We sat down with Jeff Engstrom, a Senior Advisory Associate with Hall CPA, which is also known as the Real Estate CPA, to learn about the necessity of accurate record-keeping, so your investors keep coming back.

A look into pitfalls

In the webinar he covered the following topics:

- Budgeting Practices

- Accounting Records

- Understand Revenue and Cash Flow

- Tracking CapEx and Maintenance Expenses

- Lease Renewals and Escalations

Proper Budgeting Practices

The first order of good investor relationships is to set a detailed budget for the year. After establishing a budget each year, develop a disciplined practice of reviewing your budget to the actual expenses each month. This practice will help you identify issues or abnormalities, hopefully, before they get out of control. A cost overrun could be from an operating failure or fraud. Going through the motions each month and completing an analysis helps you understand what is normal or what is not. Overall the earlier the detection of any issue, the less cost there is to the organization.

Poor operational control and expense management could lead to additional capital calls of your investors. As the investment sponsor, additional capital calls to investors puts you in an awkward position. This could result in a lack of confidence by investors in what you’re doing and invite additional scrutiny in the future.

Internal Controls

Sometimes it helps to establish internal accounting controls such that expenses over a set threshold must be approved. In a case where you employ an on-site property manager and vendor contracts are frequently established, having a multi-step process approval process helps prevent miscommunication or missteps on budget goals. In general, accounting controls help you maintain tighter control of the budgeting process.

Monthly Budgets

Preparing a regular monthly budget for actual variance analysis with narrative is highly recommended. Establish a threshold where you explain any difference. Preparing the report with a trailing 12-month view of the profit and loss will allow everyone to see the trends. Some investors may spend time combing through your reports; some may not. However, a prepared narrative for significant differences helps eliminate additional phone calls, questions, and concerns you don’t know about your business.

Here is an example of a simple variance analysis report with narrative:

Proper Accounting Records

Establishing proper accounting procedures early on is key to good budget management. If you don’t have good procedures in place, it could lead to the following issues:

- Lack of clarity to the actual property performance

- Unclear checks and balances within the organization

- Potential for audits (either from the IRS or by your lender)

- Lack of investor confidence resulting in a lack of appetite for future investments

- Difficulty with bank financing as lenders need solid, clean records to proceed with financing

- Low confidence from potential buyers. Potential buyers may request the previous year’s records, and poorly kept records could impact the sale

- Future issues with developing other solid property proformas

Accounting Procedure Recommendations

Procedure Manual and Checklist

Develop a comprehensive monthly procedural manual with checklists. The manual should include a step-by-step for all the people involved – whether doing the work or reviewing it. This should also include a checklist to make sure nothing is missed in the monthly process.

Download your free Month End Closing checklist.

Proper Chart of Accounts

Develop a proper chart of accounts (COA) and a procedure for properly coding expenses. In a set of books, you should account for anything that hits either the Balance Sheet or the Profit and Loss Statement. Make sure your COA is appropriate for real estate because every industry is a little different. Your investors are expecting to see certain things when they look at their financial statements. Finally, have procedures in place, so the expenses are recorded correctly.

We also provided a free downloadable IIF file and a video tutorial in the How to Set Up a Chart of Accounts For a Real Estate Company blog.

Complete Monthly Bank Reconciliations

The process of completing monthly bank reconciliations ensures that every single transaction that goes in and out of the bank is captured in the financials. This also ties into properly coding transactions. When completing bank reconciliations, it is not uncommon to uncover expenses that were incorrectly coded.

Establish Internal Controls for Approvals

As mentioned before, establish proper internal controls for approvals of payments will help prevent fraud. Internal approvals also help control unexpected expenses.

Understand Revenue and Cash Flow

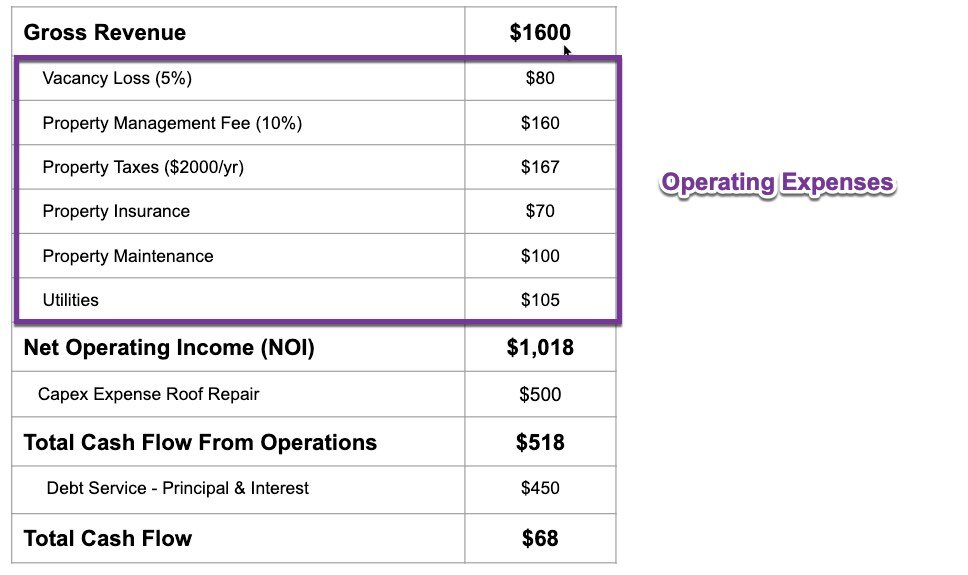

It is important to understand the difference between revenue and cash flow. Attached is an example of what one financial statement might look like:

You start with your Gross Revenue – what you actually brought in with rental income. From there, you deduct all your operating expenses. Note that this is not where you record your debt. Once you deduct your operating expenses from your gross revenue, you get to your Net Operating Income (NOI).

Gross revenue – operating expenses = NOI

From your NOI, you will deduct any CapEx expenditures. Typically the CapEx amount must exceed the de minimus tax threshold of $2,500, as outlined by the IRS in terms of tax deductions. In a case where you have audited financial statements, the CapEx de minimis tax threshold is $5,000. What this means is that you can deduct those expenses in the current year. If you decide to deduct the expense, then you will not capitalize the expense or classify it on the balance sheet, nor will you depreciate it over time.

NOI – CapEx expenses = Total Cash Flow from Operations

Next, deduct any principal and interest payments (otherwise known as debt service). Now, you see your true cash flow.

Total Cash Flow from Operations – Debt Service = Total Cash Flow

Tracking CapEx and Maintenace Expense

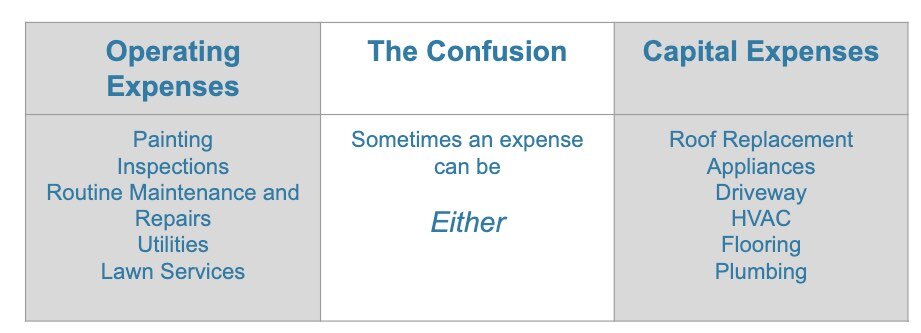

The categorization of capital expenses (CapEx) versus operating expenses is often a confusing topic.

Think of routine maintenance expenses as operating expenses. They are the expenses associated with the business’s day-to-day running, such as painting, routine maintenance and/or repairs, or lawn service.

Capital expenses, or CapEx, are out of the norm, such as replacing a roof or HVAC unit or appliances for an entire multi-family complex. Generally, CapEx expenses add to the structure of the property.

The Gray Area of Expenses

Sometimes this is a gray area.

For instance, replacing a stove in a single unit is an operating expense as it will fall under the $2,500 threshold. However, if you replace every stove in a 40-unit multi-family complex, the cost will far exceed that threshold. In this case, categorize the cost as CapEx.

Improper classification of an expense can have a huge impact on NOI and/or tax implications. The interplay between the balance sheet and the profit and loss statement will change the NOI number.

For example, with an appliance expense, if you are capitalizing the appliance expense and putting it on the balance sheet, you are effectively removing it from the bottom line NOI number (which is part of the profit and loss statement). This is because you are putting the expense on the balance sheet and not taking it as a current month or current year expense. Instead, the expense is capitalized and depreciated over the usable class life of that asset.

Lease Renewals and Escalations

Often an owner will buy a property with leases in place. Occasionally, those tenants are not paying market rent. If that is the case, there is an opportunity to improve the returns for an investor.

As the owner, you need to develop a process for tracking market comparisons to make sure you are charging fair market rents and answering market comparison questions when an investor asks. And, you want to be able to share with confidence what you are charging and how you compare to the market.

Additionally, you want to make sure you stay on top of your lease renewals and escalations to eliminate as few vacancies as possible. This means giving yourself adequate time to remarket the space and communicate with the current tenants to understand their goals. Are they staying? Are they renewing their lease? Or, do they have an option for renewal? It might mean allowing yourself 6 months to a year to refill the space for a large commercial space.

Finally, in terms of lease escalations, make sure you know what tenants have lease escalations, how much they are, and make sure you give adequate written notice to the tenant of the increase. Tools like STRATAFOLIO can help you with this.

Record-Keeping Goes Beyond an Accounting System

As you can tell, there is a lot to goes into keeping good records. It starts with the use of a good accounting system and process. But, it goes beyond that. It would help if you also had the ability to track and stay on track of your debt and loan renewals, leases, and lease renewals. If you can manage your project well, you will keep your investors coming back for more. Let us help you be successful.

Luckily, STRATAFOLIO can automate many of these processes and help you stay ahead of the game. In short, if you’re interested in using STRATAFOLIO to manage your commercial real estate, give us a call. We’d love to get you started with a free consultation and software demo!