If you manage a commercial real estate asset, you will eventually need to set up a tenant in QuickBooks online. Assuming you use QuickBooks Online or QuickBooks Desktop that is. It might be tempting to simply record your deposits and not worry about tracking your income by tenant. We’ll examine why tracking your income by tenant is essential and how you can set up your tenants in QuickBooks Online. The setup for QuickBooks Desktop is similar, but these images belong to QuickBooks Online.

If you’re the owner of multiple LLCs, you might find yourself jumping between QuickBooks files regularly. It can be difficult to get a complete picture of your financials even if you’ve set up all your QuickBooks files perfectly. STRATAFOLIO can provide a consolidated look at your commercial real estate portfolio and streamline your property management.

Why Setup Your Tenants in QuickBooks

When you have a tenant, there are a few things you need to keep track of in QuickBooks. You’ll need to track their rent payments, as well as any security deposits or other fees. You’ll also want to keep tabs on any repair or maintenance costs associated with their unit, or the associated building especially if they are NNN leases. Tracking expenses by building becomes even more important when you need to do common area maintenance (CAM) reconciliation at the end of the year since you will need to properly allocate the expenses based on the lease agreements.

By setting up a tenant, otherwise known as a customer, in QuickBooks, you can easily see all this information in one place. This can save you a lot of time and effort when it comes time to reconcile your books at the end of the year. Plus, it can give you a better understanding of your rental property business.

Invoice Creation

If you manage a property, you know tenant billing can be a headache. You’ve got rent to collect, late fees to tack on, and deposits to keep track of. QuickBooks simplifies all of this by keeping everything in one place.

STRATAFOLIO adds the additional ability to track all of your properties and companies in a single dashboard including rent escalation dates and lease expiration dates. With our tenant billing feature, you can quickly generate invoices and track payments. And if a tenant is late, you can quickly add a late fee and send them an updated overdue notice. No more chasing down payments or digging through paperwork! STRATAFOLIO makes tenant billing quick and easy.

Although most customers pay the same rent each month, you may miss rent increase deadlines and late payment fees while juggling multiple QuickBooks files. By creating your tenants in STRATAFOLIO, you can monitor important dates and deadlines for all of your companies.

Thorough Records

Tenant records are an important part of any landlord’s business. By keeping thorough records in QuickBooks, owners can save time and money while ensuring that their tenant’s data is accurate and up-to-date. In QuickBooks, owners can track tenant information such as contact information, rental history, and payments. This data can be used to generate reports or run analyses, helping owners to make informed decisions about their business.

QuickBooks can be used to store documents such as lease agreements or rental agreements. By keeping all of this information in one place, landlords can save time and reduce the risk of missing important data. For multiple properties or companies, you’ll need to switch between company files to monitor all your properties. STRATAFOLIO allows you to both store your lease and rental agreements and monitor all your properties in a single dashboard. Check out the knowledge base article How to Input a Lease to learn more.

No one wants to think about an audit. But in the event of an audit, you’ll be grateful not to have to dig through old paper records or bank statements to prove which tenant paid you when. By tracking invoices in QuickBooks by tenant, you’ll have the information readily available. You’ll be able to explain which payments you received were income and how much was allocated to deposits or operating expenses, such as CAM.

Multi-Unit Properties

For property owners with multiple tenants, such as shopping centers, it’s important to monitor the payment by the tenant. You need to track which tenants are behind on rent payments so that you can follow up with tenants who are behind and charge the appropriate late fees. You can also track expenses by tenant which allows you to calculate your profit by tenant.

Though you can track recurring invoices in QuickBooks, QuickBooks does not have an easy way to create a rental role for your properties. If you own multiple properties within a single business entity, you can track the properties using classes within QuickBooks. This requires you to identify the proper class for every transaction.

You can also keep track of tenant information, so you always know who is renting each unit although the information stored in QuickBooks is limited by the predefined fields available within the program. QuickBooks makes it easy to get the information you need to make informed decisions about your properties.

How To Setup A Tenant in QuickBooks

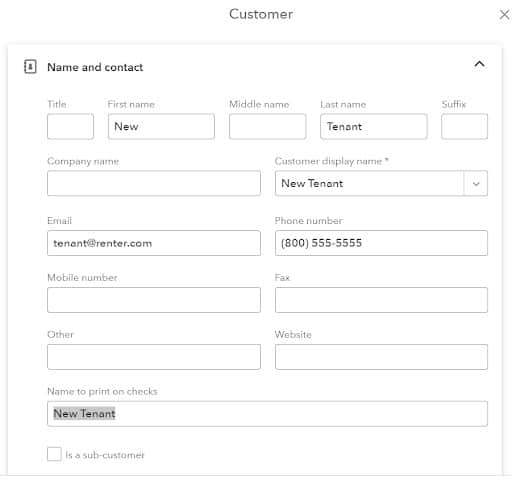

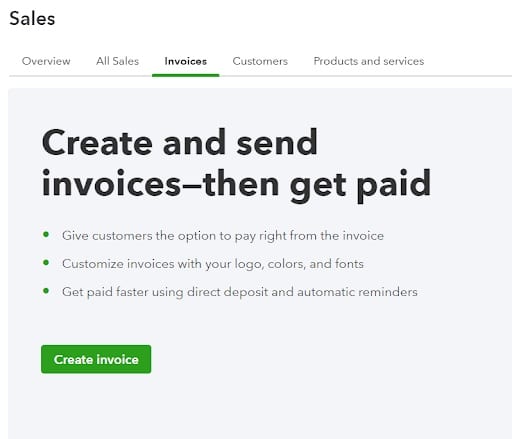

Follow the instructions below to set up a new tenant, otherwise known as a Customer, in QuickBooks. You should repeat the process for each of your tenants.

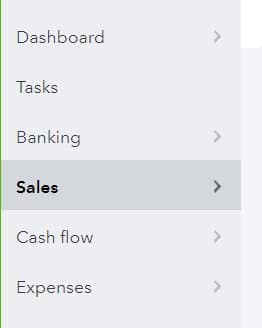

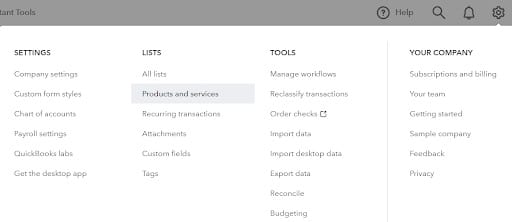

- Go to the main menu in QuickBooks and select Sales.

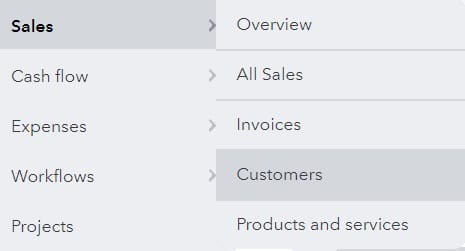

- Select the Customers submenu.

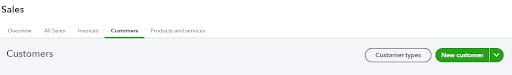

- Select the add New Customer (the green button)

- Fill out as much information as possible under the customer screen. Make sure to scroll down to enter the address, billing information, and additional information.

- Click the green save button in the bottom right corner.

Create Income Items

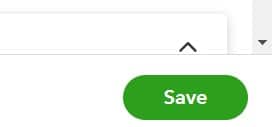

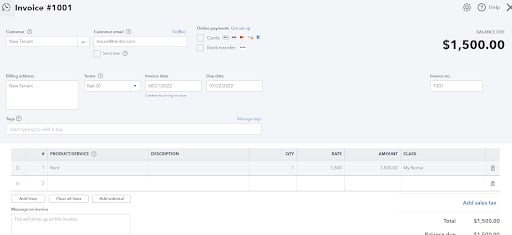

Once you’ve established your client in QuickBooks, you should set up the income items for Rent, CAM, Late Fees, and other charges.

- Go to the Setting Menu and Products and Services.

- Click on the Products and Services and then click on the green New button to create a non-inventory item. Input the name of the item you want to create such as Rent or CAM.

- Enter the customer name and QuickBooks will automatically fill out the rest of the tenant’s contact information. You can then add the type of income under Product/Service such as rent, late fees, or deposits. QuickBooks will prompt you to create an item if it doesn’t already exist.

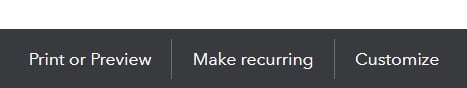

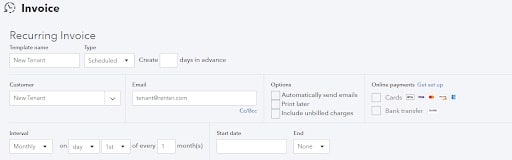

- Make the transaction recurring by clicking on the Make recurring button at the bottom of the invoice input screen.

You will then have the option of adding frequency information for the recurring bill along with options to automatically send email reminders to your tenant and accept online payments.

Now you will automatically track monthly rent payments, and your tenants will be automatically invoiced by email (if you choose that option). If you accept online payments, they will be applied to the invoice with a click of a button.

Once you have your tenants all set up in QuickBooks as Customers, you can easily track your income from each of them. Properly invoicing your customers and ensuring that all charges are included on the invoices is key to maximizing your property’s profit.

Switching between multiple QuickBooks files, downloading reports, and consolidating your financials is time-consuming and leaves room for error. STRATAFOLIO creates consolidated financial statements, rent rolls, and invoicing which saves you time and increases your profit. STRATAFOLIO allows you to use QuickBooks (which you already know) while adding features to streamline your financial management tasks.