Imagine your office free of paper checks… Then imagine what you could do with all the time you’d save if you weren’t processing checks by hand. Saving time with a streamlined payment system is one of the Benefits of ACH for Commercial Real Estate.

When you use ACH for rent payments, you optimize the payment process, saving you both time and money while letting you focus on what is most important for your business.

At STRATAFOLIO, our mission is to create innovative tools to help owners and property managers save time and money. Our software integrates ACH for rent payments because we strongly believe in the benefits of ACH for commercial real estate.

Rent Collection Affects Asset Value

The amount of rent that you collect each month affects the value of your commercial real estate property. For example, properties that are 100% occupied have a higher value than properties that are only 75% occupied. But occupancy only counts if your tenants are actually paying their rent.

Collecting the maximum payment due according to the lease and receiving it on time will help you maximize the value of your asset. Encouraging (or requiring) your tenants to set up automatic payments through ACH is a great way to make sure you are receiving payments on time and for the correct amount. Tenant utilization of ACH also provides consistent and predictable monthly income, helping real estate organizations with strategic planning and growth. Staff no longer have to spend valuable work hours chasing down rent checks and can focus on other critical tasks.

What is ACH?

ACH stands for “Automated Clearing House.” It is a network of banks & financial institutions that facilitates transactions between banks. Simply put, ACH is how electronic bank-to-bank transfers are processed. Sending ACH payments is secure and quick, with the funds typically available in 5-7 business days.

Using ACH Saves You Money

ACH is cost-effective. The Association of Financial Professionals quantified the cost of processing payments with paper checks vs. ACH payments – and the results were astounding. Processing payments with ACH costs almost 7 times less than receiving payments with paper checks. ACH also has an advantage over credit card payments. Credit card fees range from 1.5% to 3.5%, while ACH fees are usually around 0.5%.

“The median cost of receiving a paper check is $1.57. The median cost for

sending and receiving external ACH payments is $0.27.”

– AFP Payments Cost Benchmarking SurveyUsing ACH Saves You Time

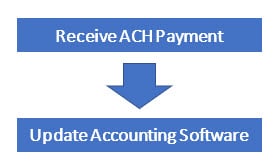

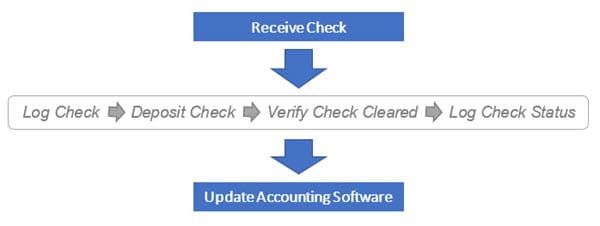

Rent collection is one of the most time-consuming processes in the day-to-day operations of a Commercial Real Estate business. Receiving, logging, depositing, & waiting for a check to clear is a 6-9 day process. Using ACH for rent collection reduces this process to 5-7 days because the intermediate steps of logging, depositing, and verifying the cleared transaction are all completed automatically. ACH streamlines your rent collection process, which can save hours of management activities each month.

Rent Collection With ACH

Rent Collection Process With Paper Checks

ACH is More Secure Than Checks

The Association of Financial Professionals reports that checks are the #1 target of fraud, with wire transfers being a close second. ACH transfers are at the other end of the spectrum, with the fewest reports of attempted fraud on ACH payments.

“Checks continue to be the payment method most often targeted by those committing or attempting to commit payments fraud and once again account for the greatest amount of financial loss due to fraud.”

Summary: Benefits of ACH for Commercial Real Estate

Whether you have a small Commercial Real Estate Business of 2-5 assets or a large business with 50+ assets, ACH payments offer many other benefits that will improve the efficiency of your business. Additional benefits include:

- Fewer mistakes with a streamlined accounting process.

- Reduced accounting time for tracking and recording payments.

- Fewer late payments with autopay options.

- Decreased cost of receiving payments.

- Reduced risk of fraud.

STRATAFOLIO: A Solution for Your ACH Needs

Interested in learning more about how to set up ACH for your Commercial Real Estate business? STRATAFOLIO has all you need with a Tenant Portal, ACH payments, and invoicing that automates rent escalations. Check out our knowledge base to learn how to set up ACH for both the owner and tenant.

STRATAFOLIO is all-in-one software to help you manage your Commercial Real Estate business from Investors & Financials to Tenants & Work Orders.

Contact us today for more information and a demo of our software!