Recording your escrow and mortgage incorrectly creates a series of issues for you as the owner, all of which are significant. Today’s blog will explore how to set up an escrow account for a mortgage. Read along!

Let’s Talk About Mortgage Escrow

First and foremost, recording incorrectly means you will have an inaccurate financial picture. Second, it makes it difficult to make decisions using your financial reports. And third, it adds costs to you because your CPA will spend more time resolving your issues at tax time.

In this blog, we talk about:

- What an escrow account is

- How to start and set up an escrow account the right way

- Understanding your mortgage escrow balance and statement details

- How to reconcile a mortgage escrow account and fix common issues

- How to record your mortgage payment with escrow correctly

- The impact of incorrectly recording your escrow

We had the opportunity to sit down with Amy Heinen from Quick Action Accounting again. She took us through some of her best tips on mortgage payments and escrow accounts. Amy is a QuickBooks expert and a favorite local accountant. We worked with Amy on two other QuickBooks blogs that may be of interest for real estate companies – Setting up a Chart of Accounts for QuickBooks Desktop and Setting up a Chart of Accounts for QuickBooks Online. Finally, If your portfolio has mostly commercial real estate assets, check out our latest article: Setting up a Chart o f Accounts for a Commercial Real Estate Company

What is an Escrow Account?

What is mortgage escrow account? At the time you take out a mortgage, lenders often give borrowers the option to create an escrow account. The escrow account is like a holding account for your lender to pay your taxes and/or insurance. It is an account that you fund each month as part of your mortgage payment. When you have an escrow account, your mortgage payment will include the following elements:

- Principal

- Interest

- Escrow for insurance (if selected)

- Escrow for taxes (if selected)

The accruing funds are used to cover the taxes and/or insurance for the property you purchased. Then, when the taxes or insurance are due, the lender withdraws from your escrow account and pays the taxes or insurance on your behalf. The lender monitors the cost of insurance and taxes and occasionally adjusts your escrow payments accordingly.

Now, let’s move on to how to set up escrow account.

How to Start and Set Up an Escrow Account the Right Way

Knowing how to start an escrow account is instrumental in maintaining compliant and transparent real estate records. An escrow account must be set up correctly from a compliance standpoint, beyond simply taking money for insurance and taxes, to protect both the borrower and lender.

Learning how to set up an escrow account for a business? Start by making sure it complies with lender requirements and federal law. The process for lenders to create and maintain escrow accounts is outlined in the Real Estate Settlement Procedures Act (RESPA). These guidelines require lenders to:

- Make an initial escrow disclosure statement within 45 days of opening the account.

- Conduct an annual escrow analysis to expose significant shortages or surpluses.

- Clearly disclose to the borrower any changes in the escrow balance.

For business or investment portfolios, being well-established also includes maintaining proper bookkeeping and internal controls. This enables escrow funds to be traceable and your Chart of Accounts to accurately reflect continuing escrow activity.scrow funds to be traceable and your Chart of Accounts to accurately reflect continuing escrow activity.

Setting up Your Chart of Accounts

To begin, include the following accounts in your Chart of Accounts:

- Property as a Fixed Asset split out between the Building and Dwelling costs

- Notes Payable (your mortgage) as a Long Term Liability

- Escrow Account as a Bank Account

- Interest Expense as an Expense

As we have talked about in a previous blog article, it is critical to set the chart of accounts up correctly from the beginning so you are able to see your complete financial picture.

Making Your Mortgage Payment

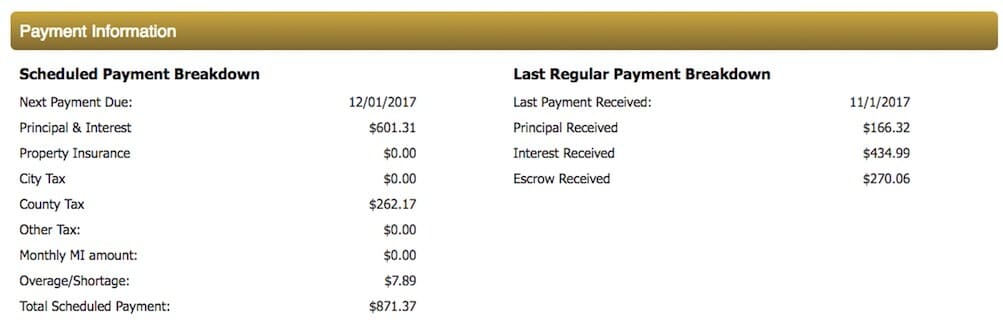

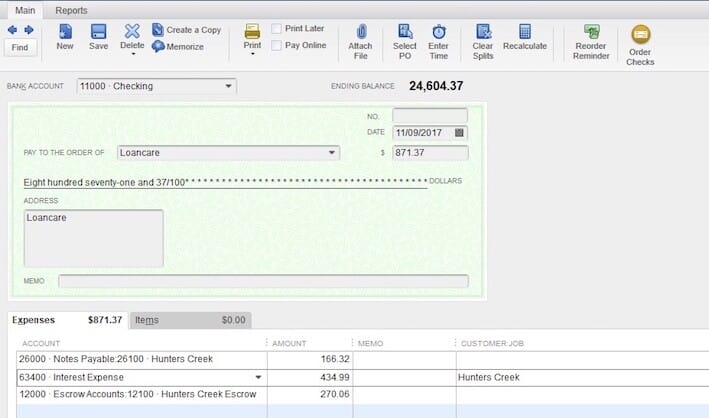

Once your chart of accounts is set up you can begin making payments. In this example, our mortgage payment to Loancare totals $871.37 as shown in this image from the mortgage statement.

When you record your mortgage payment transaction, split the payment between Notes Payable, Interest Expense, and Escrow Accounts according to what is on your mortgage statement. In this example, the actual principal and interest for the November scheduled payment are not yet known. We will enter the Last Regular Payment Breakdown information until we have more information.

Memorize the Transaction

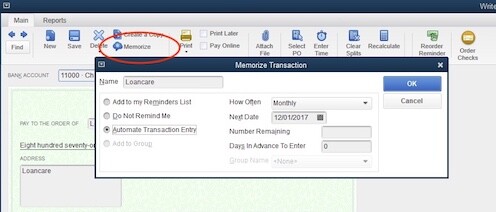

Many accounting systems will allow you to memorize a transaction which will make your life easier. We recommend you do this when recording your mortgage payment. This helps save time and helps with consistency in how you record your payments.

In QuickBooks:

- Select Memorize

- Name the transaction

- Select Automate Transaction Entry

- Select Monthly for How Often

- Identify the Next Date for the transaction

Even though this transaction has been memorized, you will need to adjust the amounts slightly each month once you receive your statement. The principal and interest amounts will adjust each month as you pay down the loan. Each month a bit more of your mortgage payment will go to the principal and a bit less to interest. Additionally, your lender may increase or decrease the amount you are paying to escrow which also has the potential to impact your mortgage payment.

Updating Your Escrow Account

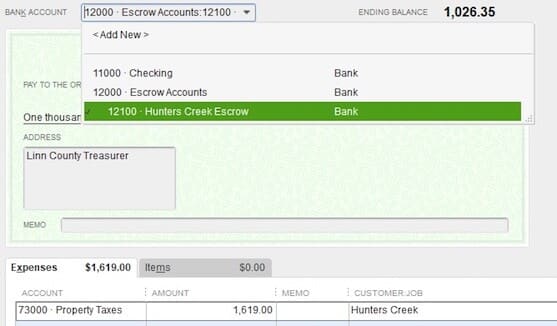

Your mortgage statement will reference when your lender paid taxes or insurance from your escrow account. Once your lender completes this transaction, record it in your Escrow Account in your accounting system. To do that in QuickBooks, use the Write Check from the appropriate Escrow bank account and write the check for the amount the paid by your lender. Your escrow balance will then stay in line with your lender.

Annual Escrow Account Disclosure Statements

At least annually, your lender will provide a statement about your escrow activity. It shows the current payment as well as any anticipated increases or decreases in your escrow payment before it actually happens. Generally, the escrow statement includes an analysis of previous escrow payments and projections for the coming year. Also available is information about recent payments for insurance and taxes.

Understanding Your Mortgage Escrow Balance and Statement Details

Your lender’s monthly statement will show an escrow balance, or the balance of funds that are present in your escrow account at a specific time. The majority of borrowers inquire, what is the escrow balance on a mortgage statement, or what is mortgage escrow balance — it’s merely the amount of money present in your escrow account at a specific time.

Monitoring this number allows you to find discrepancies between your books and the books of your lender. It is also useful when estimating changes in your mortgage payment because lenders calculate escrow payments on the basis of changes in tax or insurance costs.

How to Reconcile a Mortgage Escrow Account and Fix Common Issues

Once you have learned how to reconcile escrow accounts, use the following checklist to check for correctness and identify any problems immediately:

Step 1: Verify Opening Balances

Your opening escrow balance should be the same as your previous lender statement before entering new activity.

Step 2: Reconcile Deposits and Withdrawals

Ensure that all payments and disbursements are properly reported by verifying every transaction in your accounting system with the lender’s ledger.

Step 3: Review Annual Disclosures

When your lender prepares the annual escrow statement, review it to verify that the mortgage escrow balance is accurate according to your internal records. Also, check that any necessary adjustments have been made properly.

Step 4: Account for Disbursements Promptly

Docket each tax or insurance disbursement when it first appears on your lender’s report so your records will be up to date.

Step 5: Monitor for Shortages or Overages

Changes in tax assessments or insurance premiums may impact your monthly payment. Regular reconciliation avoids surprises and facilitates correct forecasting.

Impact of Recording Your Mortgage and Escrow Incorrectly

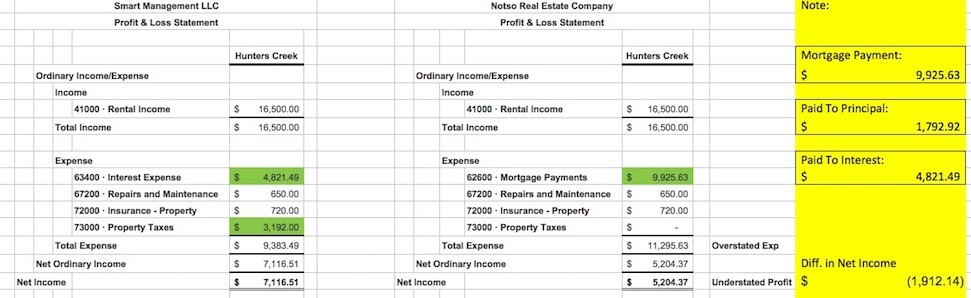

As we stated at the beginning, an incorrectly recorded mortgage and escrow information throws off your financial picture. Here is an illustration of a company that has recorded their mortgage and escrow correctly. The company is called Smart Management. Under their expenses, they have $4,821.49 in Interest Expense and $3,192.00 in Property Taxes. Their Net Income is $7,116.51.

On the other hand, Notso Real Estate Company put all their Mortgage Payments in an expense category called Mortgage Payments. They did not break out principal, interest, taxes or escrow in any way. For the same period of time, they show a Net Income of $5,204.37. Notso Real Estate Company has overstated their expenses and understated their Net Income. There is a difference in Net Income of $1,912.14 between the two companies simply because Notso Real Estate Company recorded their transactions incorrectly. This is significant and this is only for a single small value asset.

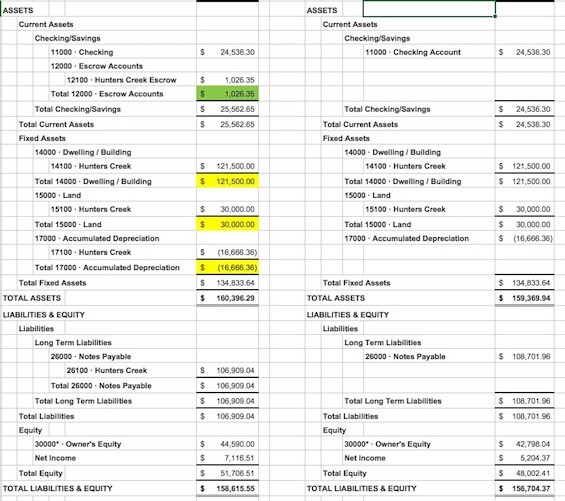

On the Balance Sheet, Smart Management has an Escrow Account balance of $1,026.35 within their current assets. They have less in liabilities because their mortgage principal payments were applied thereby reducing their Notes Payable balance.

Notso Real Estate has no record of an Escrow Account, nor do they reduce their Notes Payable with principal payments. They have also underrepresented their assets and overstated their liabilities. Unfortunately, Notso Real Estate is making financial decisions based on faulty information.

In Closing

Incorrect recording of mortgage payments is surprisingly common. But, as you can see, the impact is significant. If you have recorded your escrow or mortgage payments incorrectly, it is time to clean up your records. It is essential you are working with current accurate records. STRATAFOLIO can help! Schedule a demo today.