When discussing commercial leases and their costs, you will likely come across Common Area Maintenance (CAM) charges. If you’re wondering, “What are CAM fees?” they’re the expenses that landlords remit to their renters in order to maintain common areas. These charges are essential to a lease and significantly impact the property’s net operating income (NOI). They also impact the amount a tenant will pay to occupy the space.

So what is CAM in real estate? CAM charges (sometimes referred to as additional rent) are a common term seen on many commercial leases and transactions. CAM is one of three charges associated with operating expenses. The other two charges referred to in operating expenses are insurance and taxes. We will discuss these more later.

What is a CAM fee? It is simply the costs that property owners pass back to tenants. These costs cover the upkeep of shared spaces for everyone. There are many factors involved in this expense. Understanding how they function is critical before entering any contracts or commercial property lease agreements.

Components of CAM Charges

First, it helps to know what’s usually included in common area maintenance costs. Depending on their space, each tenant in commercial buildings pays a portion of these expenses. What are CAM expenses, you ask? They comprise:

- Maintenance and Repairs: This includes costs for routine maintenance, landscaping, parking lot services, and any necessary repairs to common areas.

- Utilities: These comprise gas, electricity, and water for communal spaces. This guarantees the preservation of these vital services.

- Property Management Fees: Amounts paid to property management firms for keeping an eye on the property, handling tenant relations, and guaranteeing upkeep.

- Insurance Costs: This includes property insurance covering common areas and liability insurance to protect against potential claims.

- Property Taxes: These are the annual taxes associated with the property.

Different properties have their own unique needs, and the tenants often share the costs associated with them. This could include on-site management, security, or other expenses required to manage and maintain the commercial property. Now you know what is included in CAM charges, but keep in mind that the exact items can vary by lease and property type. To explore what the right commercial lease for your tenant is, learn about commercial lease covers and the pros and cons of each.

Controllable vs. Uncontrollable CAM Expenses

Not all CAM expenses are created equal. Most leases contain the landlord separating uncontrollable from controllable expenses. Both of these separations set expectations for the tenant and reduce disagreements.

- Controllable CAM Expenses

These are expenses that can be negotiated or controlled by the landlord or property manager.

They are:

- Janitorial

- Groundskeeping and landscaping

- Security

- Administrative or property management fees

- Normal maintenance and occasional repairs

Because landlords can manage these costs, tenants often ask for caps to protect themselves from sudden increases.

- Uncontrollable CAM Expenses

These are costs outside the landlord’s control and cannot be reasonably capped. Examples include:

- Property taxes

- Insurance premiums

- Utility rate increases (beyond landlord’s control)

- Government-mandated compliance costs

Because these expenses fluctuate based on external market or regulatory factors, tenants typically bear their proportional share without limitations.

How CAM Charges are Calculated

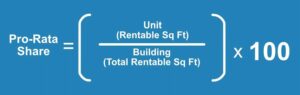

This vital calculation is based on the tenant’s pro-rata share of the space. Follow the steps below to determine what each tenant owes:

Step 1: Tenant’s rentable square footage / Total leasable square footage = the pro-rata percentage of CAM charges the tenant is responsible for.

Step 2: Take the pro-rata percentage of CAM charges, Insurance, and Taxes X the property’s estimated annual CAM, Insurance, and Taxes = the Tenant’s Annual Budget for each of these expenses in total.

Alternatively, you can calculate your Annual CAM, Insurance, and Tax Expenses / Property square footage = CAM, Insurance, and taxes fee per square foot.

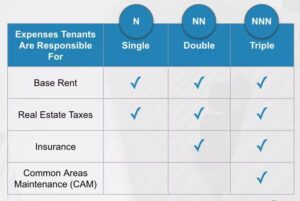

Either way you do this, the tenant is responsible for their portion of the space they occupy. Every lease is slightly different. This difference especially affects N, NN, and NNN leases regarding what landlords may or may not include in those rent CAM charges. Pay close attention to the language.

It’s also important to mention that some leases might have a “cap” on CAM charges. This means there’s a limit on how much you can charge a tenant for these expenses, no matter what the actual costs are for you as the owner.

For the most consistent and accurate results, use a property management software like STRATAFOLIO to calculate CAM charges. Property management programs avoid human error. They also save you the time of having to calculate each tenant’s share by hand, one at a time.

An Example of CAM Allocation

The property manager will estimate annual CAM and operating expenses at the start of the year. They will then divide the costs among the tenants in the building by their gross leased area.

- If you lease a 1,000-square-foot (SF) retail space in a 5,000-SF building, the tenant will be responsible for 20% of the CAM charges and other operating expenses.

The tenant’s annual CAM rent estimation portion is divided by 12 and added to their monthly rent. The property manager will do a CAM reconciliation at the end of the year. This will show how much the building’s total expenses actually were compared to what the tenants paid.

Based on this reconciliation, tenants may need to pay additional fees to cover unexpected maintenance needs. On the other hand, the owner may need to compensate tenants if the actual expenses were lower than estimated.

What Is Not Covered in CAM Charges

Exclusions are outlined in many leases to stop landlords from charging tenants excessive fees. Typical exclusions consist of:

- Capital improvements (new roof, structural replacements, building additions), unless amortized over time, and so agreed.

- Marketing and promotional costs for the building or property

- Landlord’s debt service, such as mortgage payments or refinance fees

- Executive or overhead salaries unrelated to the operations of the property

- Attorney fees, leasing fees, or tenant default incurred in landlord disputes

- Fines for violating the building code and expenses caused by the landlord

- Construction on specific tenants (build-outs or improvements that are not shared by all tenants)

Without a clear list of exclusions, landlords could pass along costs that inflate tenant expenses unfairly. Precise lease language reduces the risk of conflict and ensures tenants only pay for legitimate shared operating costs.

Addressing CAM Charges and the Differences in NNN, Modified Gross, and a Full Service Lease

In a full-service gross lease, the tenant pays a fixed monthly payment, including rent and CAM charges. Because the CAM charges are fixed, commercial landlords risk underpayment of CAM fees and, therefore, lost income. When you pay CAM as a percentage of gross leasable area, the calculation becomes more tricky.

Triple Net Leases

In triple-net leases (NNN leases), tenants assume almost all the responsibility for operating expenses. They pay their pro-rata share of property insurance, taxes, and common area maintenance (CAM). The landlord typically only has to foot the bill for capital expenditures. However, the results of lease negotiations can modify tenant responsibilities in a triple-net lease.

Modified Gross Lease

A modified gross lease is when the tenant pays a base rent plus a share of the CAM charges. The landlord takes care of the remaining expenses. Landlords who want to share some costs with tenants often choose this type of lease. It also helps keep the rent amount predictable. In some gross leases, landlords also cover utilities and janitorial services for the tenants.

Full-Service Lease

A full-service lease is typically found in high-rise buildings that have multiple tenants. This type of lease includes most but not all expenses. This ranges from janitorial services for the interior to maintaining an impressive lobby and covering utilities.

Typically, tenants cover a portion of the building’s operating expenses. The size and location of their space determine this amount. Discussing estimated pro rata expenses helps landlords and tenants clearly understand their respective responsibilities.

Triple Net (NNN) vs. Modified Gross Lease

Essentially, a triple net lease (NNN) and a modified gross lease handle expenses differently. With triple-net leases, tenants generally pay a lower base rent. However, they also take on additional costs separately, such as property taxes, insurance, and maintenance.

On the other hand, modified gross leases combine both gross and net leases. The base year rent includes certain expenses over a year, but any increase over a year will be charged to the tenant. This involves balancing the need for predictability with the flexibility to adapt.

Negotiating CAM Charges

Transparency and fairness are key for landlords negotiating CAM terms. Begin by disclosing to your tenants all expenses covered in CAM charges. Insert a base year for calculations, so that everyone is aware of the initial point. You can also allay tenant worries by capping the overall CAM charge and providing them with the ability to audit charges. Finally, implement a percentage-based system dependent upon occupied space or actual use — this makes costs divisible into equal proportions for all tenants.

Always maintain transparency and open communication to avoid disputes and build trust. Many leases require landlords to fill out a reconciliation form with the most important expense information. This form must be completed within 60 to 120 days from the start of the year. This form fully breaks down each charge that the tenant is responsible for. Most commonly, leases require landlords to complete it within 90 days.

It’s crucial to research similar properties or other properties within your portfolio. Research ensures your CAM charges are competitive.

Manage Your CAM Charges with STRATAFOLIO

CAM charges are a critical component of most commercial lease agreements. To properly manage them year to year, your business should consider property management software like STRATAFOLIO. With STRATAFOLIO, you can easily track, calculate, and reconcile CAM charges. Additionally, the information in STRATAFOLIO is integrated with QuickBooks to generate complete and accurate reports.

Schedule a demo to experience our CAM 1-click functionality. Don’t miss the chance to elevate your commercial property management experience!