What is the difference between the direct cash flow method and the indirect cash flow method? And, more importantly, how do you calculate them? And, finally, what does this have to do with my cash flow statement?

Difference Between Direct and Indirect Cash Flow

Let’s begin with the basics. Most businesses use accrual accounting as their accounting method. Accrual accounting means a company records the revenue and expenses as they occur and not when they receive payment. For those businesses that use accrual-based accounting, their income statement does not provide adequate information about a company’s cash flow. Some items impact cash flow that does not show up in the income statement, such as mortgage payments, building improvements, and the purchase of additional assets. Instead, a business needs to look at its cash flow statement to understand cash flow fully. Two methods exist to analyze operating cash flow – the direct method or indirect method.

Blog Overview

In this article we are going to address the following:

- Definition of a cash flow statement

- Direct cash flow method calculations

- Indirect cash flow method calculations

We are excited to share we have a new opportunity to offer QuickBooks Online at a discount for USA and Canadian residents.

We are excited to share we have a new opportunity to offer QuickBooks Online at a discount for USA and Canadian residents.

By using QuickBooks Online, you will save time and money! And, by using QuickBooks Online in combination with STRATAFOLIO to manage your real estate, you will save even more!

Cash Flow Statement

Among the many financial statements business leaders rely on is the cash flow statement. At its most elemental level, the cash flow statement or sometimes referred to as the statement of cash flows is a report that illustrates how cash flows both in and out of business. This financial statement helps a company understand the change in cash and how different activities impact it. There are three separate areas of a cash flow statement:

- Operating activities – Any revenue-generating business activities are recorded in the operating activities. The operating activities create revenue, expenses, gains, and losses. Essentially, operating activities do not include costs associated with investing or financing.

- Investing activities – Investing activities are everything that has to do with fixed assets or long-term assets, often referred to as property, plant & equipment (PP&E), and other investments.

- Financing activities – Finally, the financing activities on a cash flow statement document 3rd party backers of your company through investors or loans. And, this is also where your long-term liabilities and stockholder equity are recorded.

Cash Flow Statement Categories

| Operating Activities | Investing Activities | Financing Activities |

|---|---|---|

| Associated with revenue collection, expenses, gains and/or losses | Related to long-term assests | Related to long-term liabilities and owners' equity |

In reality, the only difference between direct and indirect cash flow resides in how the operating activities are calculated, as illustrated in this graphic.

For both methods, the goal is to determine a company’s net cash flow. Let’s explain it more thoroughly.

Direct Cash Flow Method

With the direct method, also referred to as the income statement method, you identify all sources of cash receipts plus all cash payments. The Financial Accounting Standards Board (FAS) recommends the direct cash flow method because it is a more transparent cash flow view. However, most companies’ charts of accounts are not structured in a way to accommodate this easily. Two categories exist for direct cash flow – cash coming from customers and cash disbursements. Attached is a description of those activities that go into the direct cash flow method.

Indirect Cash Flow Method

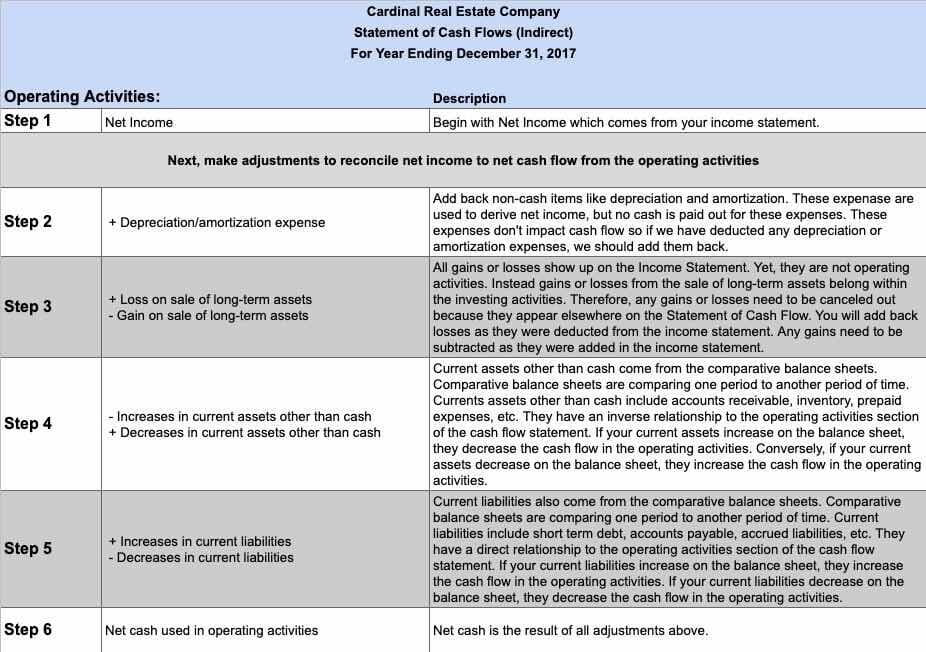

Notably, the most commonly used cash flow method is indirect cash flow. You may also see the indirect cash flow method referred to as the reconciliation method. With the indirect cash flow, you are reconciling back to cash. If you are a QuickBooks user, QuickBooks generates their cash flow reports using the indirect method. Information for indirect cash flow is simple to compile as it comes directly from the income statement and balance sheet. Ordinarily, this information is readily available through your accounting system. With the indirect cash flow method, you begin with your net income and then add back or deduct those items that do not impact cash. Attached is a description of those activities that go into the indirect cash flow method.

Subscribe to our Newsletter

Summary

Finally, the results for either method of cash flow should get you the same results.

The important thing is to select a method and stick with it. Cash flow is necessary to manage a business successfully, so owners have sufficient cash on hand to fund operations. In short, without a regularly prepared cash flow statement, it will be difficult to see the big picture of your company’s performance. If you’re a residential rental investor, your cash flow calculations will be slightly different, as this article explains.

Imagine doing CAM in seconds vs. weeks or months!

Watch this video and schedule your 1:1 demo!

Schedule your demo today!

![]() Thank you for your visit.

Thank you for your visit.

- Understanding the Different Types of CAM Caps - September 22, 2023

- Top 25 Commercial Real Estate Terms to Know - September 12, 2023

- How to Handle Tenant CAM Disputes - August 23, 2023