Have you ever been asked for a rent roll?

Investing in real estate isn’t just about the value of the property itself. It’s also essential to determine the value of the income stream, both present and future. While rent roll isn’t quite as easy to generate as the price-per-square-foot of a property, it helps you determine the actual value of an income-generating property. It’s an essential part of running a commercial real estate business. Here’s what you need to know about rent roll.

What Is Rent Roll?

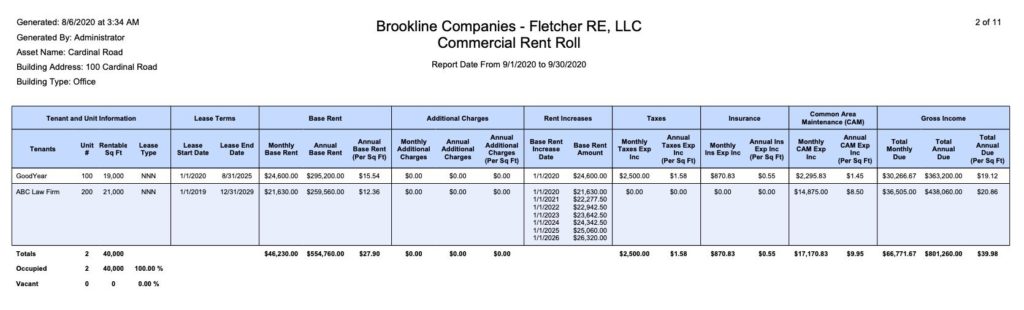

Rent (or rental) roll shows vital financial information about a rental property. Rather than going into all the details, it offers an overview of the property’s financials. It often fits on one page or less. Reports like these are helpful for both residential and commercial real estate assets, including retail and office properties, mixed-use developments, multifamily buildings, and houses.

A proper report should show tenant information, unit information, property information, and a summary of rental income. Here’s what it should include:

- Tenant name and unit number

- Rentable square feet

- Lease type (NNN, gross)

- Lease start date and end date

- Monthly and annual base rent

- Any additional charges, insurance, CAM

- Rent increase dates/amounts

- Monthly and annual gross income

In addition to the information for each unit, a commercial rent roll document should display the property address, building type, and the date it was generated.

Why Rent Roll Is Important in Commercial Real Estate

Rent roll provides several items of crucial information in a format that you can read at a glance. Here are just a few of the ways commercial real estate professionals use them:

- They are valuable from a property management standpoint, helping you to see how much each tenant owes, when their leases expire, and more.

- The information contained in the document can help you calculate financial performance in terms of Net Operating Income (NOI), and cap rate. It also makes it easy to compare the current rent being collected with market rent.

- Investors will want to review the rent roll to understand current and future cash flow. That way, they can determine how the property is performing.

- If you’re considering selling a property, they can help you understand the value of the property. Buyers will also want to see financials before they make a purchasing decision.

- Lenders will ask to see the rent roll before deciding whether to give out a loan.

- Providing clear, up-to-date documentation will instill confidence in your real estate business.

Determine the True Value of Your Properties with STRATAFOLIO

As a commercial real estate owner or property manager, you need a way to generate rent roll. STRATAFOLIO makes it easy always to have accurate, easy-to-read documentation on hand.

When a lender, investor, or buyer asks for rent roll, you’ll always have an up-to-date document available to share with them in just seconds. Get in touch today to learn more about STRATAFOLIO, how we integrate with QuickBooks, and how it can help your commercial real estate business!