In Part 1, we went over the basics of NNN lease escalations: what they are, the different types of lease escalations, and how they work.

In Part 2, we’re discussing some of the mistakes landlords make regarding their NNN leases. Here, we’ll discuss the difficulties of keeping track of Common Area Maintenance (CAM). CAM is frequently referred to as Operating Expenses or Additional Expenses. And, here, we’ll discuss the consequences of failing to keep up with them.

Operating Expenses Must Be Specified in the Lease

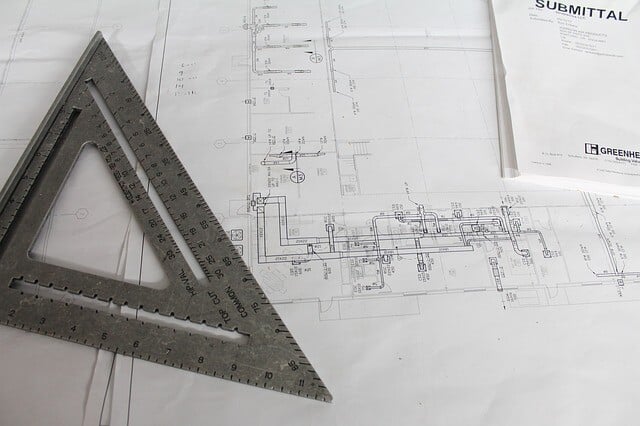

If a landlord is going to charge tenants for operating expenses, then they must specify those expenses in the lease. Some leases will group these expenses into a single category of operating expenses, taxes, and insurance. While other leases may list operating expenses such as “elevator maintenance,” “window washing,” “security system,” and more. This could be a very long list of potential expenses! And, each expense on that list is subject to change at different rates from one another.

It can be difficult to keep track of all eligible expenses and calculate each tenant’s NNN accordingly. However, it’s in the landlord’s interest to complete the work of creating this list and abiding by it. Transparency is important. If a tenant is charged for something and they don’t believe they are responsible, they could dispute the charge.

Operating Expenses Will Change Over Time

Unfortunately, it is all too common for landlords to have issues keeping tabs on NNN lease operating expenses. As assets are added to a portfolio, this becomes an even greater challenge. And, it’s very common for operating expenses to change and shift over time. Not only does a landlord have to keep tabs on the changes in operating expenses and try to manage against the budget, but they also need to notify the tenant of the operating expense rate change following an annual reconciliation. In most cases, landlords must notify tenants by a specific date to make changes to the additional expenses.

If the landlord fails to notify the tenant of the operating expenses increase, and then the tenant doesn’t change their payment, it is the landlord the must carry the financial burden. This looks poorly on the landlord, who must explain this to lenders. And then, at reconciliation for that year, the tenant is notified of any additional funds they must put in to cover the expense shortage. This situation is bad on two counts. First, the landlord must use their cash to cover the additional operating expenses for their tenants. Second, the tenant could be in for a surprise when they have to come up with a lump sum to cover the underpayment of expenses.

Costs Must Be Distributed Fairly Among Tenants

Landlords must periodically take an overhead look at all the tenants in a building and double-check that their NNN expenses are shared in a way that is fair to each tenant. Usually, this means calculating NNN in proportion to a tenant’s use of square footage (often referred to as their pro-rata share). Still, it can also be affected by each tenant’s use of common space or other factors.

To make things complicated, it’s not uncommon for a commercial building to have many different tenants. Some real estate investors own several buildings and manage hundreds of different tenants at once—that’s a lot to keep track of! It’s even more difficult when you have various units with different square footage, different amenities, and slightly different lease terms. Organization is key.

Single-Tenant Leases Need Oversight

In the world of multi-tenant buildings, as we stated before, the tenants are responsible for their pro-rata share of the operating expenses. This also means the landlord is responsible for maintenance in common areas of the building. But in the case of a single-tenant having the entire space, often all the maintenance falls to the tenant. While at first glance this seems nice, there are times when this can get out of control.

Occasionally, a tenant will look at taking on maintenance as a way to save on monthly expenses. It could mean hiring people to perform less than adequate maintenance or delaying or not performing the maintenance at all. And if there were no regularly scheduled inspections of the landlord’s property, the issues could be missed. Then, at the end of the lease, the owner can find the property in disrepair.

Landlords need to take control of this process early on to prevent this – by requiring regular maintenance inspections and approving the maintenance vendors.

What Are the Solutions to These Issues?

Now that we’ve covered some of the complex issues with NNN operating expenses, we’ll dig into how landlords can solve these issues in Part 3 of our NNN Lease series. Stay tuned!

We want to hear from you! What else have you seen as issues managing your operating expenses?