Do you have a new loan to input? Or would you like to enter updated loan information into STRATAFOLIO?

In this Knowledge Base Article, we share the steps for inputting a loan into STRATAFOLIO. With our software, you have one single location to allow for easy referencing of loan and financing information. Every time your loan gets updated in QuickBooks, your loan balance is updated on the Loan Dashboard within STRATAFOLIO. This makes sure that your analytics are always up to date with your accounting.

NOTE: Loans can only be created after you have created a Lender to house them. Click here for more information on creating a Lender in STRATAFOLIO.

Adding a Loan

To input a loan in STRATAFOLIO, follow the steps below:

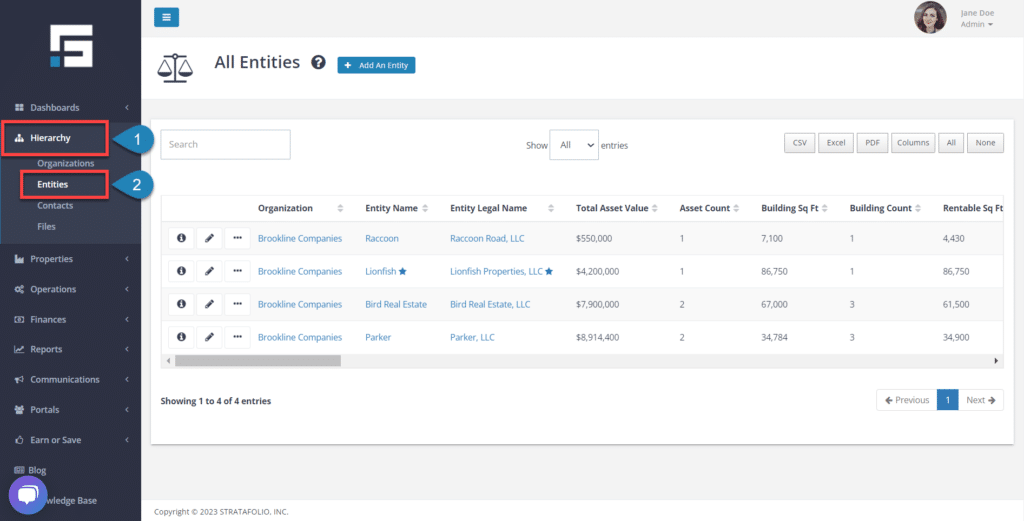

- Go to the navigation bar on the left-hand side and click Hierarchy and then Entities.

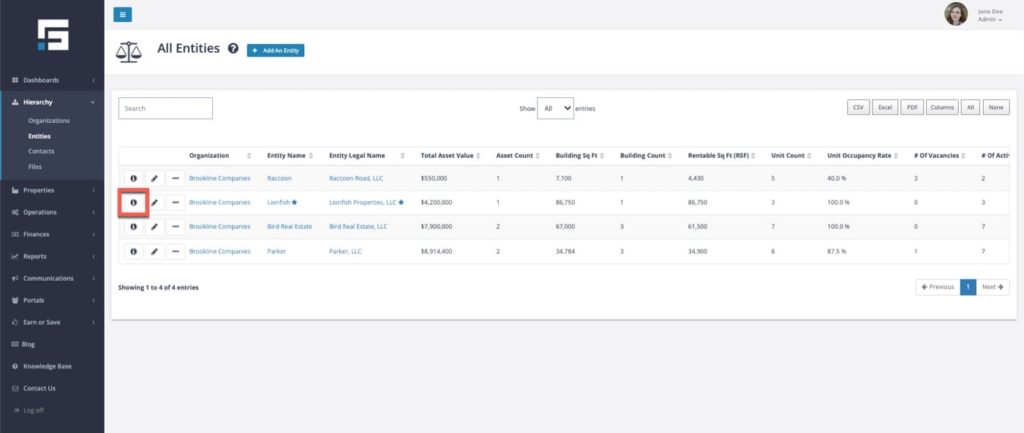

- Identify the entity to which the loan belongs and select the Information button.

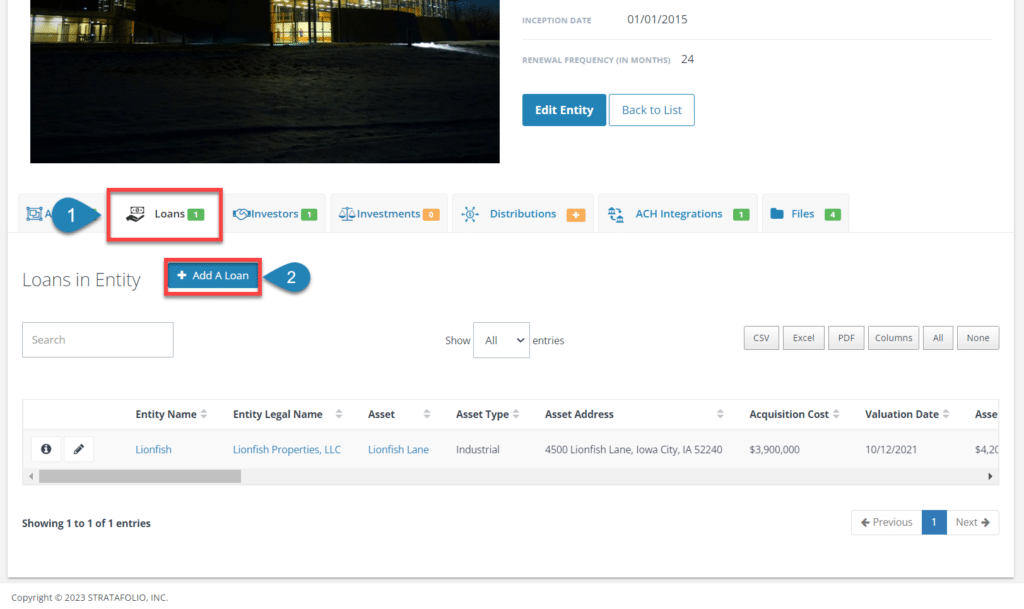

- Select the Loans tab and then Add a Loan.

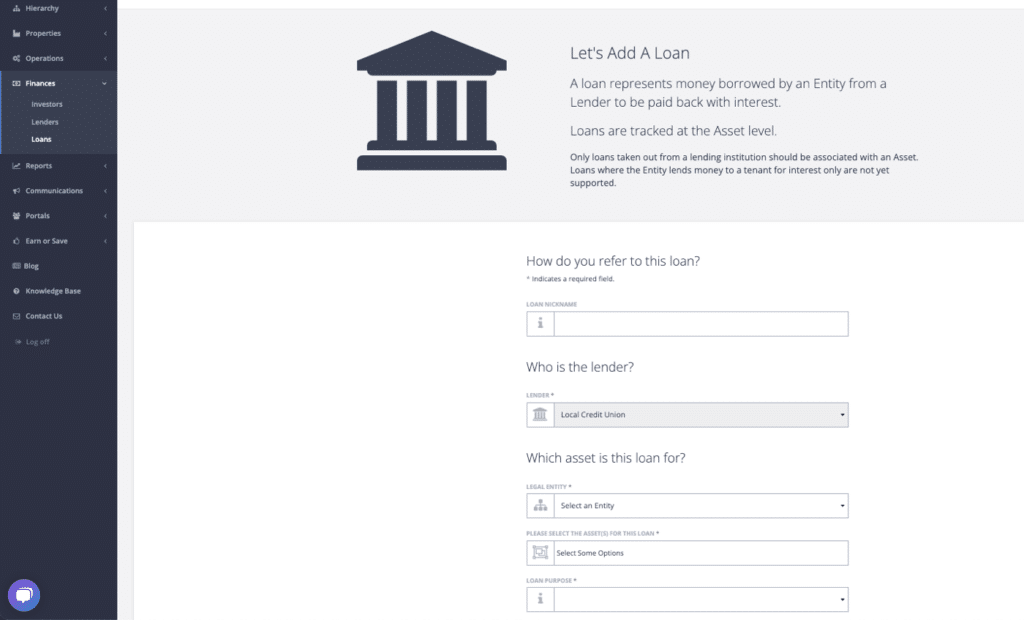

Once here, you will need to add the following information:

- Loan Nickname

- Lender Name

- Legal Entity for the Loan

- The Asset for the Loan

- Loan Purpose

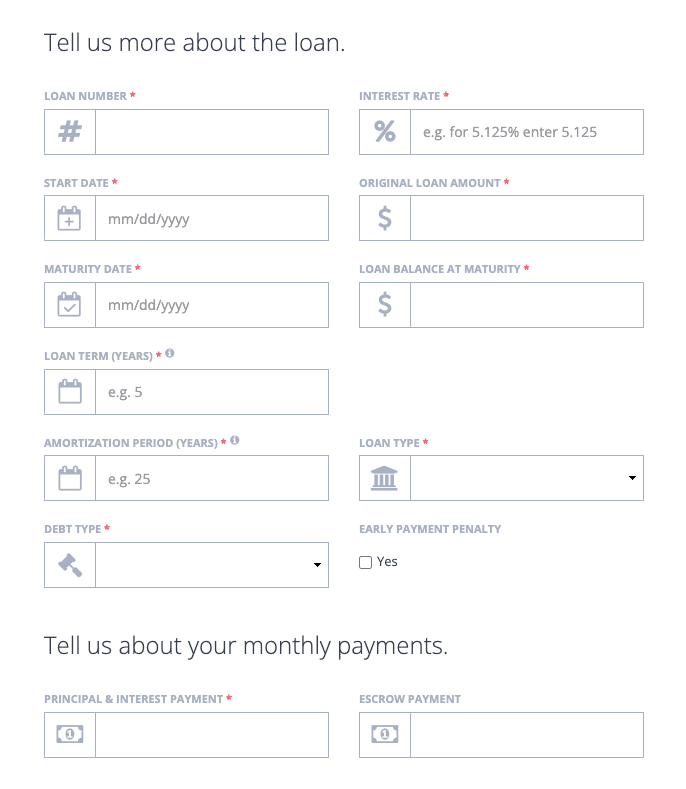

Following the first steps of entering in the Loan information, we proceed with more information to input. The following information includes:

- Loan Number and Loan Start Date

- Interest Rate and Original Loan Amount

- Maturity Date and Loan Balance At Maturity

- Loan Term (Years)

- Amortization Period (Years)

- Loan Type and Debt Type

- If there is an Early Payment Penalty

- Monthly Principal & Interest Payments

- Monthly Escrow Payment (optional)

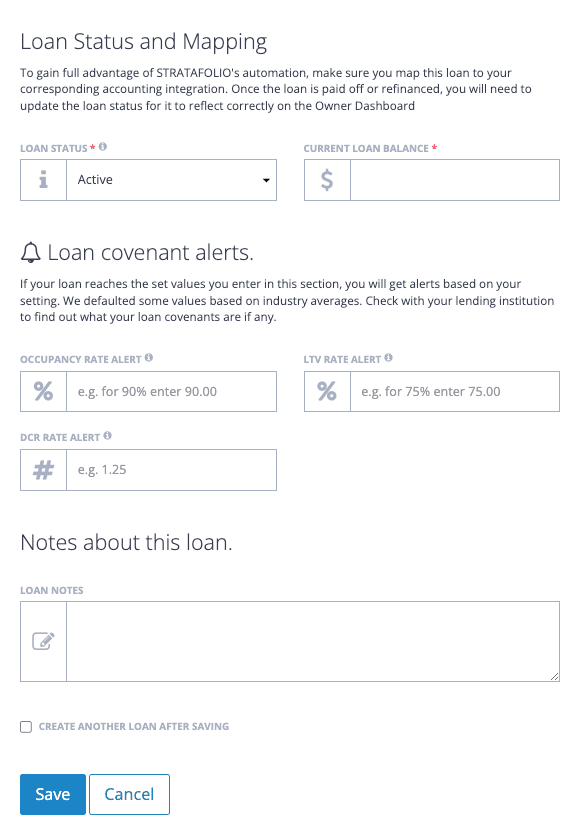

Additional information needed to finish entering in the Loan includes:

- Loan Status –

- Current Loan Balance – this links with your QuickBooks account and will update every time your QuickBooks account updates

- Loan Covenant Alerts if applicable:

- Occupancy Rate Alert

- LTV Alert

- DCR Rate Alert

- Any Notes needed for the Loan

If you have another loan that you need to enter, you can select Create Another Loan After Saving and then Save to easily add an additional loan at this time.

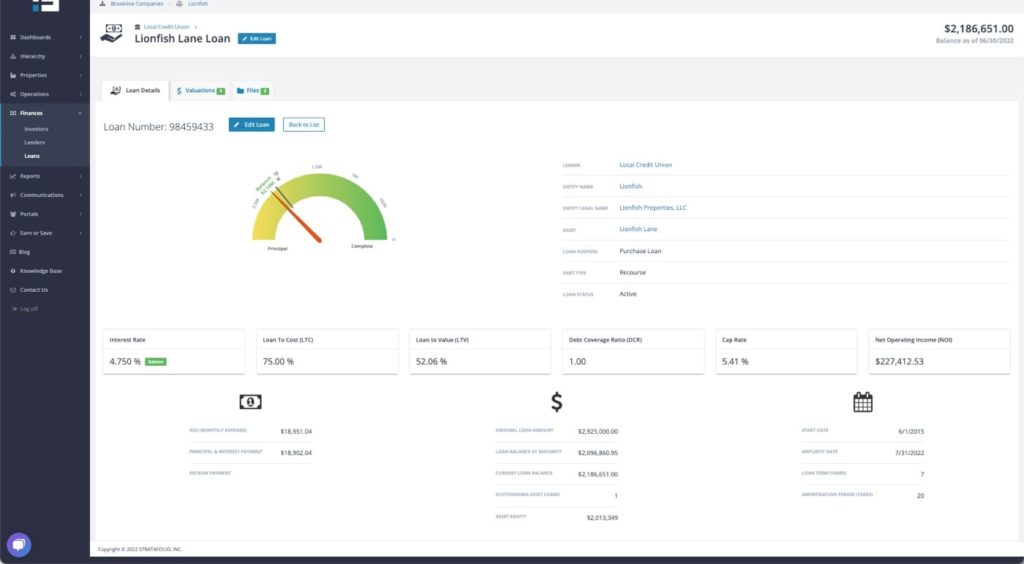

Loan Dashboard

Once your loan information is entered and saved you will be directed to the Loan Dashboard where you will be able to easily arrange and identify important information about your loan such as:

- Total Asset Value, Debt, and Equity

- Average LTC, LTV, and DCR

- Total Outstanding Loans and Maturing Loans

- Average Interest Rate

- Debt by Lender and by Asset Type

At this point, you can upload any loan documents that you may have as well as the Closing Statement, Deed to Trust, Appraisal, and any other documents that you might want to have accessible for this loan.

You will also need to map the loan to have the most current loan balance automatically updated on the Loan Dashboard in STRATAFOLIO. The directions for Mapping New Loans in STRATAFOLIO are the last step in making sure that it stays updated.

When you sell this asset or refinance your loan, make sure that you close out the loan in STRATAFOLIO. See the article on How to Close Out a Loan for more information.