Common Area Maintenance (CAM) expenses are the backbone of a well-maintained commercial property. CA, along with taxes and insurance, play a crucial role in the financial dynamics between landlords and tenants. Understanding how CAM impacts financial statements in commercial real estate can provide deeper insights into these relationships.

These charges, CAM, taxes and insurances, collectively known as operating expenses, fund the upkeep of shared spaces. They cover everything from landscaping and parking lots to security and utilities – to taxes and insurance for the entire space. A well-managed CAM structure ensures the property remains functional, visually appealing, and welcoming to tenants and visitors alike.

While CAM charges allow landlords to recover necessary expenses, the real challenge lies in accurately accounting for and reconciling them. Proper financial tracking is essential to maintaining transparency, building trust, and preventing costly disputes. Mismanagement or incorrect recording of CAM income and expenses creates significant discrepancies in financial statements. This can potentially disrupt cash flow and diminish profitability.

In this article, we’ll dive into the fundamentals of CAM expenses, explore how they’re treated in financial statements, and highlight best practices for precise accounting and reporting.

What Are CAM Expenses?

Common Area Maintenance (CAM) expenses are crucial to commercial real estate leases, covering shared property costs that benefit multiple tenants. CAM expenses typically include maintenance, landscaping, security, and utilities for common areas. They also include janitorial services and sometimes capital expenditures related to shared spaces.

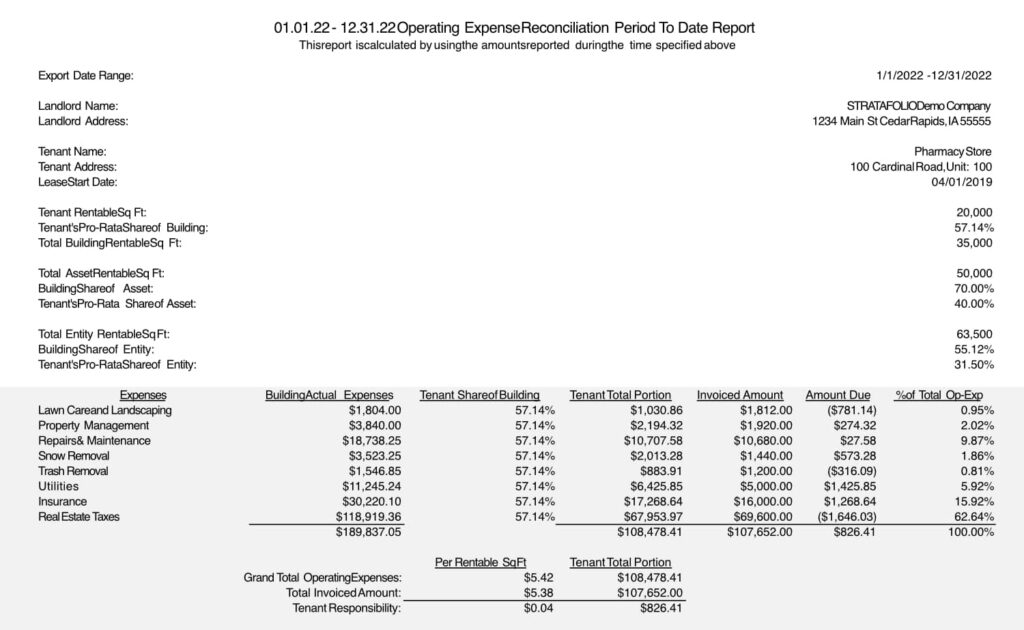

CAM charges are usually passed through to tenants as one of the components of additional rent. The additional rent ensures that the landlord recovers the costs of maintaining shared spaces. Tenants pay their proportionate share based on their leased square footage relative to the total rentable area. Accurately recording and reconciling these expenses is vital for maintaining transparency and financial accuracy.

Accounting For CAM charges

Accurately accounting for CAM charges requires a systematic approach to ensure expenses and reimbursements align correctly.

Many property owners and landlords record their CAM income incorrectly in accounting software such as QuickBooks. This leads to discrepancies when reconciling expenses at the end of the year.

CAM reconciliation ensures the landlord is made whole after reconciling expenses against the collected CAM charges. To achieve this:

- Each month, landlords should charge tenants for CAM income (also called additional income or operating income). This should be based on estimated operating expenses.

- The associated expenses should be recorded under reimbursable accounts in the accounting system.

- At the end of the year, a CAM reconciliation process should be performed. This helps compare actual expenses to the estimated charges collected.

- If tenants were undercharged, they owe the difference; if they were overcharged, a refund or credit may be due.

This approach ensures accuracy and prevents financial shortfalls or legal disputes with tenants over incorrect CAM calculations.

How CAM Charges Are Treated In Financial Statements

CAM charges impact a commercial real estate entity’s income statement and balance sheet. Understanding their treatment is crucial for maintaining financial clarity. The Income Statement reflects how CAM charges are accounted for in a commercial real estate business. Revenue recognition involves recording CAM charges collected from tenants as additional income under “Operating Income” or “CAM Income.”

Expense allocation ensures that associated CAM costs, such as property maintenance, utilities, and janitorial services, are recorded as operating expenses under reimbursable accounts.

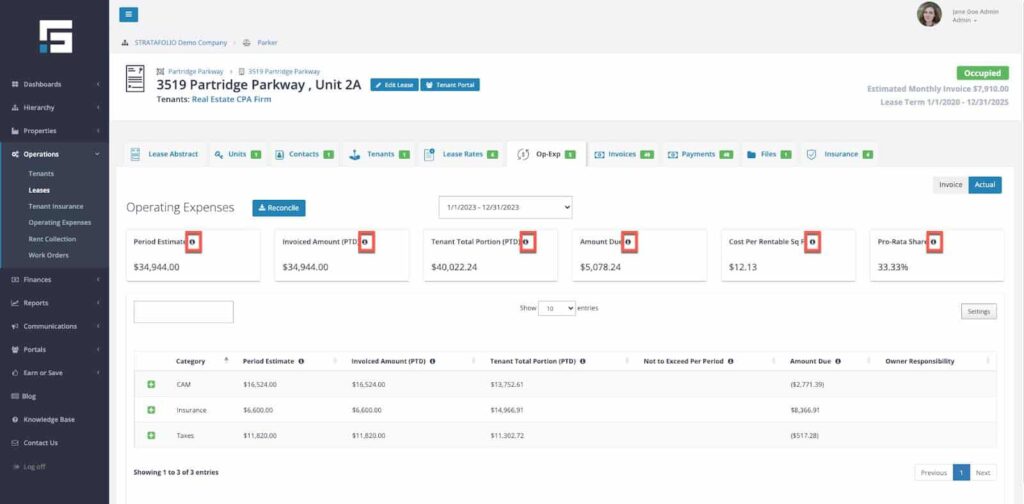

Reconciliation adjustments are made at the end of the year. If actual expenses exceed the estimated CAM charges collected, an additional receivable entry or invoice is created for the tenant balance. The CAM income is reflected as shown below.

Conversely, if charges collected exceed actual expenses, a liability or credit memo is recorded to reflect the refund or credit owed to tenants.

The Balance Sheet also captures the financial impact of CAM charges.

- Accounts Receivable (A/R) reflect amounts owed by tenants if they were undercharged for CAM expenses after reconciliation, remaining outstanding until paid.

- On the other hand, Accounts Payable (A/P) accounts for amounts the landlord owes to tenants. This occurs in cases where reconciliation determines that tenants overpaid for CAM charges.

- Deferred revenue may be recorded when CAM payments are collected in advance. This ensures that income is recognized correctly once fully earned.

Properly managing these entries ensures financial accuracy and transparency for landlords and tenants.

Components That May Directly Affect Financial Statements

Several components influence how CAM expenses are reflected in financial statements. One key factor is the distinction between fixed and variable costs. Some CAM charges remain consistent and predictable, while others fluctuate due to seasonal factors or changes in usage. Proper budgeting for these variations helps prevent financial surprises.

Another vital consideration is capital expenditures. While CAM charges typically cover routine maintenance, some landlords attempt to pass capital improvements on to tenants.

However, accounting standards dictate that these costs must be appropriately classified as expenses or capitalized assets. Vacancy adjustments also impact CAM expenses. Landlords must decide whether to absorb the proportional costs of vacant units or distribute them among existing tenants. This decision affects the property’s net operating income (NOI) and overall financial performance.

Lastly, tenant-specific lease terms can introduce additional complexity. Some leases include caps or restrictions on annual CAM increases, limiting how much landlords recover each year. The leases may also stipulate which expenses, such as capital expenses, need to be excluded from the CAM reconciliation, which must be adhered to.

Understanding these variables is essential for accurate financial reporting and effective property management.

Best Practices For Managing CAM In Financial Statements

Commercial property owners should adhere to several best practices to ensure accurate reporting and reconciliation of CAM charges.

- One of the most important steps is to use an organized chart of accounts and correctly categorize CAM revenue and expenses in accounting software like QuickBooks. This prevents misclassification and ensures that financial records remain accurate.

- Additionally, regularly reconciling CAM accounts—whether monthly or quarterly—helps avoid year-end surprises and keeps expenses aligned with collected charges.

- Transparency is key to minimizing disputes. Maintaining clear communication with tenants by providing detailed breakdowns of CAM expenses fosters trust and reduces potential conflicts.

- Property owners must also carefully review lease agreements to ensure all CAM-related terms are fully understood and correctly applied in accounting records. Adding reimbursable and non-reimbursable expense accounts to QuickBooks allows for easy verification that all of the expenses are CAM-related.

- Lastly, planning for fluctuations is crucial, as unexpected expenses—such as snow removal or emergency repairs—can arise. Budgeting conservatively for these variances helps maintain financial stability and prevents shortfalls.

Landlords can ensure more efficient CAM management and financial reporting by following these best practices.

Future Trends In CAM And Financial Reporting

The CAM and financial reporting landscape in commercial real estate continues to evolve. This is driven by tech advancements, sustainability initiatives, regulatory changes, and increasing tenant demands for transparency.

One significant trend is the increased use of technology. Property management software is becoming more sophisticated, enabling real-time tracking of CAM expenses and automated reconciliation. This shift enhances accuracy and efficiency, reducing potential errors and disputes. This is where STRATAFOLIO comes in with 1-click CAM reconciliation.

Another key development is the growing emphasis on sustainability and green initiatives. More tenants and landlords are prioritizing energy-efficient measures, which can impact CAM costs and how expenses are recovered. Implementing eco-friendly solutions benefits the environment and can create long-term cost savings and appeal to sustainability-conscious tenants.

Meanwhile, regulatory changes continue to shape CAM financial reporting. New accounting standards and lease disclosure requirements may affect how CAM charges are recorded. It is essential for landlords to stay compliant and adapt their financial practices accordingly.

Alongside regulatory shifts, tenant demand for transparency is also increasing. Tenants are scrutinizing CAM charges more closely. They often request detailed reports and sometimes require third-party audits to ensure fair cost distribution.

By staying ahead of these trends and implementing best practices, commercial real estate owners can better manage CAM expenses. They can ensure accurate financial reporting and maintain strong tenant relationships in an ever-evolving market.

Accurate CAM Tracking Matters More Than Ever

As the world of commercial real estate continues to evolve, the role of CAM expenses and operating expenses in financial management remains as crucial as ever. Properly tracking, reconciling, and reporting these charges ensures a fair and transparent system that benefits landlords and tenants.

Property owners can maintain financial stability while fostering trust with tenants by leveraging best practices, embracing technology, and staying ahead of regulatory changes. In an era where data-driven decision-making is paramount, a well-structured approach to CAM expenses enhances financial clarity. It positions properties for long-term success.

Track Your Accounts With STRATAFOLIO

Are you ready to track your commercial real estate accounts? STRATAFOLIO provides end-to-end support, enhancing operational efficiency with cutting-edge underwriting tools. We have the knowledge and expertise to help, no matter the property type or transaction. Contact us now to learn how we can help you achieve smoother, more efficient payrolls.