What a Lease Represents in STRATAFOLIO

The Lease record in STRATAFOLIO is the central source of truth for billing, operating expenses, occupancy, alerts, compliance, and reporting.

A Lease connects:

- A Tenant

- A Unit

- An Asset and Entity

- Lease Rates and escalations

- Operating Expenses

- Invoicing and accounting integration

- Documents and compliance items

Managing the Lease correctly ensures:

- Accurate rent invoicing

- Proper CAM tracking

- Correct occupancy reporting

- Reliable financial reporting

- Clean historical records

This article explains how to manage Lease updates, extensions, escalations, files, alerts, and special situations such as assignments and sub-leases.

A centralized lease database for commercial real estate gives landlords and asset managers one reliable place to store, track, and manage every lease detail: documents, key dates, tenant contacts, compliance items, and critical notes without digging through email threads or scattered spreadsheets. By keeping everything organized and searchable in a single system, you can reduce missed deadlines, improve team coordination, and respond faster to tenant needs while maintaining cleaner records across your entire portfolio.

Where to Find and Open a Lease

- From the left-side navigation, go to Operations

- Select Leases

- Click the Information “i” button next to the lease

- This opens the Lease Detail View

- The Lease Abstract tab opens by default

The Leases table displays all leases, including current, future, and expired leases.

Expired leases:

- Will not show under Building or Unit views if a newer lease exists

- Will not appear on the Rent Roll if expired

How to Input a Lease Extension/Amendment Into STRATAFOLIO

When a lease extension or amendment is executed, you should update the existing Lease record instead of creating a new lease. This preserves historical accuracy.

Only create a new lease if:

- Lease terms drastically change

- A completely new tenant agreement begins

- A lease is assumed under substantially different terms

Keeping track of expiration dates and lease escalations in STRATAFOLIO is imperative for maintaining an up-to-date portfolio. The lease already entered has the security deposit, the lease options to renew, and copies of the original lease. There is no need to start over and re-enter all of that. Here are the steps to extending a lease.

- If the Lease Expiration has passed or the type of lease has changed, Change the Lease Status

- Extend the Lease Expiration Date

- Add Lease Rate Escalations

- Extend or Add the Operational Expense period if needed

- Upload the Contract to the Files tab

Instead of inputting a new lease, extend the current lease for historical purposes. The only reason why we would suggest expiring the old lease and adding a new lease is if the lease terms drastically changed or if a tenant is acquiring someone else’s lease.

Changing the Lease Status

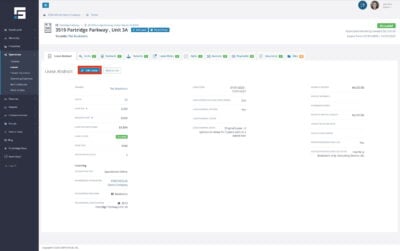

When the expiration date passes, STRATAFOLIO automatically marks a lease as Expired. Locate the lease by going to Operations from the left-side navigation menu > Leases> i icon beside the lease

NOTE: The Leases table will display all leases, current, future, and expired, inputted into STRATAFOLIO. Expired leases will not show under the Building or Unit views if a newer lease has been entered. They will also not show on the Rent Roll if they have expired.

After you have chosen the proper lease, under the Lease Abstract select the Edit Lease button.

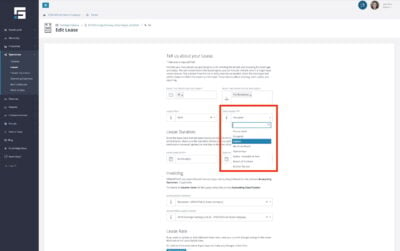

Modify the Lease Status drop-down to the appropriate status.

Change End Date

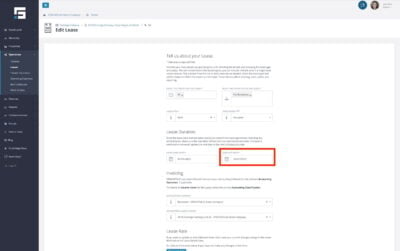

Modify the Lease End Date to the new end date on the amendment or extension.

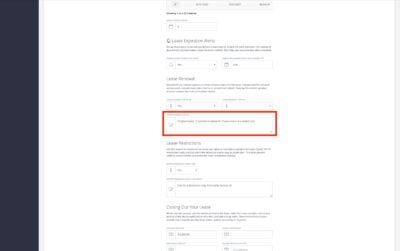

If the tenant has executed an option, update the Lease Renewal options on the Edit a Lease form with (option # executed) so it is clear how many options remain. Then choose Save.

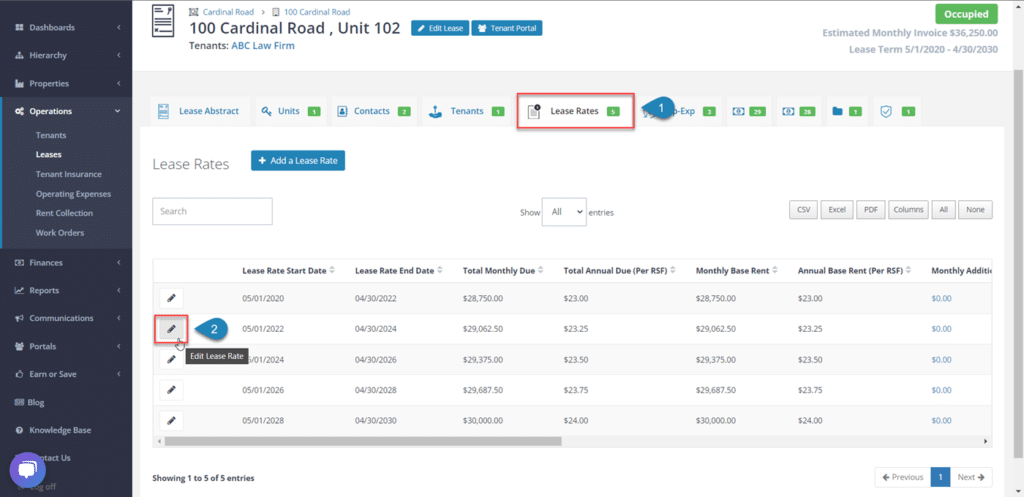

Add Lease Rate Escalations

Now that the lease end date is extended, the Lease Rates can be modified. Note that the Lease Term or End Date must be extended to enter the new escalations. You cannot add Lease Rates past the end of the Lease Term.

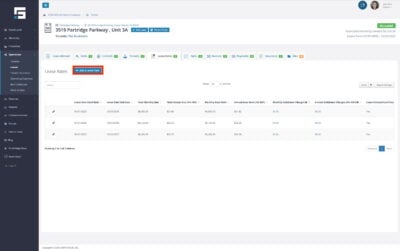

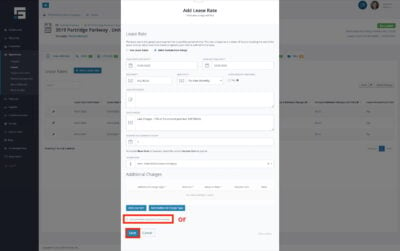

While you are in the Lease Detail View, navigate to the Lease Rates tab, then select Add a Lease Rate.

STRATAFOLIO will automatically calculate the dates for the next year and populate them. Modify dates as needed.

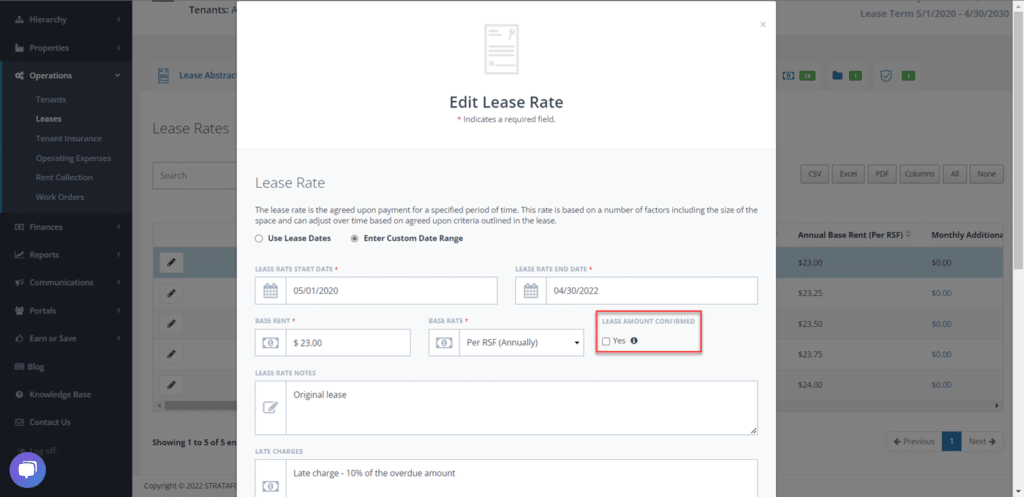

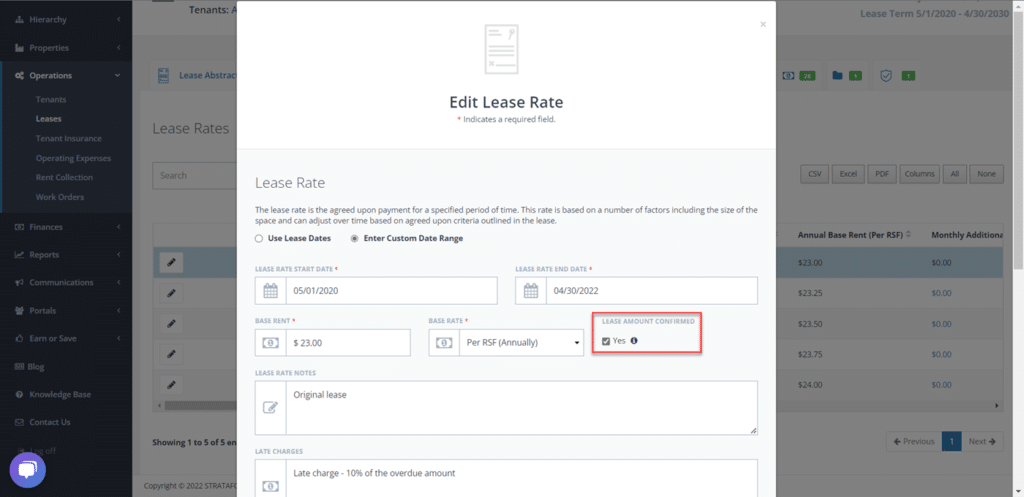

Enter the new Lease rate amount, type, and whether the lease rate is confirmed or not.

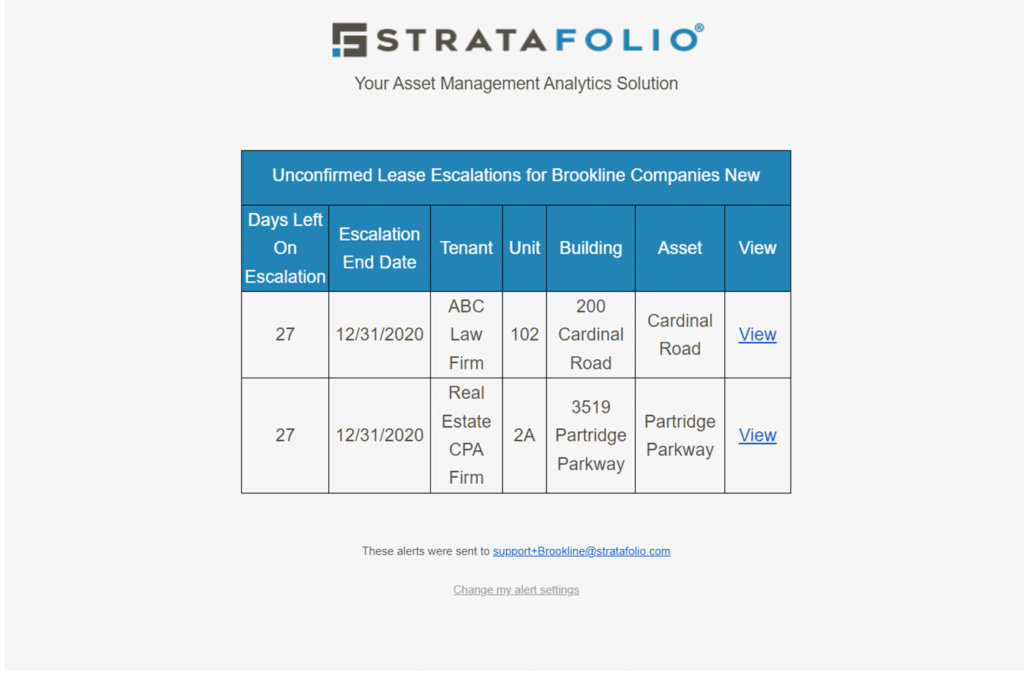

If unchecked or not confirmed:

- STRATAFOLIO sends an alert 30 days before escalation

- This is common for CPI-based increases or unclear escalations

To resolve an Unconfirmed Lease Rate Alert:

- Open the Lease from the alert email

- Navigate to the Lease Rates tab

- Click the pencil icon to edit the rate

- Update the amount if needed

- Check the Confirmed box

- Save

The alert ensures you verify rent increases before invoicing.

In the Lease Rate Notes, STRATAFOLIO’s Onboarding team enters the document where the lease rate is located. Please use the note field for whatever notes you need for this specific lease rate period. The Late Fees and Due Date should pull through from previous rates. The Income Item should also pull through, but be sure it is the correct Income Item you would like to use for invoicing.

Select Save or select the Add Another checkbox to continue adding escalations.

NOTE: These dates must be within the dates entered for the Lease Term. The Lease Rate end date cannot be set before the lease’s start date or after the lease’s end date.

Extend Operational Expenses if Needed:

Navigate to the Op-Exp tab and the pencil button next to the appropriate year – extend the period expiration if needed. You can only extend this period until the end of the Lease Term.

Note: STRATAFOLIO Onboarding recommends utilizing a new Operating Expense period each year. At the end of this year, you can utilize our cloning feature to copy over the same sub-categories you have used. Find directions for that feature at How to Clone Operating Expenses or CAM in STRATAFOLIO. After cloning, you can update the invoice amounts for the next year as needed.

Add Contract to Files

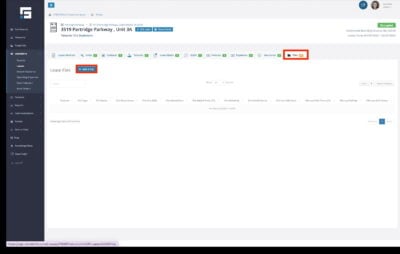

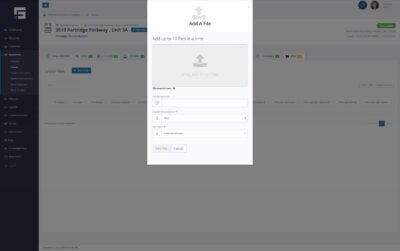

While in the Lease detail view, select the Files tab. Select the button to upload a file. Upload up to 10 files at a time by dragging and dropping or selecting the button to browse and find the file.

Choose the file type and write a description if needed. You can choose whether the tenant can access this file if they have an active tenant portal.

Now that you have updated the lease with the new expiration date, new escalations, new operating expenses, and new files, it’s important to use the current lease to maintain complete historical data on each tenant. This will save you from re-entering data that has already been entered. To ensure that the escalations are correct, run the Rent Roll.

How to Upload Lease Files

Keeping track of important paperwork such as leases, loans, certificates of insurance, and countless other files requires a savvy filing system for the commercial real estate property manager. Because our focus at STRATAFOLIO is to offer solutions to streamline and simplify the management for commercial real estate owners, our software offers the option to upload and store files in a secure, organized location.

A few things to Note When It Comes to Lease Files

All the file types cannot exceed 30 MB in size.

The accepted file types are:

- Image files (jpg, jpeg, bmp, and gif)

- Other files (doc, docx, pages, ppt, pptx, key, rtf, txt, csv, xls, xls, numbers, pdf)

- Video file (mp4 and mov)

- Compressed files (zip)

Where to View and Upload Lease Files

To begin uploading files related to a specific lease, navigate to the Operations from the left-side navigation menu, then select Leases. This view will show all the leases in your organization, including both current and past leases. Click on the ” Information Button “i” beside a lease, and this will open the Lease Abstract of the lease you would like to view.

Once on the Lease Details page, select the Files tab.

From the Files tab you can:

- Upload a File

- Edit a File

- Allow Tenant Access to a File

- Download & View a File

- Delete a File

1. Upload a File

To upload a file, from the Files tab, click on the blue Upload a File button, and a form will appear. Here on this form, you have the following options:

- Gray Drag & Drop Rectangle – Drag or drop up to 10 files at a time into the gray rectangle, or click on the rectangle to browse for the file on your computer.

- Upload Description – You can add a description to the file in this field if needed.

- Tenant Permissions – This allows you to select the level of access you grant to the tenant in the Tenant Portal.

- File Upload Restrictions – Hover your mouse pointer over the “i” to see the limitation details on the types of files that can be uploaded. In general, files may be no more than 30MB and should be standard file types such as .jpg, .pdf, .docx, .xls, etc.

After you have selected the file(s) to upload, click Upload File at the bottom of the pop-up and wait for the page to refresh. The file(s) you uploaded will appear at the bottom of the file list.

By default, all files are initially set to Hide access and cannot be viewed by the Tenant in the Tenant Portal. You can update each file with View, Edit, or Delete access if you choose. If you do not change the file access, it will remain hidden from the tenant’s view. Access levels and how to download & view files are discussed below.

2. Edit a File

To edit the file description, click the pencil button next to the file to open the Edit File Information pop-up. In this pop-up window, you can edit the file description, delete the file, and select the Tenant Access Level/Permissions for the file.

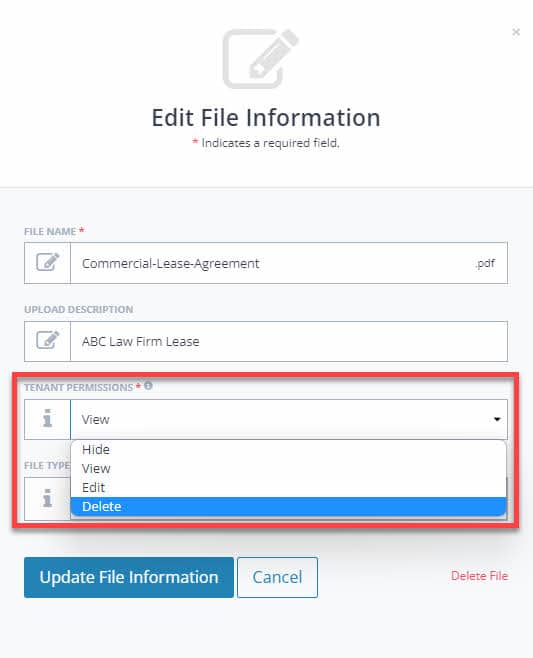

3. Allow Tenant Access to a File

Tenant access permissions can be edited by clicking the pencil icon next to the file you want to edit. Once you click the Edit button, the Edit File Information pop-up will appear, and you can select Tenant Permissions from a dropdown list.

File Access Permissions

There are four file permission levels for files in STRATAFOLIO. Detailed information for each level is below. For more information on file uploads and what the tenant view is like in the Tenant Portal, click here.

- View: View access allows a tenant to download and view the file only. The tenant cannot edit the file description or delete the file.

- Edit: Edit access allows a tenant to download and view the file and edit the file description. However, the tenant cannot delete the file.

- Delete: Delete access allows a tenant to download and view the file, edit the file description and delete the file.

- Hide: If the landlord has selected to hide access to a file, the tenant will not see the file in their list in the Files tab of the Tenant Portal.

NOTE: The landlord can change the access level for files that the tenant uploads after they are saved by the tenant. A tenant cannot change the file access permissions. Access permissions can only be changed by a STRATAFOLIO User.

- Landlord File Upload: When a landlord or the landlord’s agent initially uploads a file to STRATAFOLIO, it will have Hide access and will not be visible to the tenant in the Tenant Portal.

- Tenant File Upload: When a tenant initially uploads a file to STRATAFOLIO, the tenant will have full access to view edit & delete the file until the landlord changes the permissions.

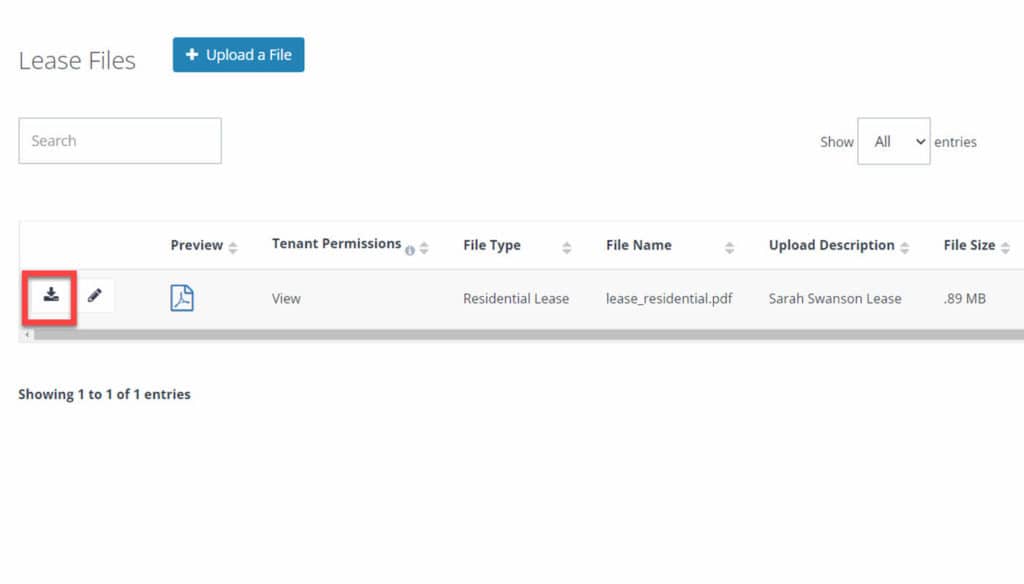

4. Download & View a File

To view a file, click on the Download Button next to the file. This will download the file to your computer where you can open and view it. You can also select the Preview button and it will open up in another window.

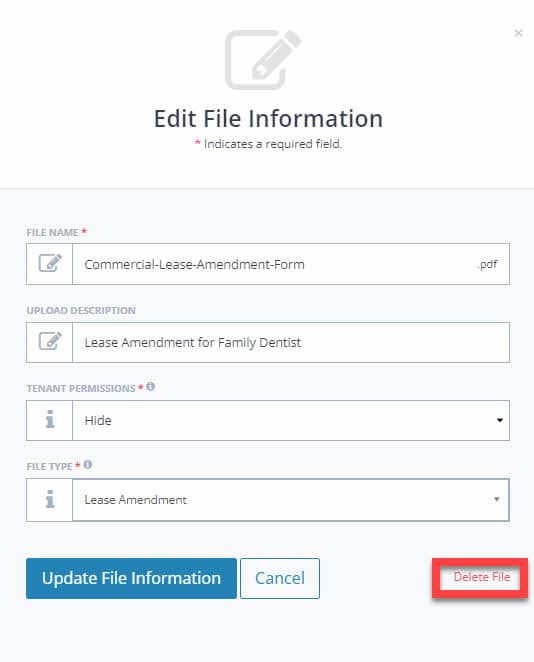

5. Delete a File

To delete a file, open the Edit File Information popup by clicking the Edit button next to the file.

Click Delete File in the lower right corner. Before the file is permanently removed, you will be asked to confirm that you want to delete it.

NOTE: Only a user with Administrator Rights is able to Delete a File from STRATAFOLIO.

Unconfirmed Lease Rate Alerts and What It Means

An alert in your email means something in STRATAFOLIO needs your attention. If this is your first time getting a Lease Rate Unconfirmed Alert, it may be confusing as to why it was sent. There are several reasons, as we will explain in detail.

Understanding alerts

When entering Lease Rates, you may have noticed a small checkbox after the amount column. If you did not check it when entering the Lease Rate, that may be the reason why. If you leave this unchecked, you will get these alerts 30 days before the lease will escalate.

One reason for this box not being checked by the Onboarding team is normally for the leases that escalate by an unknown rate, i.e., by the Consumer Price Index or CPI. When entering these lease rates, the future can be unknown, but STRATAFOLIO still needs to alert you that an escalation may occur. It is important to show on the Rent Roll that the lease will escalate even if the amount is unknown until it happens. When this box is unchecked, STRATAFOLIO will send an alert that there is an Unconfirmed Lease Rate.

In the emailed alert, select the View link, which will bring you directly to the Lease in question. Look in the Lease Rates tab for the escalating Lease Rate. Select the pencil icon to edit the Rate.

If the Base Rent amount needs to be modified due to a different CPI rate, change it. Then choose the Lease Amount Confirmed Box and Save.

There are other reasons that the Onboarding team will leave the Confirmed Lease Rate box unchecked. Including unclear rates in the lease, such as an “Annual increase of no less than 2%.” The team will enter a 2% escalation, but the amount may be different when the time comes. The alert is to help you verify that you are charging the correct amount and that you are letting the tenant know what the new amount will be 30 days prior.

How to Handle Sub-Leases and Lease Assignments

When a tenant assigns or transfers a lease to another entity, such as in the case of an assumption or sub-lease, STRATAFOLIO provides two options to correctly manage the change.

You can either modify the existing lease to reflect the new tenant or close out the old lease and create a new one, depending on the lease terms.

Option 1: Handle the Sub-Lease by Modifying the Existing Lease

If the lease terms remain unchanged and the new tenant is simply assuming the existing lease, follow these steps:

- Add the New Tenant and Contact

- Navigate to Contacts and add a new Contact for the incoming tenant.

- Navigate to Tenants and add a new Tenant record.

- Edit the Existing Lease

- Search for the lease in STRATAFOLIO and select Edit Lease.

- Replace the old tenant with the new tenant.

- Under Invoicing, update the Accounting Customer to the new customer record synced from QuickBooks.

- Document the Change

- In the Lease Closing Notes, explain the situation briefly (e.g., “Lease assumed by Burlington Coat Factory after Jo-Ann Fabric bankruptcy”).

- Upload the assignment or sub-lease documentation to the Files tab of the lease record.

This approach ensures that the lease continues seamlessly under the new tenant while maintaining the financial and historical integrity of the record.

Option 2: Handle the Sub-Lease by Closing and Creating a New Lease

If the terms of the lease are changing, or if your accounting process requires a clean start:

- Close the existing lease by marking it as Expired.

- Create a new lease for the new tenant.

Use the article: How to Add a Lease and Assign a Unit.

This method provides a clear delineation between the two tenant agreements for reporting and audit purposes.

Best Practice

- Always include supporting documentation (e.g., bankruptcy filings, assumption agreements) in the Files tab.

- Double-check the QuickBooks Accounting Customer link to ensure proper synchronization.

- Note any relevant financial or legal transitions in the Lease Notes to maintain a complete audit trail.