Keeping accurate records for credit card accounts is imperative to proper accounting in commercial real estate. Here’s everything you need to know about recording credit card payments for your commercial real estate business in QuickBooks Online.

Let’s look at the steps

One way to record a credit card payment in QuickBooks Online is through the “Pay Down Credit Card” option. Here is the process:

Step #1: Click “+ New”

First, you want to find the “+ New” button on the right-hand toolbar.

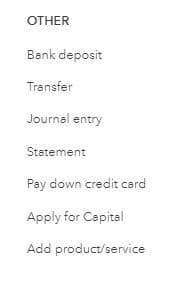

Step #2: Click “Pay Down Credit Card”

Then, under Other, select “Pay Down Credit Card.”

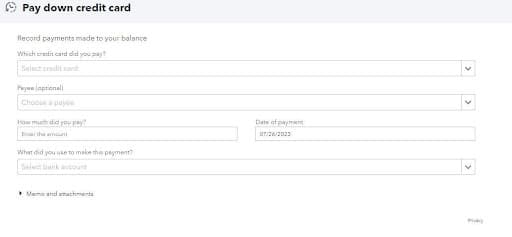

Step #3: Enter Applicable Information

This will bring you to this screen:.

You should enter all applicable information: the credit card you are paying, the amount of the payment, the date, and which account the payment is coming out of. You can also add a memo description and upload attachments, such as a copy of the online payment verification or credit card bill.

Step #4: Enter Check Information, If Applicable

Sometimes, you might pay your credit card bill with a check. Once you select the account used to make the payment, there will be a checkbox asking if you made the payment by check. If you did, select this box and enter the check number.

Be sure that you select the “Print Later” checkbox if you don’t need to print a physical check. You won’t need to print a physical check if the payment is electronic.

Step #5: Select “Save and Close”

Once you’ve entered all the necessary information and you’ve double checked everything for accuracy, select the “Save and Close” button at the bottom right-hand corner of your screen.

Step #6: Check Bank Ledger

If you have your bank accounts connected in the bank feed, those payments will show in the feed. To avoid double counting your credit card payment, you want to “exclude” or match the transactions in Bank Feed.

Recording Credit Card Payments Using Transfers

Another method that can be utilized is using the Transfers function in QuickBooks Online. Here are the steps for that method:

Step #1: Click “+ New”

First, you want to find the “+ New” button on the right-hand toolbar.

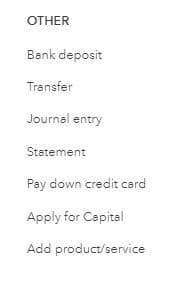

Step #2: Click “Transfer”

Then, under Other, select “Transfer.”

Step #3: Enter Applicable Information

This will bring you to this screen:

The “Transfer Funds From” account will be the bank account you are paying out of, while the “Transfer Funds To” account will be the credit card receiving the payment. Also, enter the date of the transaction, the transaction amount, and any memos or attachments.

Using this option doesn’t give you the ability to enter check details. If you are paying your credit card by check, you should use the “Pay Down Credit Card” option instead.

Step #4: Select “Save and Close”

Once you’ve entered all the necessary information, select the “Save and Close” button at the bottom right-hand corner of your screen.

Why is it Important to Record Credit Card Payments?

Although credit card payments don’t affect your profit and loss statement, they do impact your balance sheet. Neglecting to record credit card payments can result in an overstated credit card balance and an understated bank balance. Business credit is important for investing in commercial real estate.

It’s not uncommon for commercial real estate businesses to have dozens of credit cards and bank accounts. Ensuring that you are entering accurate credit card payments keeps clean and accurate accounting records.

Summary

Do you still have questions about recording credit card payments? Are you feeling overwhelmed with the level of credit card payments or accounting in your commercial real estate business? If so, reach out to one of our team members at STRATAFOLIO today. STRATAFOLIO can help handle the property management side of your business while utilizing the powerful QuickBooks Online platform for accurate and up-to-date record keeping.