There are times when the CAM Reconciliation Reports have special circumstances either by Tenant or by Entity. Some of these circumstances can include separating out the Controllable from the Non-Controllable expenses, calculating Base Years or Floors, and may also include restricted expenses. This may also include adding additional fees for Administrative or Management Fees.

Controllable/Non-Controllable Expenses

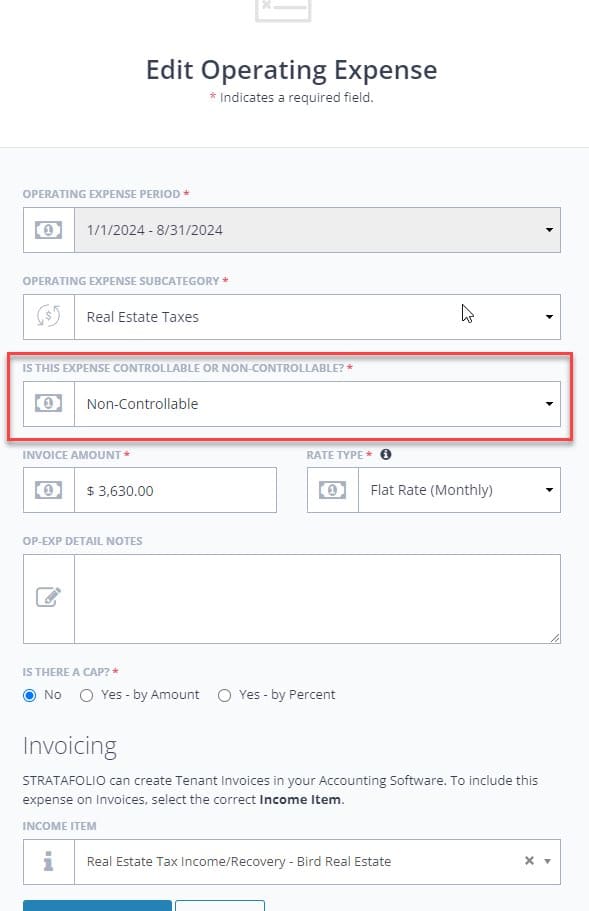

STRATAFOLIO has the ability to break out Subcategories into Controllable, Non-Controllable, and N/A expenses. This helps when a lease has caps on controllable expenses to group those together. As an industry standard, Real Estate Taxes and Insurance are expenses that are typically Non-Controllable. Separating out these expenses on the CAM Reconciliation Report helps with differentiating these to calculate the caps correctly.

Under the Op-Exp tab in the Lease Abstract, open the time period and click on the Edit pencil next to the Subcategory that needs to be updated. Choose Controllable, Non-Controllable, or N/A in the drop-down for each of the Subcategories that need to be updated.

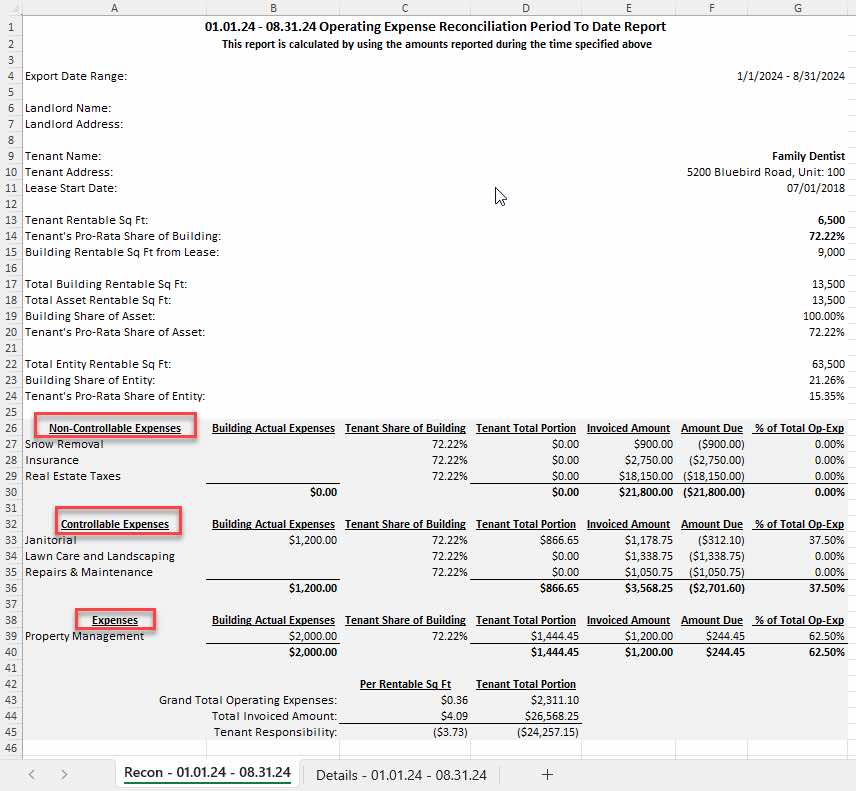

The groups created on the CAM Reconciliation Report can be seen below:

Base Years/Floors

We currently do not calculate base year automatically on the CAM Reconciliation Report. The STRATAFOLIO Onboarding Team does have a way to help with that calculation though. Please contact them directly if you need assistance.

Restricted Expenses

When leases exclude charges still charged to the other tenants in the building, it is simple to set this up in STRATAFOLIO. The Subcategory expense should be removed or not added to the Op-Exp Invoice tab for this lease. This ensures that the expense for this Subcategory will not be added to that particular CAM Reconciliation Report. Each lease is set up individually so it is important to make sure that you are adding the specific requirements as set forth in the lease.

NOTE**The expense will not be spread over the remaining leases in the building but will come in at each tenant’s pro-rata share of the expense. **

Administrative/Management Fees

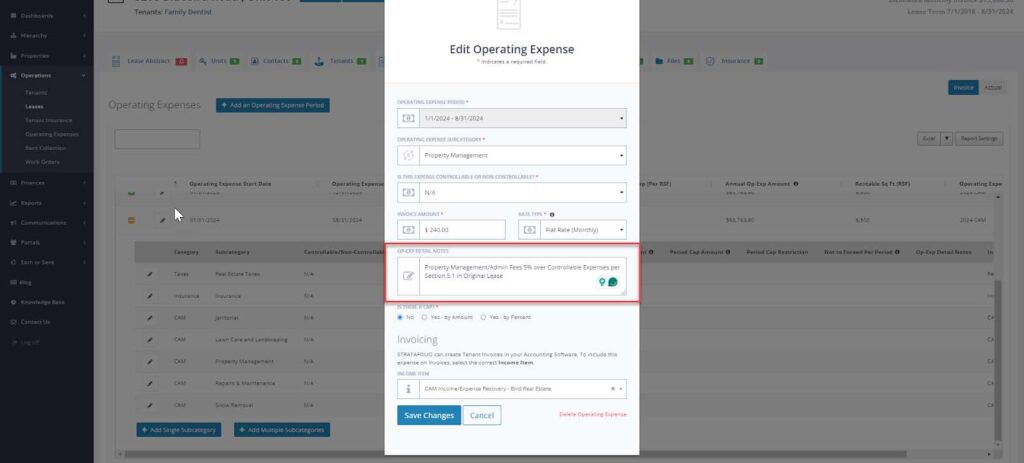

You can create a Subcategory for Administrative or Management Fees even if you do not have an account in your QuickBooks designated for this. This will create a line on the CAM Reconciliation Report for you to later calculate and add the fees. Sometimes, you can utilize the grouping of Controllable, Non-Controllable, or N/A expenses from the directions above if only specific Subcategories can have the fees added.

Creating a new line in the Excel sheet also works if you would prefer to add it it manually.

It is highly recommend to add any verbiage or restriction around Administrative/Management Fees from the lease. Use the Note section under the Subcategory selection. This will save time and resources when looking for that information annually when producing the CAM Reconciliation Report.

For any other special circumstances around CAM and Operating Expenses, feel free to check out other Knowledge Base articles. STRATAFOLIO’s Onboarding and Support Team is also available if you have any out-of-the-box scenarios.