Exactly how do you run a rent roll in QuickBooks? Well, the answer is pretty simple. You don’t. But, we have a great solution for you! Keep reading…

Most people using QuickBooks create their own version of a rent roll in a spreadsheet. Then, update the spreadsheet on a fairly irregular basis because of the manual nature of a spreadsheet. There are other automated solutions for this which we will get to, but first, let’s start with the basics.

What’s a Rent Roll and What’s its Purpose?

At the most basic level, a rent roll is a standard list of rental charges. It is a listing of every property contained in your portfolio. It outlines the sources and amount of income from all your income-producing assets. Maintaining a current, accurate rent roll is vital to good property management. And, it’s necessary for maintaining relationships with both your lenders and investors. Aside from the Profit & Loss and the balance sheet, the rent roll is the next most important document to maintain.

Purchasing an Asset

If you are purchasing an asset, a rent roll should be one of the first pieces of information requested during your due diligence. Why? A surprising amount of information is shared within that document. First and foremost, it outlines the income potential of the asset you are considering purchasing. A detailed rent roll report will give you a good sense of how that property is performing. It answers questions like:

- Number of vacancies

- How long current tenants are expected to stay

- How much income the asset generates

- Size and use of spaces within the asset

- Tenant mix – are they more local businesses or big box tenant

Although you will want to dig deeper into every lease during your due diligence, a rent roll provides a quick overview of the current occupancy and incomes.

Refinancing an Asset

If you are refinancing, the rent roll will be among the documents required by any lender. The lender needs to see where the income is coming from so they can evaluate the risk associated with the asset. By looking at each tenant, the length of the lease, and the expected income, the lender can then make an assessment on profitability.

The cleaner and more accurate your rent roll, the fewer questions and scrutiny you receive from both your lenders and investors. And, the speed in which you can produce a report also plays a role in their perception of you and your organization. It pays to be organized.

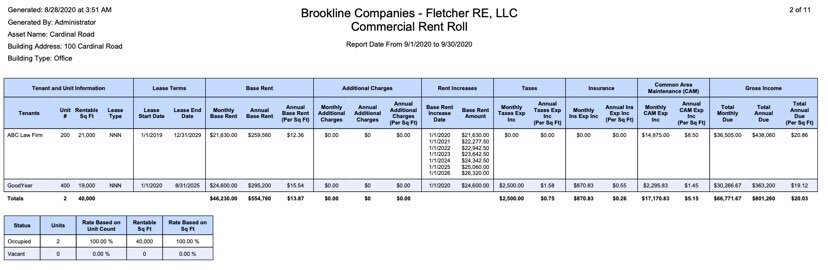

What Information Should be Included in a Rent Roll

A good rent roll will always contain the following information:

- Owner of the organization

- The entity that owns the asset

- Building address

- Building type

- Listing of units

- Tenants associated with each unit

- Square footage of the units

- Lease terms for each tenant

- Break out of rent increases over the lease

- Income associated with recovery of taxes, insurance and common area maintenance (CAM)

- Total gross income

- Rental income summary

- Occupancy summary

Many variations exist with this report. Essentially, it captures a view of each asset and the anticipated income you can expect.

How do I create a Rent Roll?

For most people using QuickBooks, the answer to the creation of a rent roll is a spreadsheet. This is necessary because QuickBooks handles the accounting side of managing a real estate portfolio. However, QuickBooks lacks support from the asset management and property management side that really allow you to produce a true rent roll. Until now that is.

With STRATAFOLIO, we connect directly to both QuickBooks Desktop and QuickBooks Online and access each company QuickBooks file. With that, we are able to access your financials and provide you a global view of your entire portfolio in a dynamic fashion. Plus, we support users with the full complement of data necessary to effectively manage a real estate business including:

- Asset management – view of what you own, where it is, when it was purchased, how large it is

- Financial management – the ability to easily see global cash flow and debt and the associated metrics

- Investor management – tracking who is invested in your operation and their returns

- Operations management – managing the day-to-day lease and tenant activities including supporting users with an easy-to-produce rent roll

If you are looking for other suggestions on QuickBooks as it relates to your real estate, check out our article on the Commercial Real Estate and QuickBooks: The Best Ways to Get Started.

Producing a Report in STRATAFOLIO

As part of operations management within STRATAFOLIO, we capture detailed information about each asset including the unit level details. For each unit, we track lease status, size of the space, and type of space. For each lease associated with the unit, we track detailed information about:

- Lease terms

- Lease escalations

- Operating expense recovery

- Tenant name

- Renewal terms

- And much more

This information can be used not only to assist with making sure you are invoicing the correct amount but also with the creation of a rent roll as shown below.

Filters also allow you to produce the report for select entities, assets, buildings, tenants, or time periods. These reports can then be easily shared with lenders or investors.

Final Thoughts

A rent roll is a valuable tool for managers of any real estate portfolio. Here are a few important things to remember:

- A rent roll provides detailed information about each tenant and the length of current tenant leases.

- You should stay prepared to share a rent roll for your entire portfolio or for a single asset.

- Accuracy and completeness of the report are crucial to building and maintaining confidence with your lenders and investors.

- There are ways to automate the creation of these reports.

Learn more about how STRATAFOLIO can help you with your commercial real estate company if you use QuickBooks.