Day-Count Convention is a small section of your loan that may be more important than you realize.

We all know that debt is a significant part of most commercial real estate investments. The modern commercial mortgage climate boasts low-interest rates, as well as an abundance of available capital. But how much do we actually understand about how our mortgage actually works?

When shopping for a mortgage, we typically compare LTV (Loan-to-Value) / LTC (Loan-to-Cost), interest rates, and amortization schedules. However, there are other aspects of your debt to consider as well. And, specifically, how the interest is calculated on a loan. Although the method may not be negotiable with the lender you are working with, the interest rate calculation should be considered when shopping around for the best possible capital stack.

Your Loan Calculation Method Can Save or Cost You Thousands of Dollars Over the Course of Your Loan

Let’s begin with a simple example of a 20-year term loan calculated using three different calculation methods.

In this example, the method of calculation shows a difference of $75,152 between the most and least favorable terms.

You wouldn’t leave $75,152 of profit on the table when you sell a property, so why would you leave it on the table when buying the property?

Now that we know why the day-count convention is important, let’s look at how it is calculated.

Day-Count Convention: How is your Mortgage Interest Calculated?

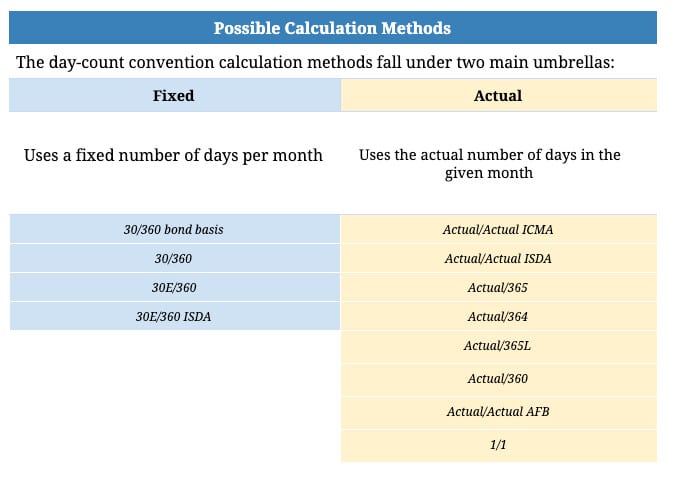

This difference in interest payments is caused by the day-count convention method used. The day-count convention determines how your interest accrues over time. It may not sound important. But as part of the 20 year-long contracts you’ve signed, it’s worth understanding. Most commercial and residential mortgages use one of these calculation methods:

- 30/360

- Actual/360

- Actual/365

Although these are the most common loan calculation methods, there are many different methods. Most methods fall into two main categories of either fixed or a variable (actual) number of days in the month.

ISDA : International Swaps & Derivatives Associations

Your loan calculation method can cost or save you thousands of dollars over the course of your loan. When you multiply the impact of this over the number of properties in your portfolio, the impact could be staggering.

The Most Common Loan Calculation Methods

Most likely your loan is calculated using one of the following day-count convention methods.

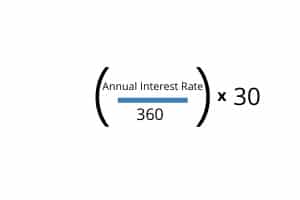

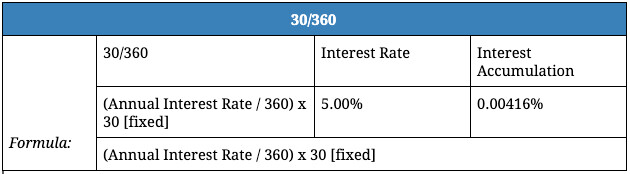

30/360

To calculate 30/360, first, divide the annual interest rate by 360. Next, multiply the quotient by 30. Because this is a ‘30’ method, the number of days in the month will always be fixed at 30.

This method is the quickest to accrue interest; making it the most expensive option.

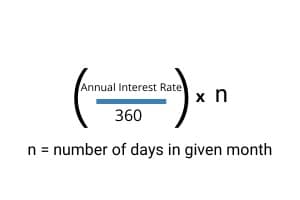

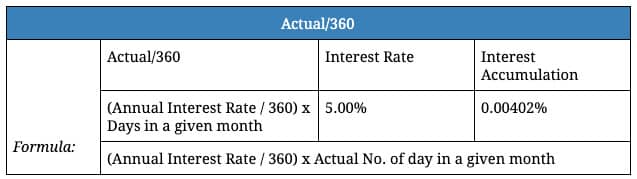

Actual/360

Similar to 30/360, in order to calculate Actual/360, you will first divide the annual interest rate by 360. However, instead of multiplying the quotient by a fixed 30, you will multiply by the actual number of days in the given month.

This day-count convention method accrues interest at a slightly lower rate than the 30/360.

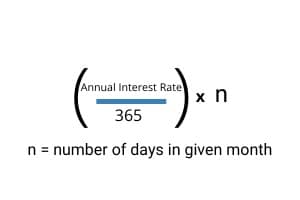

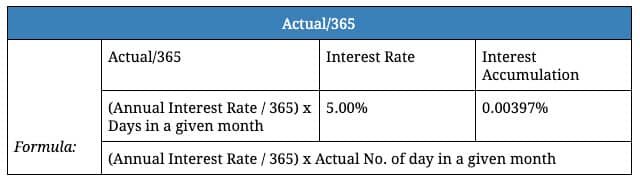

Actual/365

And finally, to calculate Actual/365 divide the annual interest rate by 365. Next, multiply the quotient by the actual number of days in the given month.

Note: Actual/365 amortization terms have recently become less popular when compared to its Actual/360 and 30/360 counterparts.

Now we understand:

- Mortgage interest rate calculations

- Different day-count convention methods accrue interest at different rates

Next, let’s look at how these different day-count methods become significant.

Overall Cost Comparison

The simplest answer when choosing a method is to choose whichever method is cheapest. However, with the variety of factors at play in your loan, it is most important to choose the lender that is offering you the best overall loan package.

Once the appropriate debt product has been used, you can repeat the comparative analysis across your portfolio and into future acquisitions. Debt has many moving parts, being knowledgeable on every detail helps you create the most profitable portfolio possible. STRATAFOLIO offers a seamless way for you to manage this debt and recognize additional opportunities within your portfolio. Dig into the details of your loan when your next loan is up for renewal. Know how your loans compare to one another. Sign up for a demo at stratafolio.com to start managing your real estate debt like a pro.