Are you tracking your tenant security deposits? This is a must-do activity for anyone that owns real estate.

In this article, we go over what a security deposit is, why they’re necessary to track, how to do it in QuickBooks and how STRATAFOLIO helps.

What is a Security Deposit?

A security deposit is a deposit paid upfront by the tenant to the landlord. It is a way for the landlord to protect property. It is an incentive for a tenant to take care of the property. Additionally, it is also a way for a landlord or owner to protect themself in the event the tenant stops paying rent.

Often the security deposit is based on lease amount and the tenant credit score. However, not all landlords require a security deposit.

Every state (and sometimes cities) has different laws around this. Specifically:

- The amount you can charge for a security deposit.

- What you are allowed to chargeback as a deduction on a security deposit.

- How quickly you must return the security deposit once the tenant vacates.

- Landlord retainage of any interest earnings on the security deposit accounts.

- If unpaid rent can be taken from a security deposit.

- Requirements around account setup to track security deposits.

Check out the article Security Deposit Limits and Deadlines in Your State to learn more about specific information regarding your state’s law.

Tracking in QuickBooks

The security deposit does not belong to the landlord and should be kept in a completely separate account. Do not co-mingle security deposits with the owner’s money. The best practice is to establish a separate security deposit checking account for every building.

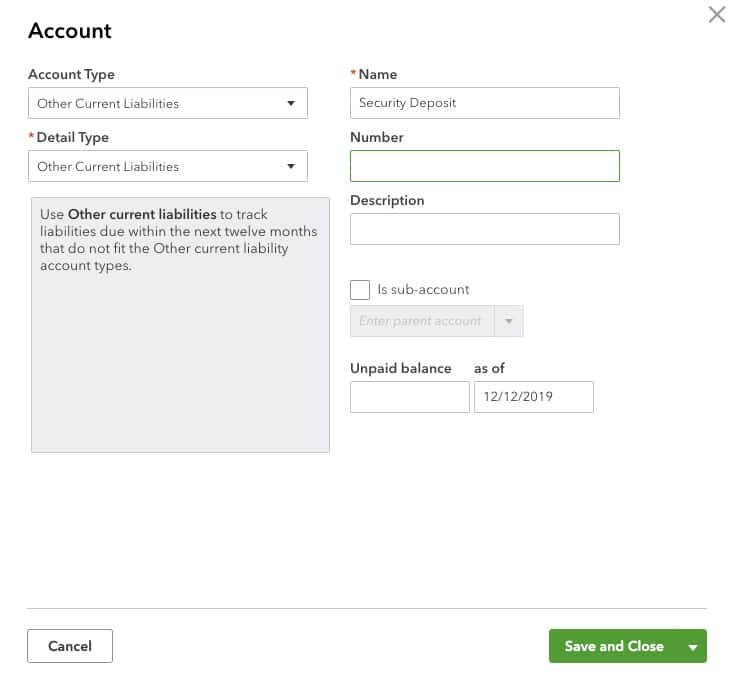

Record a security deposit as an Other Current Liability in QuickBooks. It will sit on the balance sheet until the tenant leaves.

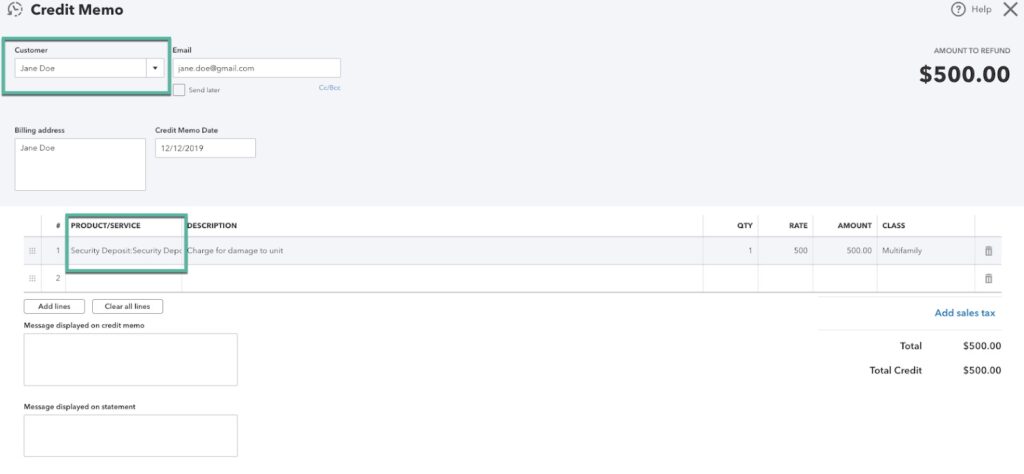

Record any charges against that security deposit as a credit memo and return the remaining deposit to the tenant once they leave.

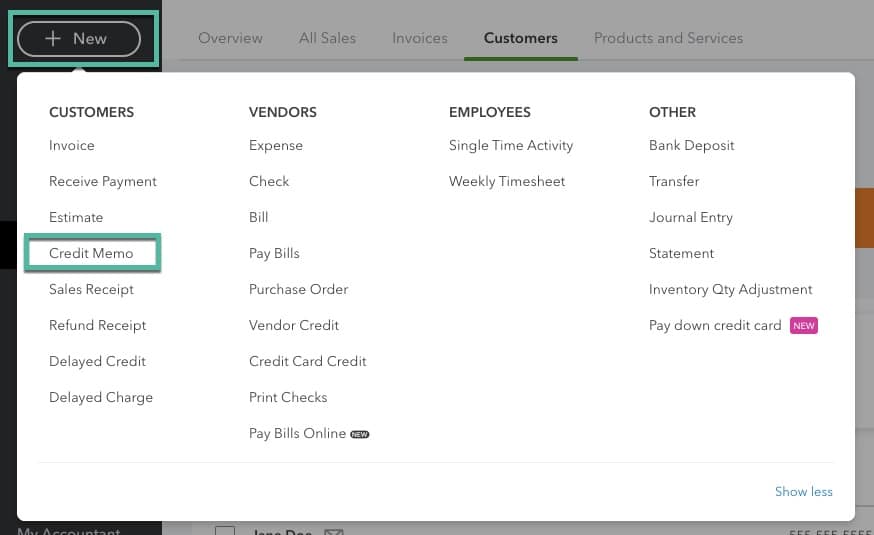

To record the credit memo, select +New and under Customers, select Credit Memo.

Once there, select the Customer, select the Product/Service of Security Deposit, and enter the reasons for the security deposit charge. Deduct this amount from the amount to return to the tenant.

This article will help walk you through it, too.

The Necessity of Tracking Security Deposits

Tracking security deposits closely is important for a number of reasons. First and foremost, some states require separate accounts for this and very clear records. Each state has clear rules around the timeline for returning the security deposit to the tenant or notification around deductions to that tenant. And unfortunately, a missed deadline could result in forfeiting the entire security deposit (warranted or not) and sometimes even fines or penalties.

Second, you can count the portion of the security deposit you retained to cover damages or missed rent as income. Tracking this clearly in QuickBooks will help. But, there are other supporting solutions for this as well.

STRATAFOLIO – Solution for a Complete Record of Your Security Deposits

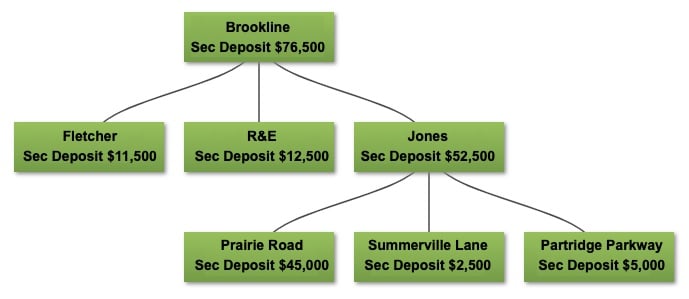

Even with all this tracking in QuickBooks, seeing and tracking your security deposits across your organization is still difficult with the information scattered across multiple accounts. With STRATAFOLIO, you can quickly see what your security deposit balances should be at the building level (Prairie Road, Summerville Lane, and Partridge Parkway), the legal entity level (Fletcher, R&E, and Jones) and at the organizational level (Brookline). Check out the graphic below.

Really, isn’t this great?

At STRATAFOLIO, we continue to automate activities that owners, property managers, and accounting staff must do on a regular basis. That way, your team can focus on growing your business. What other things does your team need to automate? Contact us for a demo today.