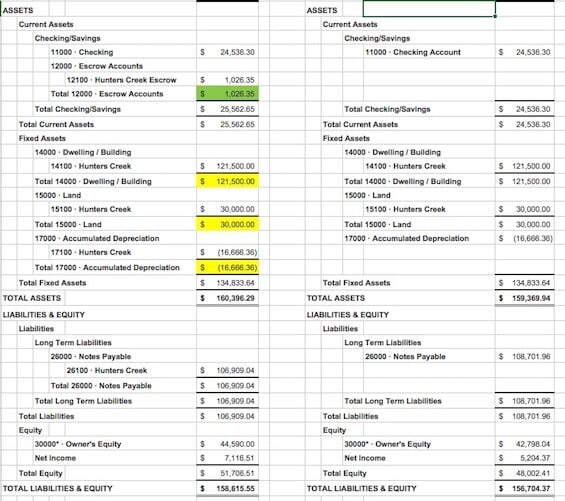

As we stated at the beginning, an incorrectly recorded mortgage and escrow information throws off your financial picture. Here is an illustration of a company that has recorded their mortgage and escrow correctly. The company is called Smart Management. Under their expenses, they have $4,821.49 in Interest Expense and $3,192.00 in Property Taxes. Their Net Income is $7,116.51.

On the other hand, Notso Real Estate Company put all their Mortgage Payments in an expense category called Mortgage Payments. They did not break out principal, interest, taxes or escrow in any way. For the same period of time, they show a Net Income of $5,204.37. Notso Real Estate Company has overstated their expenses and understated their Net Income. There is a difference in Net Income of $1,912.14 between the two companies simply because Notso Real Estate Company recorded their transactions incorrectly. This is significant and this is only for a single small value asset.

On the Balance Sheet, Smart Management has an Escrow Account balance of $1,026.35 within their current assets. They have less in liabilities because their mortgage principal payments were applied thereby reducing their Notes Payable balance.

Notso Real Estate has no record of an Escrow Account, nor do they reduce their Notes Payable with principal payments. They have also underrepresented their assets and overstated their liabilities. Unfortunately, Notso Real Estate is making financial decisions off of faulty information.

Subscribe to our Newsletter

In Closing

Incorrect recording of mortgage payments is surprisingly common. But, as you can see, the impact is significant. If you have recorded your escrow or mortgage payments incorrectly, it is time to clean up your records. It is essential you are working with current accurate records. STRATAFOLIO can help! Schedule a demo today.

Imagine doing CAM in seconds vs. weeks or months!

Watch this video and schedule your 1:1 demo!

Schedule your demo today!

![]() Thank you for your visit.

Thank you for your visit.

- Understanding the Different Types of CAM Caps - September 22, 2023

- Top 25 Commercial Real Estate Terms to Know - September 12, 2023

- How to Handle Tenant CAM Disputes - August 23, 2023

2 thoughts on “Mortgage Escrow Account: How to Properly Set It Up”

Your blog has been very helpful in setting up my business, but I have a question I wonder if you could cover in a future post. I’ve recently placed a house I’ve owned and occupied for a couple of years into service as a rental, and I was wondering how to account for this in QB. Should I “buy” it from myself? And if so, at what price? I don’t want to make myself liable for capital gains on it, and the business doesn’t have the cash on hand or on paper to down-pay it from its original purchase price to where the mortgage is at now. Thanks in advance for your wisdom and expertise!

Hi Jason –

This is a great topic! Thank you for the suggestion and we will get this in the queue. Have a nice holiday! – Jeri