STRATAFOLIO offers simple and streamlined invoicing within our software. First, all invoices added within our software are seamlessly pushed to your QuickBooks Online accounts, typically within minutes. Also, since STRATAFOLIO integrates all your QuickBooks accounts together in one place, by using bulk invoicing, you can add invoices across all your QuickBooks accounts with just a couple of clicks. Finally, when you add invoices in STRATAFOLIO, the system automatically captures rent changes and escalations, ensuring that you never miss an escalation. This article walks you through how to add an invoice in STRATAFOLIO that syncs seamlessly with QuickBooks.

Why You Should Invoice Your Tenants

It is best practice to add monthly invoices for all your tenants in your QuickBooks. This does not mean you have to send the invoices to the tenants, but that they should have an invoice added. This helps with the following:

- Verifying the correct amount of Rent and NNN Charges are being invoiced to the tenant

- Make sure that you are not missing any escalations of rent

- Checking to make sure that the tenant is paying their invoices on time

- It is better business practice to show a paper trail for all Rent and NNN Charges if ever needed

In STRATAFOLIO, we show all payments collected from the tenants on a cash basis. This is one more reason to ensure that you have invoices added in your QuickBooks or STRATAFOLIO each month. We will not display Sales Receipts or A/R reports, so the Invoices are the best way to track all payments due to your organization.

How to Invoice in STRATAFOLIO

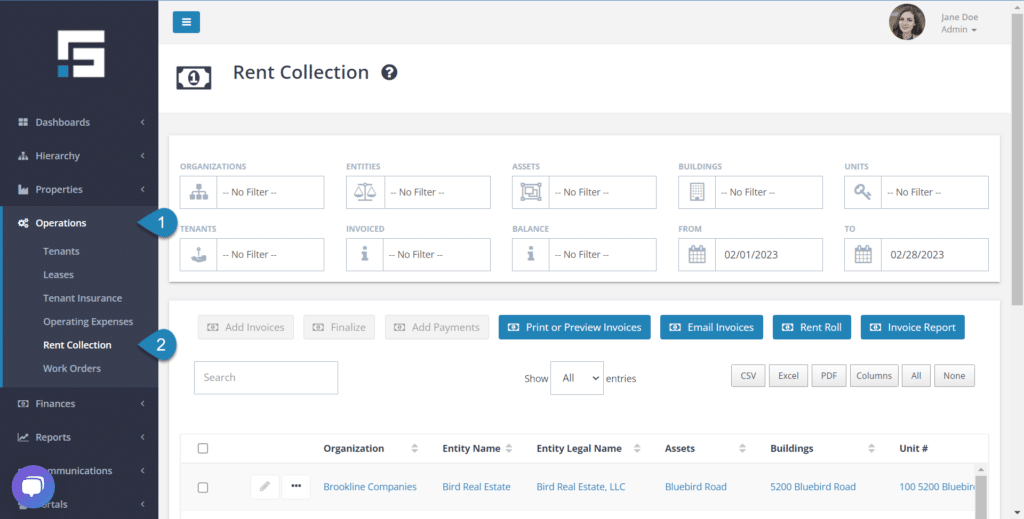

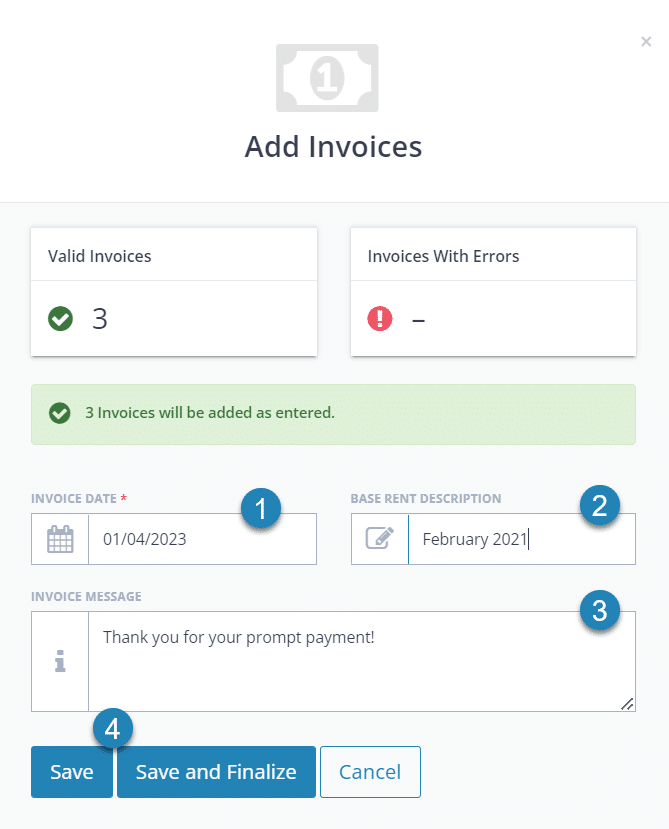

To begin invoicing through STRATAFOLIO, navigate to the Rent Collection page by navigating to Operations, then Rent Collection in the left-hand navigation panel.

Rent Collection Page

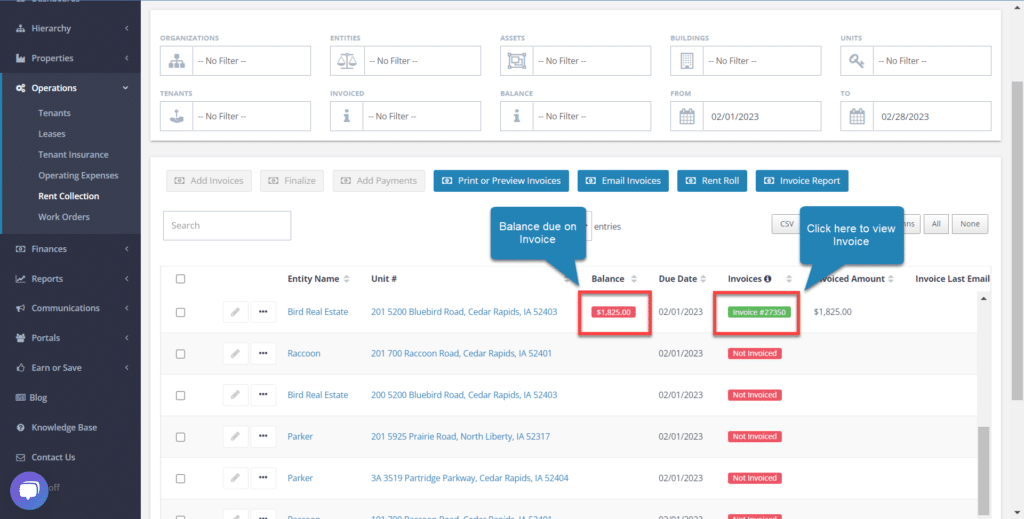

The Rent Collection page is packed full of helpful information and search options. You can search by Organizations, Entities, Assets, etc., as well as invoice status (not invoiced, draft, or invoiced) and invoice balance (overdue, current, or credit). The Rent Collection page also shows the balance due for each invoice, and you can select the invoice number to open a detailed view of the invoice.

Verify that the Invoice Has Not Yet Been Added

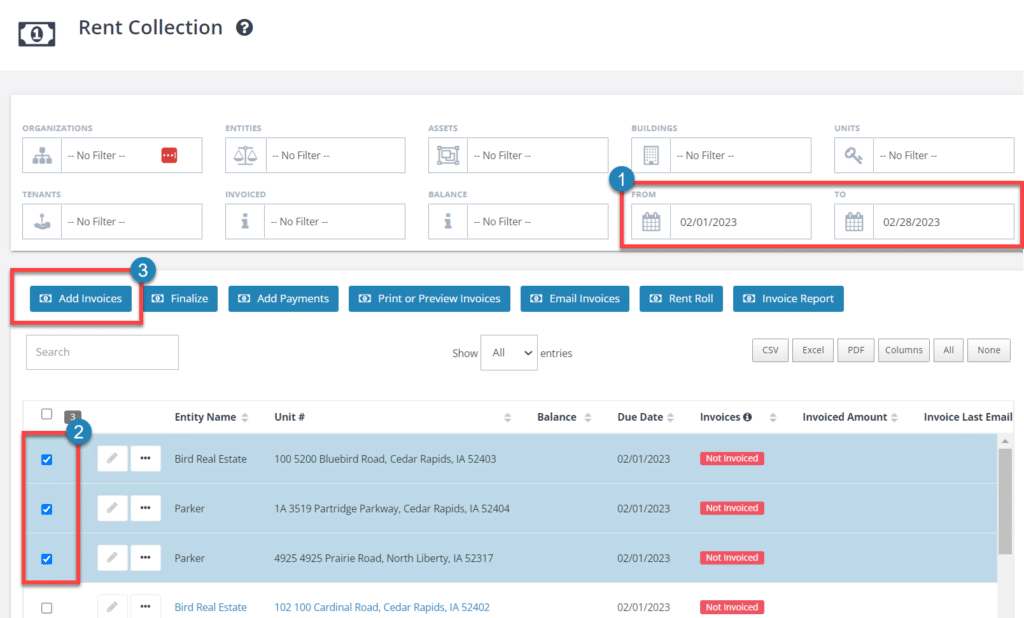

TIP: When you first navigate to the Rent Collection page, starting on the 16th of each month, the dates will always default to the next month. Example: If today’s date is May 3, the default dates on the Rent Collection page will be May 1 to May 31, but if today’s date is May 16, the Rent Collection page will default to June 1 to June 30.

The first step is to verify that the ‘From & To’ dates filter options have the correct range for the invoicing period, so you can check if an invoice has already been generated for the selected period. If not, proceed to add the invoice.

Select Invoice(s)

- Select the checkbox next to each lease to select it, or select all the leases shown in the table by selecting the checkbox in the table header.

- You add a single invoice to a single lease, which allows you to update more items when creating that invoice. We explain this in more detail in the Creating a Single Lease section below. Or, you can select multiple or all your leases at once and generate invoices in bulk for the selected leases. This is also explained in the Bulk Invoicing section of this Knowledge Base, which is provided below.

- Each one of the selected leases will generate a separate invoice containing all the correct charges and OpEx for that period. such as (income item, rent rate, CAM amounts, etc.).

- Once you have selected the lease or all the leases you want to add an invoice to, select the Add Invoices button

Creating a Single Invoice

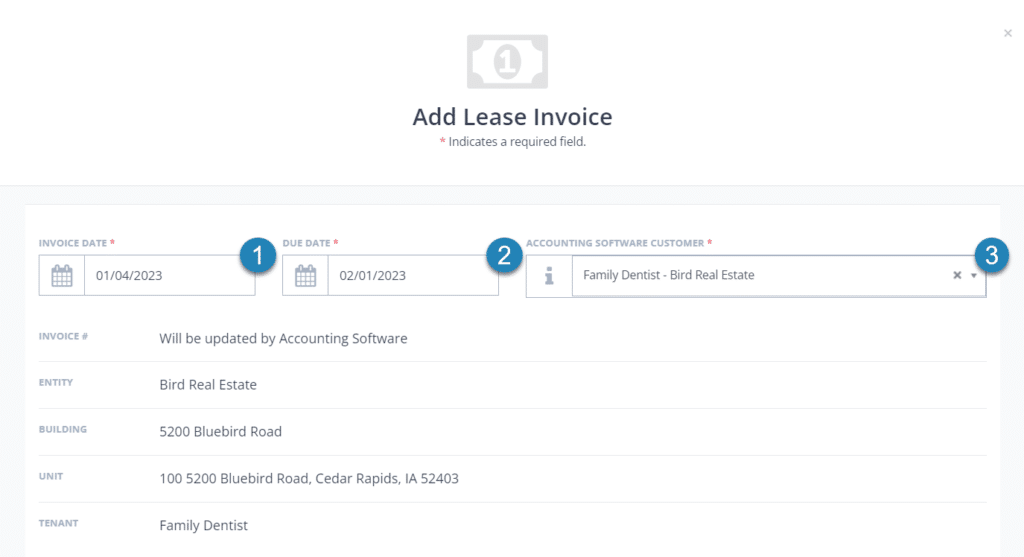

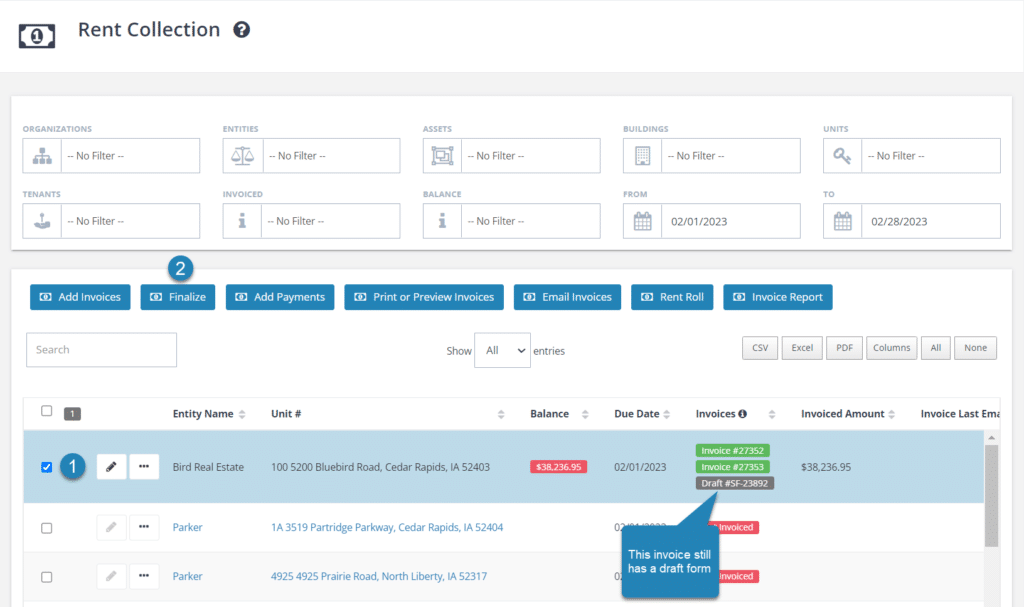

If you select one invoice using the steps above, the Add Lease Invoice popup window will open. This window automatically fills in most fields with the information you provided for Lease Rate and Op-Exp when you entered the lease into STRATAFOLIO.

A description of each field is below:

- Invoice Date (required) – This is the posting date that will be used in QuickBooks. It is NOT the due date. It defaults to today’s date, but you can adjust it if needed, such as changing it to the 1st of the month to align with the invoice date.

- Due Date (required) – This is the date that was stated in the lease, such as the 1st of the month. You can update the due date, but if you see a date that does not match the month you selected in the filter, cancel it and confirm that your dates are accurate before proceeding.

- Accounting Software Customer (required) – The Accounting Software Customer is the Customer in the QuickBooks account and selected in STRATAFOLIO when you entered the Tenant‘s information.

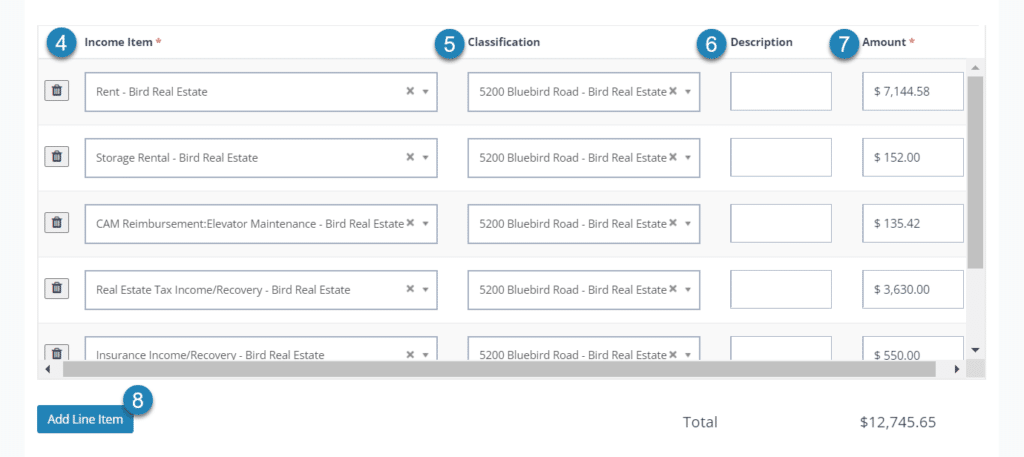

This section of the invoice includes the information that was already entered for the Lease in STRATAFOLIO.

- Income Item (required)-This is the Income Item created in QuickBooks for posting this line item. The system automatically populates the Income Item based on the lease information you set up in STRATAFOLIO.

- Classification -If applicable, the system will automatically fill in the Classification based on the lease information you enter in STRATAFOLIO. Ensure that this aligns with the Class you set up in QuickBooks for posting this invoice.

- Description – Add a description if desired. For example, “July 2021 Rent.”

- Amount (required) – The system will automatically calculate the Amount based on the lease rate and/or the operating expenses for the selected time period. You can adjust this amount if necessary. The amount for Rent and Op-Exp will reflect any escalations entered for that lease period.

TIP: It is important to remember to update the Lease Rate and Op-Exp whenever there is a change to the lease!

- Add Line Item Button – If needed, choose this to add an additional line for billing. For example, a one-time payment for utility reimbursement or a late fee.

- Invoice Message – Add a message if needed. This will appear at the bottom of the invoice.

- Statement Message – Add a message if needed. This will appear on the statements created in QuickBooks.

- Save Draft – Select Save Draft to save the invoice(s), but not sync them with QuickBooks. This option allows you to add the invoice and return later to make changes. Or,

Save and Finalize to save the invoice(s) and sync them with your QuickBooks accounts. When you select the Save and Finalize button, a confirmation popup will appear, asking you to confirm that you want to finalize the invoice.

NOTE: Once you Finalize an invoice it will be synced with QuickBooks and any changes to the invoice will need to be made in QuickBooks. All changes made in QuickBooks to an invoice will sync back and be updated in STRATAFOLIO.

Bulk Invoicing

With bulk invoicing, you can send invoice online across multiple QuickBooks accounts in just a few clicks.

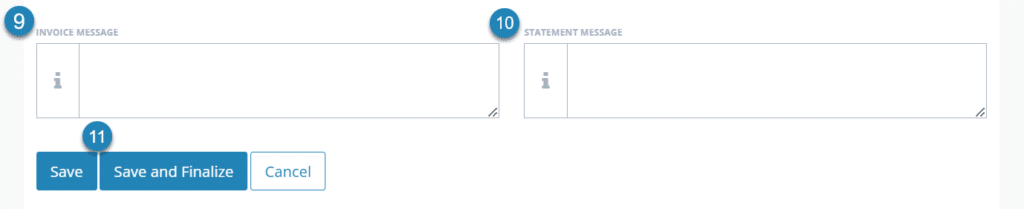

Select more than one lease, then select the Add Invoices button

NOTE: All information entered on this page will be reflected on all selected invoices.

- Invoice Date (required) – This is the posting date that will be used in QuickBooks. It is NOT the due date. It defaults to today’s date, but you can adjust it if needed, such as changing it to the 1st of the month to align with the invoice date.

- Base Rent Description – If desired, add a description. For example, “July 2021 Rent.” This will be the same on all invoices.

- Invoice Message – Add a message if needed. This will appear at the bottom of all of the invoices.

- Save Drafts – Select Save Drafts to save the invoice(s), but not sync them with QuickBooks. This option allows you to add the invoice and return later to make changes. Or,

Save and Finalize to save the invoices and sync them with your QuickBooks accounts. When you click the Save and Finalize button, a confirmation popup will appear, asking you to confirm that you want to finalize the invoices.

Finalizing a Draft Invoice

If you select Save Draft instead of Save and Finalize when creating a single or bulk invoice, the system will mark it as a Draft and highlight it in red in the Invoices column.

- You can only edit draft invoices in STRATAFOLIO until you finalize them.

- You must finalize draft invoices in STRATAFOLIO to sync them with QuickBooks.

Select the invoice from the list, then choose the Finalize button

After you select the Finalize button, a popup will appear, prompting you to confirm that you want to finalize the invoice.

Your invoice will not show in QuickBooks until STRATAFOLIO completes a sync with your account. If you are using QuickBooks Online, this will usually happen within minutes. If you are using QuickBooks Desktop, you need to run the Web Connector and sync the account to finalize it, so it appears in both STRATAFOLIO and QuickBooks.

This article serves as a step-by-step invoice creation guide for small business owners and commercial real estate managers who want accurate, efficient billing. Other articles that may be of help are How to Turn Off Custom Transactions Numbers in QuickBooks Online, Adding Invoice Payments in STRATAFOLIO, and Tracking Paid & Overdue Invoices in STRATAFOLIO.

Creating Monthly Routine Invoices

To maintain a consistent invoicing schedule:

- Generate invoices for upcoming months using the same steps as above.

- When selecting the billing period, adjust the dates to match the future month(s) you need to bill.

- Save each invoice once details are correct.

This lets you prepare rent invoices ahead of time and ensures all future billing periods are created and ready according to your schedule.

How Do I See if a Tenant was Emailed an Invoice?

STRATAFOLIO gives you multiple ways to confirm whether a tenant has been emailed their invoice. This feature is important for ensuring tenants are billed correctly, for resolving questions about whether an invoice was received, and for maintaining clear accounting records.

You can verify invoice email activity in three different methods within STRATAFOLIO:

- In Rent Collection, using the “Invoice Last Emailed Date” column

- In the Invoice Activities tab when you open an invoice directly

- In the Lease record, when you open the Invoice

This article will walk you through each method and provide troubleshooting tips if an invoice was not sent successfully.

Ensure Contacts Can Receive Invoice Emails

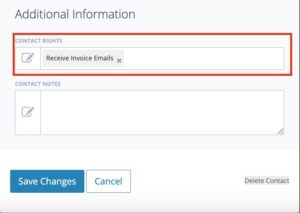

Before invoices can be emailed, the tenant’s associated contact must have the “Receive Invoice Emails” permission enabled in their Contact Rights.

- If this box is not checked, invoices will not be sent to that tenant’s email.

- When you try to email invoices, STRATAFOLIO will alert you to any errors.

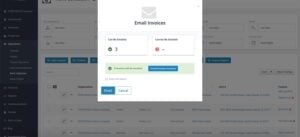

For example, the Email Invoices pop up that shows when you attempt to email an invoice clearly indicates which invoices can be emailed and which cannot. If an invoice cannot be emailed, you will see an error message, along with the option to Download Errors for troubleshooting.

To check if the contact can receive invoices email, simply navigate to Contacts under Hierarchy in the left-side navigation menu, locate the contact and find the column that says “Contact Rights” where you should see “Receive Invoice Emails” if this has been enabled.

Check if an Invoice was Emailed via Rent Collection

- Navigate to Operations > Rent Collection in the left-side navigation menu.

- Locate the tenant in the Rent Collection table.

- Scroll to the right (depending on your column order) until you find the Invoice Last Emailed Date column.

- This date confirms the last time an invoice was successfully emailed to the tenant.

- This date confirms the last time an invoice was successfully emailed to the tenant.

- For more details, select the invoice number to open the invoice.

- In the pop-up window, select the Invoice Activities tab.

The Invoice Activities log provides a complete history, including:

- The date and time the invoice was emailed.

- The STRATAFOLIO user who sent it.

- The exact email address where the invoice was delivered.

This makes it easy to confirm email delivery or identify if an invoice still needs to be resent.

Check if an Invoice was Emailed via the Lease Record

You can also verify email activity from the lease record itself.

- Navigate to Operations > Leases in the left-side navigation menu.

- Locate the lease and select the i icon to open it.

- Select the Invoices tab.

- Open the invoice in question.

- Select the Invoice Activities tab.

As with Rent Collection, you’ll see a log showing the full history of invoice emails for that specific lease.

Check if an Invoice was Emailed by Opening the Invoice Directly

Anytime you are viewing invoices in STRATAFOLIO, you can simply choose the Invoice Activities tab to check the log for when invoices were last emailed.

What to Do if an Invoice Wasn’t Emailed

If an invoice does not send, STRATAFOLIO provides tools to identify and resolve the issue quickly.

Check Contact Rights

- Select the tenant’s associated contact profile. Navigate to Edit Contact to open the pop up and see all the information on the contact.

- Confirm that “Receive Invoice Emails” is enabled under Contact Rights.

- If it is not enabled, update the setting and try resending the invoice.

Download Error Report

- When emailing invoices, if you see an error message, select the Download Errors button.

- The error file will provide details on why the invoice could not be sent.

- Common issues include missing email addresses, incorrect permissions, or outdated contact records.

Verify Email Information

- Double-check that the contact’s email address is correct and up to date.

- Ensure the tenant has at least one valid contact set to receive invoices.

Resend the Invoice

- Once you’ve corrected the issue, return to the Rent Collection table and select Email Invoice again.

- Confirm delivery by reviewing the Invoice Activities tab.

Why This Matters

- Improved Communication: Tenants receive invoices on time, reducing delays in payments.

- Accurate Records: Invoice Activities provide a reliable audit trail for accounting purposes.

- Faster Troubleshooting: With error reporting and contact rights, you can quickly fix issues and resend invoices.

By using Rent Collection, the Lease record, or the Invoice Activities log, you can always verify if an invoice was emailed to a tenant. And if something goes wrong, STRATAFOLIO provides clear tools, like contact permissions and downloadable error reports, to help you correct the issue and keep your invoicing process running smoothly.